First Solar (NASDAQ:FSLR) underwent analysis by 25 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

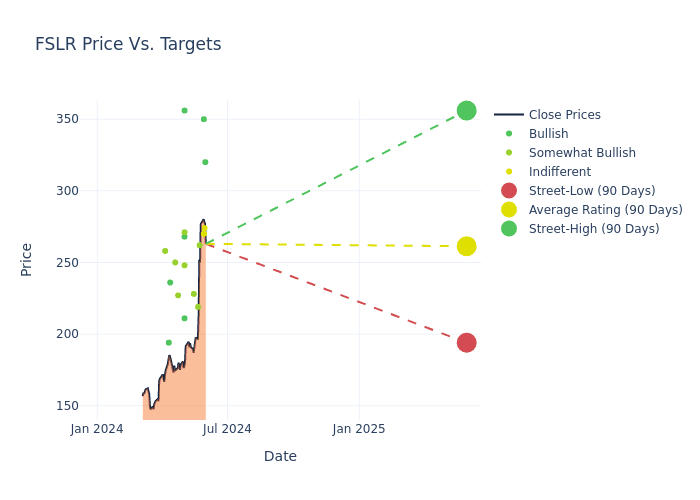

Analysts have set 12-month price targets for First Solar, revealing an average target of $253.76, a high estimate of $356.00, and a low estimate of $194.00. This current average has increased by 6.4% from the previous average price target of $238.50.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of First Solar among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to First Solar. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of First Solar compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of First Solar's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into First Solar's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on First Solar analyst ratings.

Get to Know First Solar Better

First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company's solar modules use cadmium telluride to convert sunlight into electricity. This is commonly called thin-film technology. First Solar is the world's largest thin-film solar module manufacturer. It has production lines in Vietnam, Malaysia, the United States, and India.

Breaking Down First Solar's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining First Solar's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 15.58% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: First Solar's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 30.14%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): First Solar's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.38% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): First Solar's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.5%, the company showcases efficient use of assets and strong financial health.

Debt Management: First Solar's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.09.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FSLR

View More Analyst Ratings for FSLR

View the Latest Analyst Ratings

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.