Utility stocks have been making waves lately, and for good reason. As artificial intelligence’s (AI) influence expands, fueling a projected 160% surge in data center power demand by 2030, utility stocks are poised for substantial gains.

Investors’ enthusiasm for utility stocks is evident from the S&P 500 Utilities Sector SPDR’s (XLU) impressive return of 15% on a YTD basis, making it the third-best performing sector among the 11 S&P sectors this year. Leading investment bank Goldman Sachs (GS) shares this optimism, emphasizing the sector's unique blend of AI exposure and defensive characteristics in a recent analyst note.

Among Goldman’s favorite utility stocks, here’s a closer look at three - Sempra (SRE), Xcel Energy Inc. (XEL), and Eversource Energy (ES) \- that have consensus “Buy” ratings on Wall Street, and double-digit upside to analysts’ mean price targets.

Utility Stock #1: Sempra

Commanding a market cap of $48.7 billion, California-based Sempra (SRE) is a leading energy infrastructure company, serving nearly 40 million consumers. Sempra is involved in the sale, distribution, storage, and transportation of electricity and natural gas (NGN24). The company serves major markets across California, Texas, Mexico, and globally.

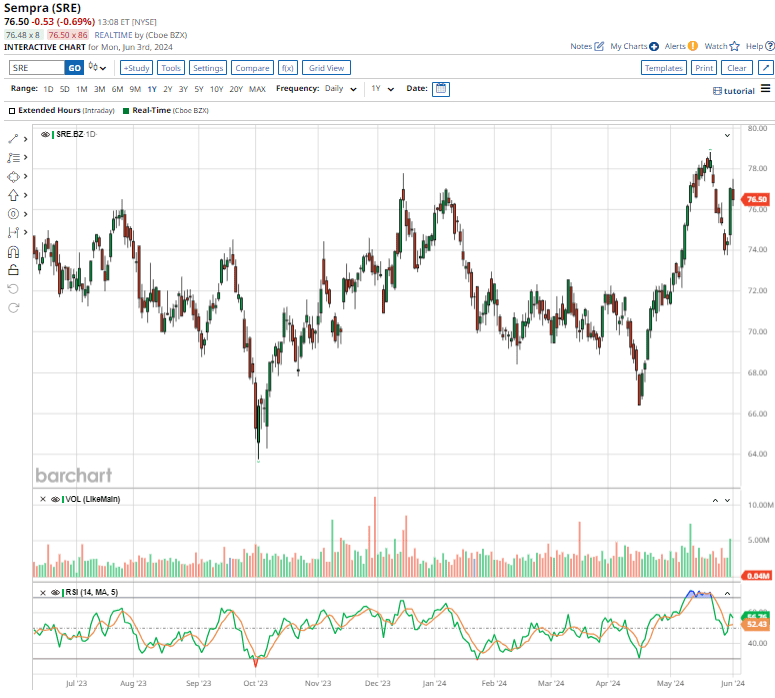

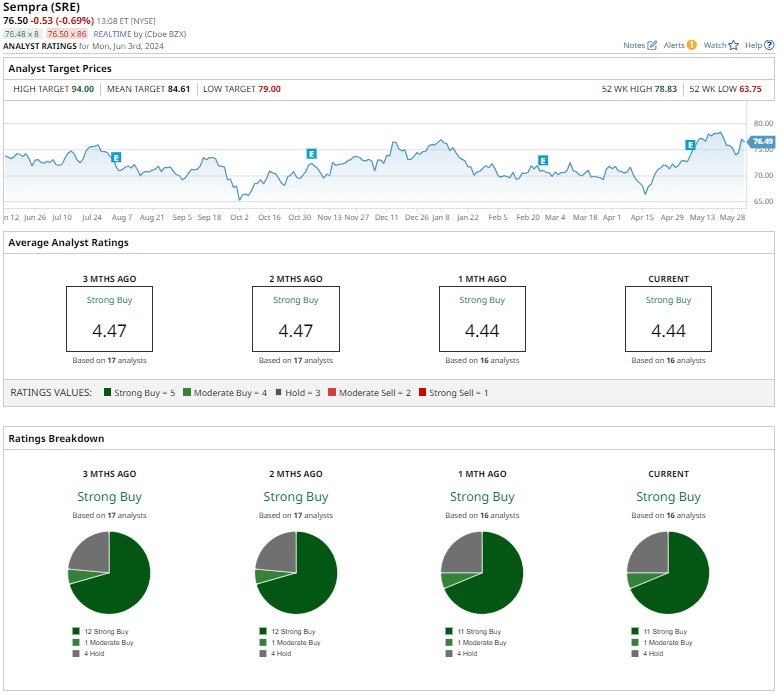

Shares of Sempra have gained 5.8% over the past 52 weeks, and 9.5% over the past three months.

On May 14, Sempra declared a quarterly dividend of $0.62 per share, payable to its shareholders on July 15. The company has a solid track record of 13 consecutive years of dividend growth. Plus, its annualized dividend of $2.48 translates to an attractive 3.2% dividend yield.

In terms of valuation, the stock trades at 15.44 times forward earnings and 2.82 times sales, lower than its own five-year averages of 17.59x and 3.26x, respectively.

The company reported its Q1 earnings results on May 7, which fell short of consensus estimates. Total revenue fell 44.5% annually to $3.6 billion, hit hard by declines in the natural gas and energy-related segments. That more than offset gains in the electric segment, which showed a 2.8% annual improvement. During the quarter, Sempra’s adjusted earnings amounted to $854 million, or $1.34 per share, while its cash and cash equivalents rose to approximately $606 million.

For fiscal 2024, management now projects GAAP EPS to range between $4.52 and $4.82, while adjusted EPS is expected to be between $4.60 and $4.90 \- in line with management’s targeted long-term EPS growth rate of 6% to 8%.

Analysts tracking Sempra project the company’s profit to climb 4.1% year over year to $4.80 per share in fiscal 2024 and grow another 6.7% to $5.12 per share in fiscal 2025.

Sempra stock has a consensus “Strong Buy” rating overall. Out of the 16 analysts covering the stock, 11 suggest a “Strong Buy,” one advises a “Moderate Buy,” and the remaining four give a “Hold” rating.

The average analyst price target of $84.61 indicates a potential upside of 10.8% from the current price levels. The Street-high price target of $94 suggests potential upside of 23.2%.

Utility Stock #2: Xcel Energy

Founded in 1909, Minnesota-based Xcel Energy Inc. (XEL) generates, purchases, transmits, distributes, and sells electricity. With a market cap of about $30.8 billion, Xcel Energy serves 3.8 million electricity customers and 2.2 million natural gas customers, offering a comprehensive portfolio of energy-related products and services through its regulated operating companies.

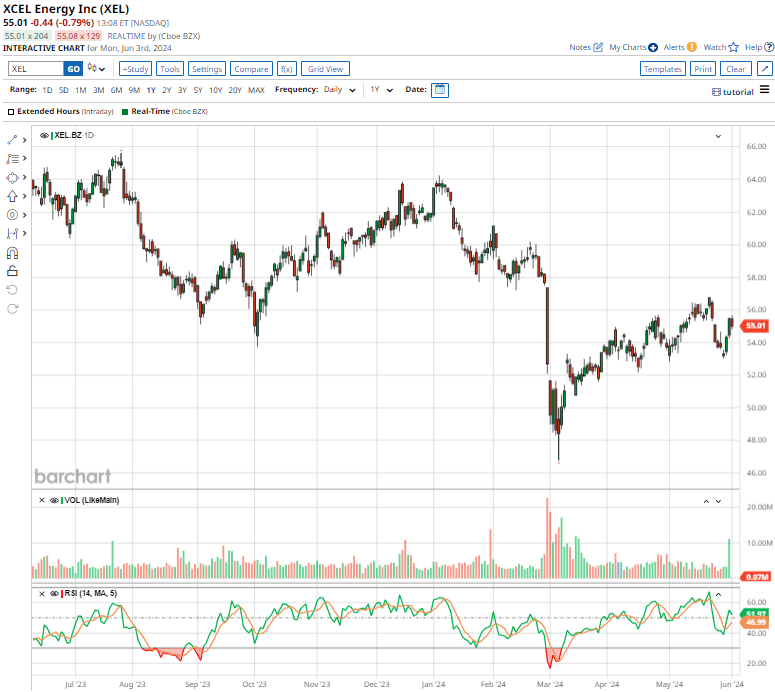

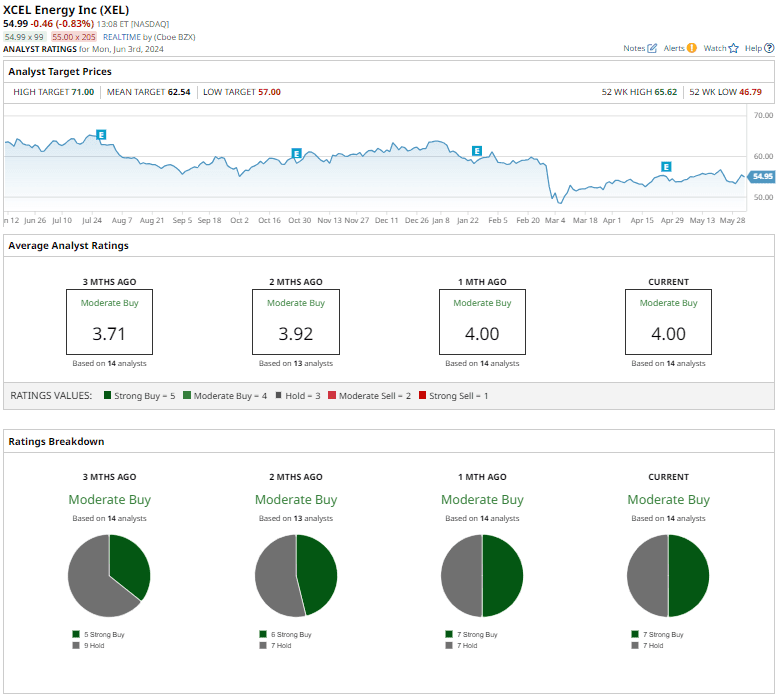

Shares of Xcel Energy have pulled back almost 13% over the past 52 weeks, but soared 10.9% over the past three months.

With a remarkable track record of 19 consecutive years of dividend growth, Xcel Energy is highly committed to rewarding its shareholders. On May 22, the company declared a quarterly dividend of $0.5475 per share, payable to its shareholders on July 20. Its annualized dividend of $2.19 translates to a 3.9% dividend yield.

Priced at 15.28 times forward earnings, the stock is trading lower than the electric utilities industry median and its own five-year average.

On April 25, Xcel Energy revealed its Q1 earnings results, which exceeded Wall Street’s predictions on the bottom line. Total revenue during the quarter stood at $3.7 billion, while EPS of $0.88 jumped 15.8% annually, sailing past Street estimates by exactly 10%.

The earnings growth was fueled by the ramped-up recovery of infrastructure investments, coupled with optimized operations and maintenance expenses. During the quarter, operating income rose 18.5% year over year to $679 million, while total operating expenses plummeted by 15.3% year over year to $3 billion, driven by decreases in electric fuel, purchased power costs, and expenses related to natural gas sales and transportation.

In fiscal 2024, management anticipates EPS to range between $3.50 and $3.60, while retail electric sales are projected to improve 1% to 2% annually. Longer term, management targets 5% to 7% EPS growth and annual dividend increases within the same range.

Analysts tracking Xcel Energy expect the company’s profit to reach $3.56 per share in fiscal 2024, up 6.3% year over year, and rise another 7.6% to $3.83 per share in fiscal 2025.

Xcel Energy stock has a consensus “Moderate Buy” rating overall. Out of the 14 analysts offering recommendations for the stock, seven suggest a “Strong Buy,” and the remaining seven give a “Hold” rating.

The average analyst price target of $62.54 indicates a potential upside of 13.8% from the current price levels. The Street-high price target of $71 suggests that the stock could rally as much as 29.2%.

Utility Stock #3: Eversource Energy

Incorporated in 1927 and headquartered in Massachusetts, Eversource Energy (ES) transmits and distributes electricity and natural gas, operates solar power facilities, and provides water services to approximately 4.4 million customers across Connecticut, Massachusetts, and New Hampshire. The company’s market cap currently stands at $20.9 billion.

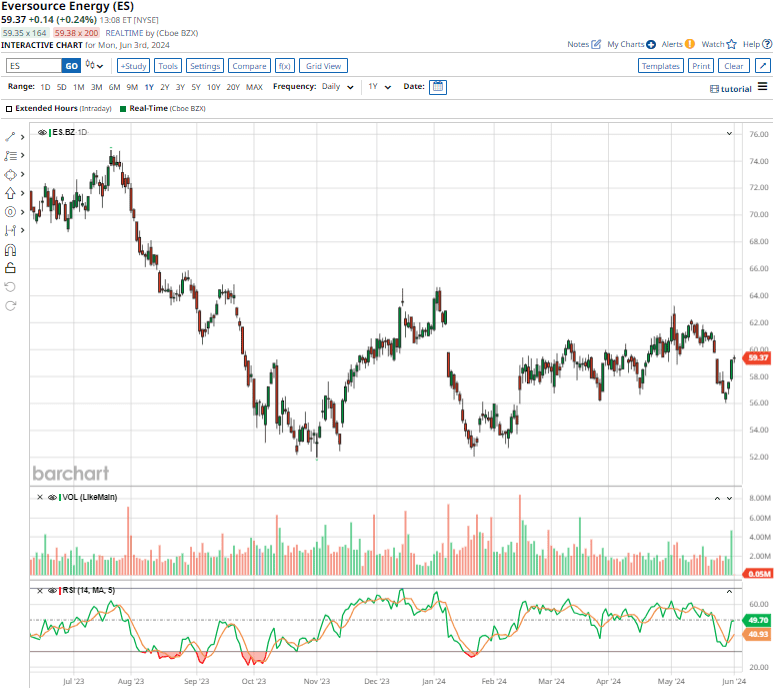

Shares of Eversource Energy have pulled back 15.4% over the past 52 weeks, but recovered 13.7% from their early January YTD lows.

On May 1, Eversource declared a quarterly dividend of $0.715 per share, payable to its shareholders on June 28. The company holds an impressive 23-year track record of rewarding its shareholders with consecutive dividend increases. Moreover, its annualized dividend of $2.86 offers a highly appealing 4.8% dividend yield.

Apart from its generous dividend yield, the stock is trading at 12.71 times forward earnings and 1.70 times sales, much lower than its industry median and its own five-year averages.

The company disclosed its Q1 earnings results on May 1. While its operating revenue of $3.3 billion fell short of Wall Street projections, its EPS of $1.49 climbed 5.7% year over year, topping estimates by 2.8%. Eversource reported solid 13.9% earnings growth in the Electric Transmission segment, driven by increased investment in the electric transmission system to accommodate system capacity growth and facilitate the delivery of clean energy resources.

Commenting on the company’s Q1 performance, President and CEO Joe Nolan said, “We were proud to make history during the first quarter, when Eversource and Ørsted’s South Fork Wind farm became the first operational commercial-scale offshore wind facility in the U.S.”

For fiscal 2024, management expects non-GAAP EPS between $4.50 and $4.67. Additionally, the company reaffirmed its capital investment plan of $23.1 billion.

Analysts tracking Eversource Energy project the company’s profit to increase 4.4% year over year to $4.53 per share in fiscal 2024 and grow another 5.3% to $4.77 per share in fiscal 2025.

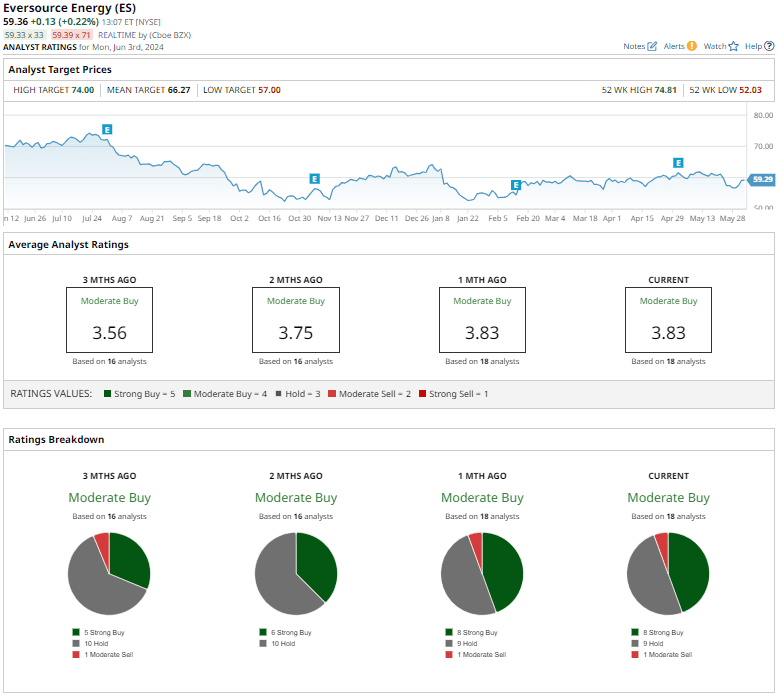

Eversource Energy stock has a consensus “Moderate Buy” rating overall. Out of the 18 analysts covering the stock, eight suggest a “Strong Buy,” nine advise a “Hold,” and the remaining one gives a “Moderate Sell” rating.

The average analyst price target of $66.27 indicates a potential upside of 11.6% from the current price levels. The Street-high price target of $74 suggests the stock could rally as much as 24.7%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.