Across the recent three months, 12 analysts have shared their insights on Phreesia (NYSE:PHR), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

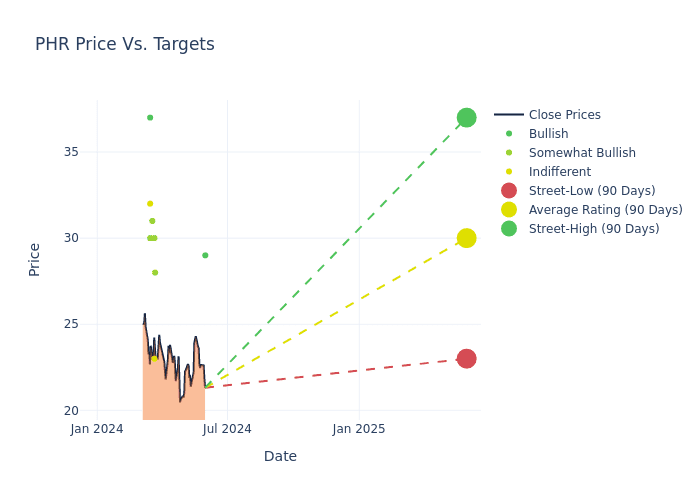

Insights from analysts' 12-month price targets are revealed, presenting an average target of $29.0, a high estimate of $37.00, and a low estimate of $23.00. Observing a 3.06% increase, the current average has risen from the previous average price target of $28.14.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Phreesia. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Phreesia. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Phreesia compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Phreesia's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Phreesia's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Phreesia analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Phreesia

Phreesia Inc is a provider of comprehensive software solutions that improves the operational and financial performance of healthcare organizations by activating patients in their care to optimize patient health outcomes. Through its SaaS-based technology platform, it offers healthcare services clients a robust suite of integrated solutions that manage patient access, registration, payments, and clinical support. The Phreesia Platform encompasses a comprehensive range of technologies and services, including, but not limited to, initial patient contact, registration, appointment scheduling, payments, and post-appointment patient surveys.

Financial Milestones: Phreesia's Journey

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, Phreesia showcased positive performance, achieving a revenue growth rate of 24.05% as of 31 January, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Phreesia's net margin excels beyond industry benchmarks, reaching -32.26%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Phreesia's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -11.88%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Phreesia's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -8.23%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.05.

Analyst Ratings: Simplified

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PHR

View More Analyst Ratings for PHR

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.