By Ben Aris in Berlin

Russia’s budget is in robust health, considering the economy isoverheating and the war in Ukraine is consuming vast amounts of money, but investors into the Russian Finance Ministry’s OFZ treasury bills, the workhorse of the Russian budget, are getting squeamish. Despite a radical rate hike to 16% at the end of last year, the Central Bank of Russia (CBR) has not tamed inflation, which continues to creep upwards.

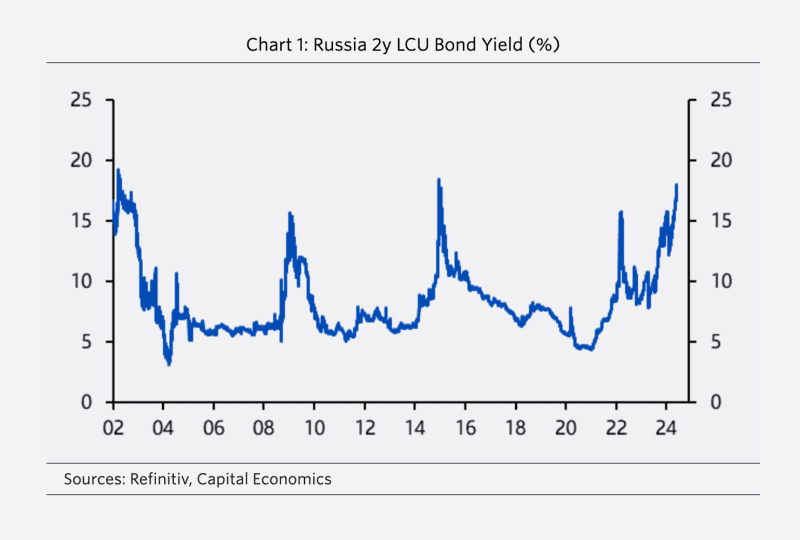

“Sovereign bond yields in Russia have surged to multi-year highs this year as markets have increasingly questioned the trade-off between the war effort on the one hand and policymakers’ ability to maintain fiscal stability and control inflation on the other. Further aggressive interest rate hikes from the central bank appear baked in and there is a growing risk of a hard landing in the economy further down the line, Liam Peach, the senior emerging market economist with Capital Economics, said in a note on May 29.

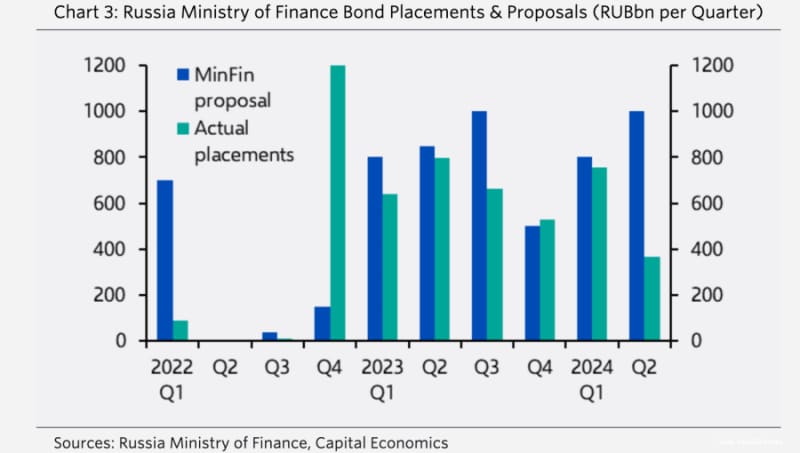

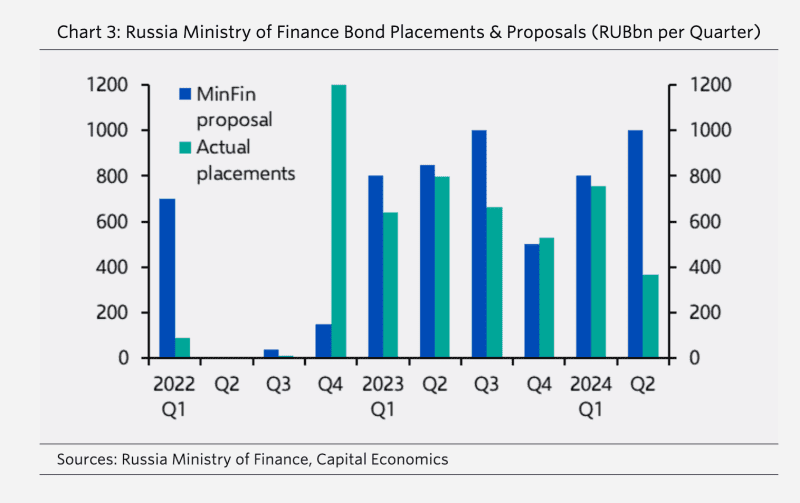

Russia has been cut off from the international capital markets and the share of foreign investors in the domestic debt market has shrunk significantly from around a third at its peak pre-war to only 7.2% of the total outstanding now (chart). Yet the Ministry of Finance (MinFin) is increasingly turning to its own debt to fund the budget deficit increasing borrowing from around RUB2.5 trillion to an anticipated RUB4 trillion this year.

“Russia’s bond market is under strain. The benchmark two-year local currency bond yield has risen by 300bp since the start of the year and now stands at 18.00%. This is the highest it has been since the peak during the market panic in late 2014. Yields have shifted up across the curve,” says Peach.

The key driver of this surge appears to be a recognition of a shift towards permanently looser fiscal policy to support the war effort. Markets were notably unsettled by the 2024 draft budget presented by Finance Minister Anton Siluanov in October, which included a 'huge stimulus' with a 20% increase in spending. This marked a departure from Siluanov’s reputation for fiscal discipline and was followed by a sharp increase in the finance ministry's gross bond issuance plan to RUB4.1 trillion.

As bne IntelliNews reported, there has been a big change in the Putinomics model since the war started with a shift from hoarding cash and paying down debt, to spending freely and modestly increasing the economic leverage by borrowing more on the domestic market. The result has been unexpectedly strong economic growth, but that is accompanied with tenacious inflation. (chart)

In its lastmacroeconomic survey in April, the CBR predicted that inflation will fall from the current 7.8% to 5.4% by the end of the year, but with inflationary pressures rising, analysts say that inflation is more likely to rise to over 8% by the end of this year.

Compounding the issue, Russian banks, the only buyer of OFZ after the foreigners left, are showing increasing reluctance to hold more sovereign debt. There is still plenty of liquidity in the banking system to buy more OFZ that taps a pool of around RUB19 trillion of banking liquidity, but enthusiasm for the bonds is fading, says Capital Economics.

“Siluanov called out Sberbank and VTB last year for failing to bid in OFZ bond auctions and on three occasions this quarter auctions ended unsuccessfully due to a lack of bids. Bond issuance this quarter has fallen sharply and an auction this week was called off amid “market volatility”. Lower appetite to hold sovereign debt likely reflects the growing share of bonds issued at fixed rather than floating rate this year as well as banks ramping up private sector lending. These shifts in the supply of and demand for OFZs have raised the term premium embedded in Russia’s sovereign bond yields,” says Peach.

Corporate lending continued to grow quickly in April, up 1.9% y/y with developers accounting for around a third of the increase as project financing for residential construction, the CBR said in its latest banking sector update. The feel-good rising real incomes coupled with a state subsidies mortgage programme have been fuelling the apartment buying boom in Russia’s real estate sector. Around three quarters of mortgage loans issued in April were issued as part of the government programmes, the CBR said.

The feel-good real income rise is also driving a surge in consumer borrowing, mostly by using credit cards, that is also worrying the CBR, which has increased the macroprudential limits on retail loans to try and head off a credit bubble forming.

However, both these trends are a growing vulnerability which will be very painful if the military Keynesianism growth music stops playing and Russia’s economy contracts sharply.

In the meantime, falling demand for bonds has forced MinFin to hike yields from around 7% per-war to around 18% now, making domestic borrowing increasingly expensive.

The government’s looser fiscal stance has also heightened inflation and interest rate expectations. Core inflation strengthened in April, and the central bank announced that the 'disinflation trend came to an end' last month. Policymakers have hinted at further interest rate hikes, with the latest weekly inflation figures pointing to month-on-month annualised inflation exceeding 6% this month, against the central bank's 4% target.

The central bank argues that Russia’s economy can handle high interest rates and that the surge in yields should not threaten financial stability. And as the prime rate is some nine percentage points higher than inflation, real wages are growing strongly fuelling a consumption boom that is further heating the economy but pleasing the population.

Debt securities account for 11% of banks’ assets, according to Capital Economics, with a significant portion being floating rate OFZs, whose prices have increased this year. The central bank estimates unrealised losses as of April at 0.8% of bank capital, a manageable level.

Despite the broader financial system's resilience, higher private sector debt servicing costs may adversely affect highly leveraged households and corporates with weak balance sheets. Nevertheless, the risks to financial stability appear limited, with good lending quality, low household debt ratios, and a large share of corporate and mortgage borrowing under preferential government programmes.

“The broader and perhaps more important point is that the situation in Russia – in which the government ramps up state spending and the central bank is forced to tighten monetary policy ever further in response – is becoming unsustainable. We argued that this was likely in a Focus in mid-2023. Large debt issuance will put further upward pressure on government bond yields and we now think another central bank interest rate hike looks likely next week, with a 200bp increase to 18.00% not out of the question,” says Peach.

The growing risk is that loose fiscal policy could lead to tighter monetary conditions, potentially causing a sharp economic slowdown. Interest rates might become prohibitively expensive for the private sector, and financial repression policies may force state banks to reduce private sector lending to absorb higher bond issuance.