I asked if natural gas prices can rebound in an April 30 Barchart article. Nearby prices were just over the $2 level at $2.013 per MMBtu on April 29. I concluded the article with the following:

Two bullish factors face the bearish natural gas futures arena in late April 2024. While inventories are high, elevated open interest and the war in Ukraine could cause significant upside price variance in the blink of an eye.

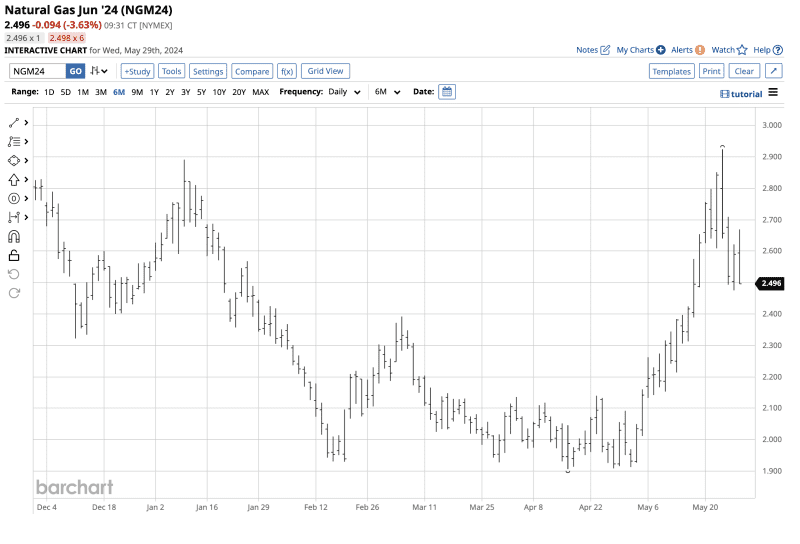

The most recent high in nearby NYMEX natural gas futures was $2.924 per MMBtu, 45.3% higher than April 29.

A short-term bullish trend developed

June NYMEX natural gas futures reached a $1.907 low on April 16 when they ran out of downside steam.

The chart highlights the over 53% rally that took natural gas to the $2.924 per MMBtu level on May 23. Natural gas futures prices have made higher lows and higher highs since mid-April. The first upside technical target above the recent high is the psychological $3 level.

Inventories remain at high levels

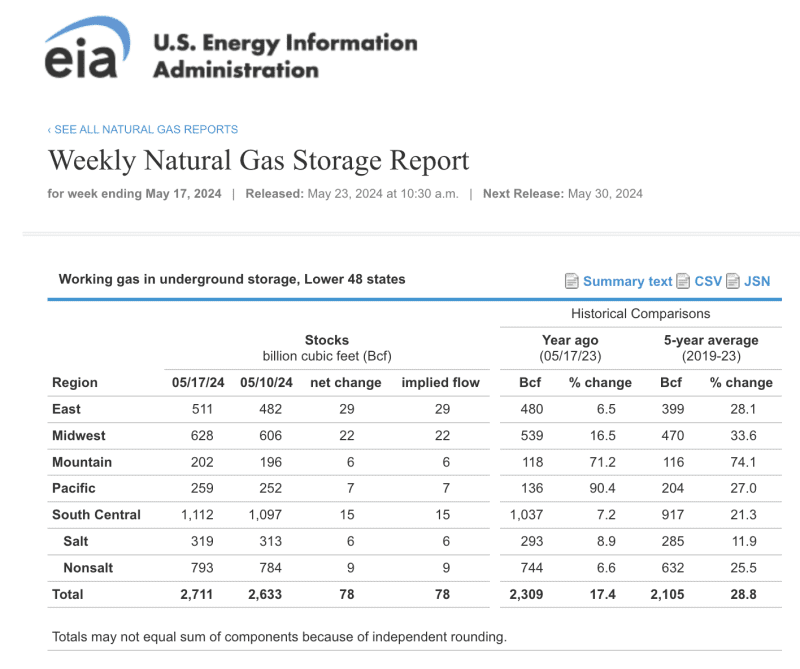

Natural gas stockpiles across the United States have risen over the past weeks after the 2023/2024 withdrawal season. The peak season ended with 2.259 trillion cubic feet of natural gas in storage, the first time the level was above the two tcf level since 2019 and prior years.

As the chart highlights, natural gas in storage across the U.S. was at 2.711 trillion cubic feet as of the week ending on May 17, 17.4% above the previous year and 28.8% over the five-year average. The high stock level is not bullish for natural gas futures; another speculative factor has pushed prices higher.

Nothing powers a rally like too many bears

The late April Barchart article highlighted the number of open long and short positions in the natural gas futures arena, which stood at over 1.547 million contracts. On May 29, open interest at just over 1.502 million contracts was slightly lower but remained elevated.

When open interest increases to near-record levels in a futures market, it tends to indicate an overabundance of speculative risk positions. NYMEX natural gas’s volatility tends to attract significant speculative activity. The high inventory level during the shoulder months, when natural gas demand reaches a seasonal low during spring, gas incentivized bearish risk positions. Temperate weather caused demand for heating and cooling to decline. Meanwhile, nothing can power a relief rally, as we have seen, like too many short-risk positions.

The upside technical levels to watch

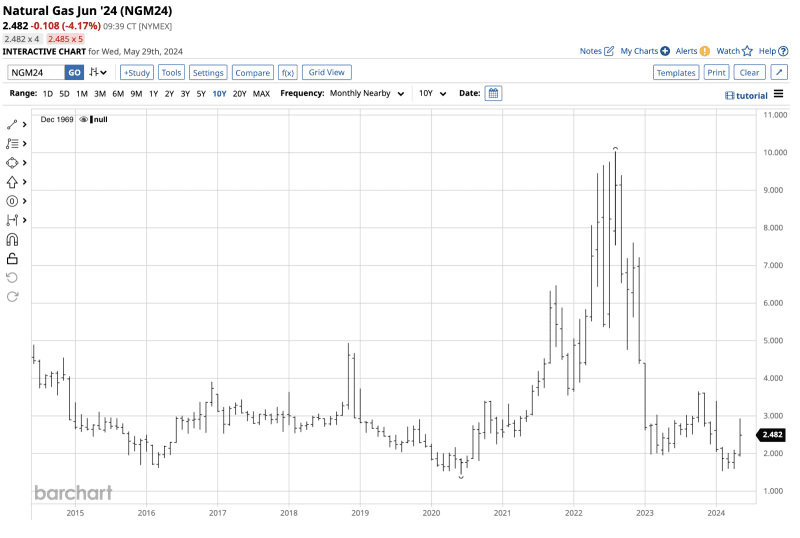

The first technical resistance level on June NYMEX natural gas futures stands at $3 per MMBtu.

The ten-year chart illustrates the continuous contract’s resistance levels are at the January 2024 $3.392 high and the October 2023 $3.643 peak.

In August 2022, nearby NYMEX prices rose to the highest level since 2008, when they briefly eclipsed the $10 level and rose to $10.028 per MMBtu. While a rise to the level is unlikely, there is plenty of room for a further recovery rally in the volatility energy commodity’s futures market.

The shoulder months will end, and cooling demand is on the horizon

As the markets head towards the 2024 summer, cooling demand will rise. Natural gas is a critical input in electricity generation. A hot summer across the U.S. could cause further gains, even though inventories remain the highest in years.

Moreover, LNG means that U.S. natural gas travels the world on ocean vessels to regions with significantly higher prices.

The chart shows the U.S. as the leading natural gas producer, with Russia second. Russia traditionally supplies Western Europe with the energy commodity through the pipeline network. As the war in Ukraine continues, fewer Russian exports to Western Europe could cause more U.S. natural gas to flow to the region. Therefore, rising European prices could support higher U.S. natural gas prices over the coming months.

Natural gas rallied at the start of the 2024 injection season, likely due to an increased level of speculative shorts. Even though U.S. stocks are at a historically high level, the potential for higher prices will depend on the U.S. and European demand during the upcoming cooling season. Weather conditions are the primary factor determining the path of least resistance of the energy commodity’s price. With open interest remaining elevated, a hot summer could keep the rally going as shorts close or reverse their risk positions.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.