Duolingo Inc. (DUOL) is a language learning platform that uses sophisticated data and artificial intelligence (AI) to make learning more fun and easy. It keeps its users motivated by using class art, animation, and design to make its courses interactive and help its users achieve their goals. Its lesson platform includes speaking, translating, listening, and multiple-choice questions to grade its users. Established in 2011, it offers more than 40 languages, with its headquarters in Pittsburgh, Pennsylvania.

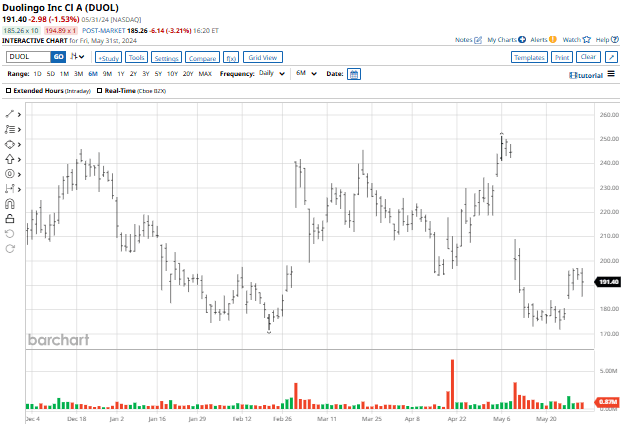

Duolingo stock is up 28.3% in the last year, but has pulled back around 24% since reaching its 52-week high in May.

DUOL Stock Sells Off After Q1 Earnings

Shares of the growth stock gapped sharply lower after its Q1 earnings report in early May, even as Duolingo reported quarterly results that beat Wall Street's expectations.

Revenue for the period jumped 44.9% year over year to $167.6 million, edging past consensus estimates of $165.7 million. Duolingo swung to a profit of $0.57 per share, reversing its year-ago loss of $0.06 per share - and sailing past the average analyst estimate for a profit of $0.30 per share.

Free cash flow for the period surged 67% to $79.62 million, while gross margin held steady at 73%.

Looking ahead, the digital learning company expects Q2 revenue of around $176.3 million at the midpoint, which arrived in line with analysts' estimates. For the full year, Duolingo expects revenue of $723.5 million to $731 million.

Investors sold the news, zeroing in on slower growth in daily active users (DAUs) and paid subscriptions. Both metrics rose 54% year over year in Q1, marking a deceleration from their Q4 pace.

Addressing the slowdown, CEO Luis von Ahn said, "Kind of the way we see it is we're at around 60% DAU growth. I mean some quarters are a little more, some quarters a little less. It was kind of the fluke thing that we were going - creeping up for like 10 quarters in a row. But the way we see it is we're around 60% DAU growth. And we think that that's going to continue for a while. It's hard to say exactly what a while means, but we feel pretty good about our DAU growth."

Analysts remain upbeat on DUOL, projecting EPS to grow all the way to $2.64 in fiscal year 2025, compared to $0.35 in 2023.

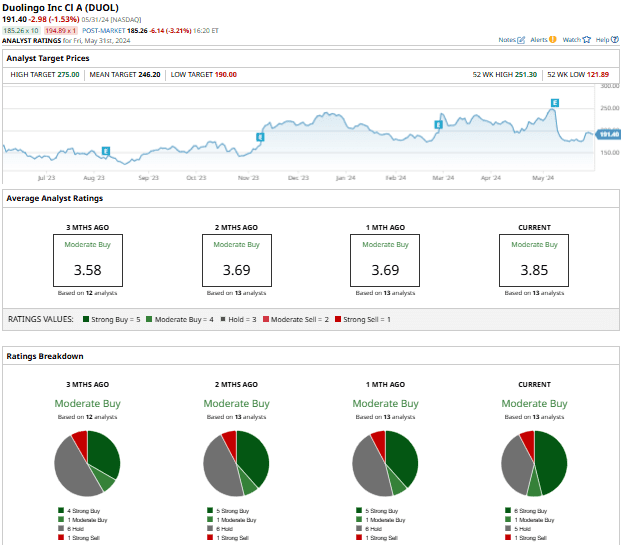

What Do Analysts Think Of DUOL?

In fact, Wall Street has gotten more optimistic on the growth stock lately. DUOL stock has a consensus “Moderate Buy” rating, based on 6 “Strong Buy” ratings - up from 4 a few months ago - 1 “Moderate Buy,” 5 “Holds,” and 1 “Strong Sell.”

The mean price target among these 13 analysts is $246.20, signifying an upside potential of 28.6% from current levels.

Recently, JMP Securities raised its rating on the stock to “Market Outperform” from “Market Perform” with a target of $260 - suggesting an upside potential of 35.8% from current levels. The brokerage cited “structural moats around freemium, data, and a growing brand,” as well as DUOL's more attractive valuation following the post-earnings pullback.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.