Amid the stock market's volatility, dividend stocks can offer investors a relatively stable and predictable source of income. “Dividend King” is a title reserved for those stocks that have not only paid but consistently increased dividends for at least half a century, like retail giant Target Corporation (TGT). This prestigious title underscores Target's commitment to efficiently maximizing shareholder return via dividends.

Shares of Target sold off last week after earnings, extending a longer-term stretch of underperformance against the broader equities market. However, as brokerage firm UBS (UBS) recently explained, the post-earnings weakness could be a prime opportunity to pick up shares of this Dividend King on the dip.

Let's have a closer look.

About Target Stock

Headquartered in Minnesota, Target Corporation (TGT) has transformed from a brick-and-mortar retailer into a cutting-edge omnichannel powerhouse. With a modernized supply chain and the acquisition of Shipt for same-day delivery, Target now offers a vast range of owned and premium brands across categories like household essentials, electronics, toys, and apparel. With a market cap of $68 billion, the company operates approximately 1,956 stores across the U.S. Its in-store amenities and extensive digital channels ensure a seamless shopping experience, combining convenience and variety.

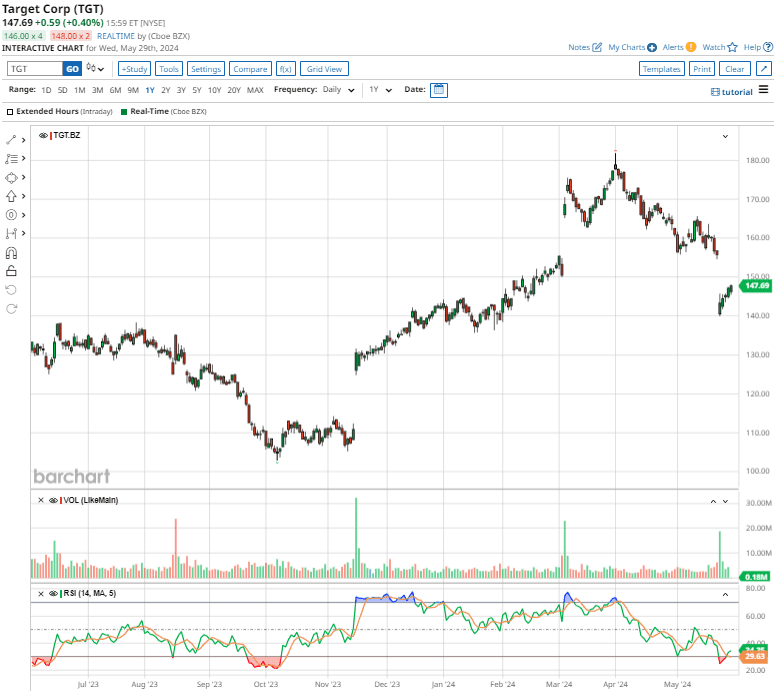

Shares of Target have rallied 5.9% over the past 52 weeks and 11.7% over the past six months, lagging the S&P 500 Index ($SPX) over both time frames. The stock is down about 19% from its 52-week high, set in early April.

Target’s stellar 55-year streak of dividend increases has crowned it a "Dividend King." In March, the company announced a $1.10 per share quarterly dividend, payable to its shareholders on June 10. This marks Target’s 227th consecutive dividend payment since going public in October 1967.

With an annualized dividend of $4.40, Target’s 3.03% yield outshines the S&P Retail SPDR’s (XRT) yield of 1.28%, enhancing its appeal to income-focused investors. Additionally, a dividend payout ratio of 48.6% ensures room for growth and potential dividend boosts.

In terms of valuation, the stock is trading at 15.50 times forward earnings and 0.62 times sales, which are lower than both its industry peers and Target’s own five-year average multiples.

Target Reports Mixed Q1 Earnings Results

On May 22, the general merchandise giant reported Q1 earnings results that disappointed investors, sending the stock down 8%. Revenue dipped 3.1% year over year to $24.53 billion, narrowly edging out estimates for $24.52 billion, while comparable sales declined by a steeper-than-forecast 3.7%. Non-GAAP EPS of $2.03 fell short of estimates for $2.05.

Target's operating income margin edged up to 5.3% from 5.2%, showing resilience. Its selling, general, and administrative (SG&A) expense ratios climbed from 19.8% to 21.1% due to higher pay, benefits, and marketing investments, while the gross margin rate rose to 27.7% from 26.3%, driven by a better sales mix and effective cost management. The company paid $508 million in dividends in the first quarter, reflecting a 1.9% increase in the dividend per share.

Chair and CEO Brian Cornell said that while the “pace of bottom-line growth is somewhat slower than we've seen on the top line and below what we'd expect to see over time, it reflects some unique profit rate pressures that we faced during the period, a portion of which we expect to offset over the next several years.”

Target's management forecasts flat to 2% growth in Q2 comparable sales, with GAAP and adjusted EPS between $1.95 and $2.35. For fiscal 2024, they project similar comparable sales growth and EPS between $8.60 and $9.60.

Analysts tracking Target predict its profit to surge by 4.8% to $9.37 per share in fiscal 2024 and then another 12.8% to $10.57 in fiscal 2025.

What Do Analysts Expect for Target Stock?

Ahead of Target’s Q1 earnings results, UBS analyst Michael Lasser reaffirmed a “Buy” rating on the retail giant and emphasized that Target’s price cuts on “frequently shopped” items are a strategic move leveraging healthy margin gains for long-term benefit. He projected potential margin impacts of 0.1 to 0.3 percentage points from the move, with a conservative EPS estimate of $9.45 for fiscal 2024, factoring in forecasts of margin expansion.

Lasser lowered the stock’s price target to $185 from $191 post-earnings, but still viewed Target's Q1 performance favorably. "In our view, TGT's 1Q had more positives than negatives. As a result, we believe the pullback in the shares will prove to be a good buying opportunity," wrote the analyst.

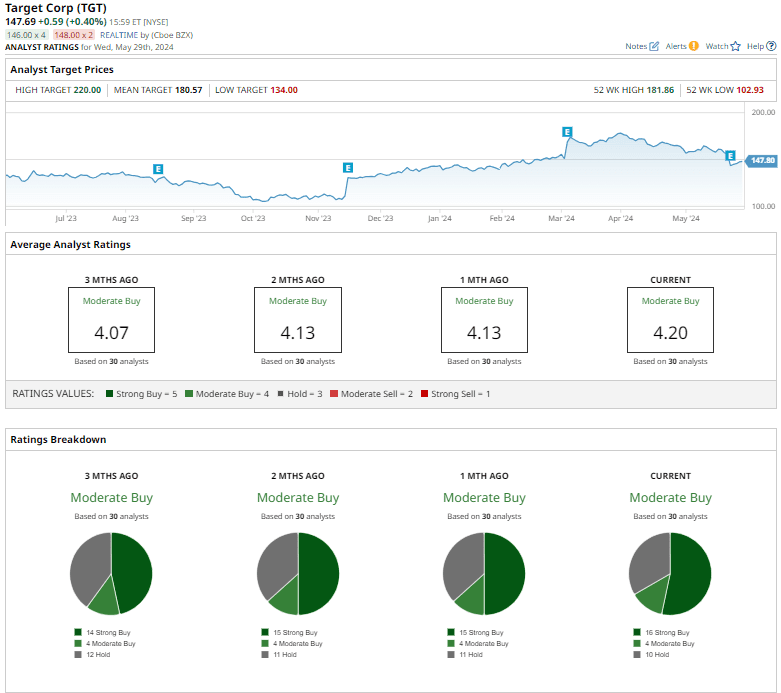

Target has a consensus “Moderate Buy” rating overall. Out of the 30 analysts offering recommendations for the stock, 16 analysts recommend a “Strong Buy,” four analysts advise a “Moderate Buy,” and the remaining 10 suggest a “Hold” rating.

The mean price target of $180.57 suggests an upside potential of 22.3% from the current price levels. The Street-high target price of $220 for Target implies the stock could rally as much as 48.9%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.