A pledge to abolish inheritance tax (IHT) by the Tories is likely "coming down the track" in an attempt to save the Conservative Party from electoral disaster, according to George Osborne.

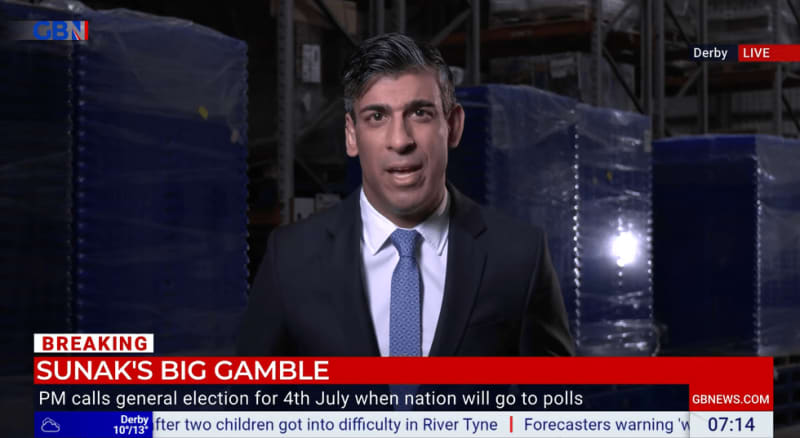

The former Chancellor is highlighting how the "much-hated" levy could be on the chopping block as Prime Minister Rishi Sunak looks to reverse the Tories' polling woes before the General Election on July 4.

In 2007, Osborne proposed raising the IHT threshold to £1million while the Conservatives were in opposition in a move that would have effectively scrapped the tax.

Jeremy Hunt, who is currently serving as Chancellor, floated ending inheritance tax earlier this year and has previously described the levy as "profoundly anti-Conservative".

According to his predecessor, abolishing inheritance tax may be a "potent weapon" in enticing voters and could be the Tories "one big throw of the dice" during this election campaign.

Speaking to The Telegraph''s Political Currency podcast, Osborne broke down why the Tories are potentially exploring ending IHT in some capacity.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

He explained: “We haven’t heard from the Tories on tax and I think a pledge to abolish inheritance tax or all but abolish inheritance tax is probably coming down the track.

“I hope it’s something that over time a Conservative government would be able to look at.”

According to the former politician, scrapping the tax has always had "a particular purchase" among certain quarters of the electorate.

Osborne added: "Partly because for every estate that pays inheritance tax, there are quite a lot of individuals who benefit from that, different children and grandchildren, and because of rising house prices, lots of people think they’re going to be in the inheritance tax net in the future, so sometimes the numbers are a bit misleading.

“It also is a much-hated tax, so it’s a very potent weapon for the Conservatives, and I think there will be loads of pressure so try something big.”

Both the Conservatives and Labour have ruled out raising income tax ahead of polling day, with the latter promising not to raise National Insurance or VAT also.

However, if announced, scrapping inheritance tax would be the boldest fiscal move made by any of the political parties so far.

In the latest YouGov poll, the Tories are forecast to have their worst performance in a General Election since 1906 with only 140 seats.

What is inheritance tax?

This is a tax that is charged on the estates of individuals who have passed away, if said estates are worth more than a specific amount.

It is currently charged at 40 per cent on estates, including money, possessions and property, which are priced over the £325,000 threshold.

LATEST DEVELOPMENTS:

Based on the figures HM Revenue and Customs (HMRC), around 27,000 estates paid inheritance tax in the 2020-21 tax year.

Over the period, an estimated £5.76billion in liabilities for the levy were generated.

This represents a 16 per cent hike in IHT revenue which

This was a 16 per cent increase from usual figures which is believed to be partially contributable to deaths during the Covid-19 pandemic.