EV giant Tesla Inc (NASDAQ:TSLA) on Friday released a step-by-step guide for shareholders to vote ahead of the company’s upcoming meeting in June.

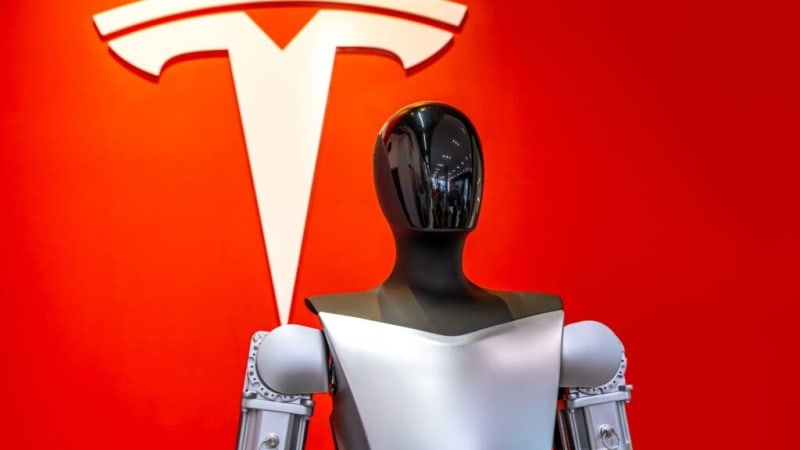

What Happened: Tesla used its humanoid bot, Optimus, to demonstrate the voting process for shareholders on Elon Musk-owned social media platform X. Shareholders were shown how to vote online, by QR code, phone, or mail.

The guide also lists the proposals recommended by the Tesla board to vote for and those the board suggests that shareholders vote against. The board is pushing strongly for the reinstatement of CEO Elon Musk‘s 2018 pay package.

Updates On Optimus: During Tesla’s first-quarter earnings call in April, Musk said that he anticipated Optimus’ limited production to begin by the end of 2024, with external sales potentially starting by the end of 2025.

"I think Optimus will be more valuable than everything else combined. Because if you've got a sentient humanoid robots that is able to navigate reality and do tasks at request, there is no meaningful limit to the size of the economy,” he added.

Earlier this year, Musk confirmed to an X user that the Optimus will be priced between $25,000 and $30,000 initially and less as time passes. The CEO explained that making the Optimus costs the company only half as much as making a car.

Why It Matters: Shareholders will vote on moving Tesla’s state of incorporation from Delaware to Texas and Musk’s rescinded 2018 pay package ahead of the upcoming meeting.

The pay package, worth $56 billion at the time of award, was rescinded by a Delaware court earlier this year after deeming it an "unfathomable sum." Tesla’s board is trying to have it reinstated by a shareholder vote yet again in June, including by investing in advertisements to the effect.

In a note earlier this month, Morgan Stanley analyst Adam Jonas said that the upcoming meeting will drive material volatility in the stock and determine the company's long-term strategic direction.

Price Action: Tesla shares closed down 0.4% on Friday at $178.1 and dropped 0.3% after hours. The stock is down by nearly 28.3% year-to-date, according to data from Benzinga Pro.

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read More: Tesla Recalls Over 125,000 EVs To Fix Faulty Seat Belt Warnings: Which Models Are Affected?

Photo courtesy: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.