In a May 2 Barchart article on the wood futures market, I concluded:

Lumber is in a bearish trend in May 2024, and the trend is always your best friend. The path of least resistance of physical lumber futures could depend on the Fed’s monetary policy path over the coming weeks and months. Higher rates will likely be bearish, while rate cuts could ignite an explosive upside move.

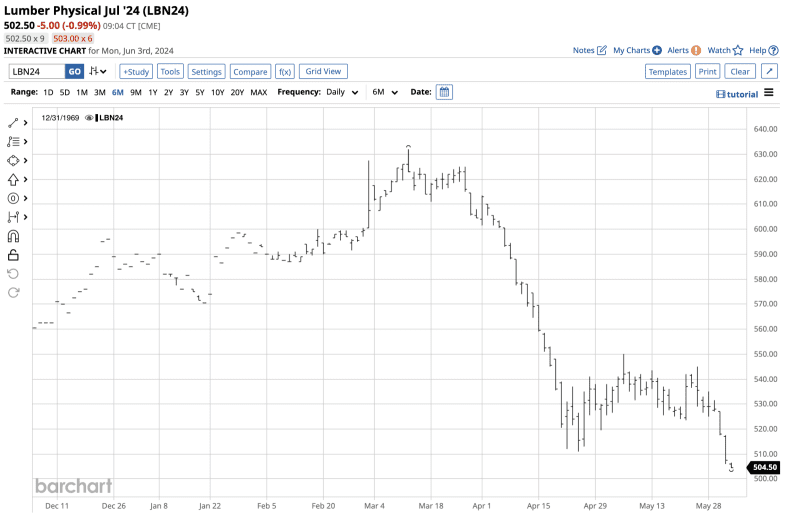

Nearby July physical lumber futures were at the $527 per 1,000 board feet level on May 1 and have only edged higher to the $538.50 level on June 1.

Lumber is stuck in a sideways range

Since April 18, CME physical lumber futures for July 2024 delivery have traded in a $500 to $550 per 1,000 board feet range.

After falling from a $632 high on March 12, the lumber futures market has settled into a narrow consolidation range of directionless trading.

A narrowing range over the past years

The trading ranges have significantly declined compared to the continuous random-length lumber futures market and the physical lumber contracts that replaced them over the past years.

- In 2021, nearby lumber futures traded in a $1,263.20 range from $448.00 to $1,711.20 per 1,000 board feet.

- In 2022, nearby lumber futures traded in a $1,006.80 range from $470.60 to $1,477.40 per 1,000 board feet.

- In 2023, nearby lumber futures traded in a $274.50 range from $352.50 to $627 per 1,000 board feet.

- So far, in 2024, nearby lumber futures traded in a $141.50 range from $470 to $611.50 per 1,000 board feet.

The narrowing ranges over the past years signal consolidation in the lumber futures arena.

Boom-and-bust action could be ahead- Lumber remains illiquid

The explosive and implosive price action in 2021 and 2022 gave way to an extended period of calm in the lumber futures market. While narrower trading ranges are often a sign of increased liquidity, lumber futures continue to suffer from highly illiquid trading conditions that can lead to wild price swings.

The contract size of the current physical lumber futures is one-quarter the size of the random-length futures they replaced. As of the end of May, open interest, the total number of open long and short positions in the lumber futures market, was at the 9,565 contract level. The current open interest would translate to under 2,400 total open interest in the old random-length contracts, hardly a liquid market.

Low liquidity often causes bids to buy to disappear during price declines and offers to sell to evaporate during rallies, leading to the type of boom-and-bust price action in 2021 and 2022. When lumber’s current consolidation ends, there is a high potential for another bout of extreme price variance.

Keep an eye on interest rates

Lumber is highly sensitive to interest rates. The 2021 and 2022 rallies resulted from historically low interest rates, leading to sub-3% 30-year conventional fixed-rate mortgage levels. With home financing above the 7% level, excluding many potential home buyers, the demand for mortgages and new homes has declined, weighing on lumber demand and prices. Falling interest rates could trigger increased demand for new homes, increasing lumber prices.

Given the inverse relationship, the path of least resistance of lumber futures is a function of rising or falling interest rates. We could see a sudden rally if mortgage rates fall below 6%, as many existing homeowners have financing at or below the 3% level. The existing home shortage means the demand for new construction could soar, and lumber is the critical ingredient in homebuilding.

Lumber has been stuck in neutral with the market going back and forth on the odds of rate cuts in 2024.

WY, WOOD, and CUT are liquid

I have been trading commodities since the early 1980s and have traded almost every raw material futures market. However, given the low liquidity, I have never bought nor sold one lumber contract and do not plan to ever venture into the arena.

I favor using stocks and ETFs that have a high correlation with lumber prices when bullish or bearish on wood prices. My products of choice include:

- Weyerhaeuser Company (WY) operates as a real estate investment trust in lumber, owning or leasing significant timberlands in the U.S. and Canada.

- The iShares Global Timber & Forestry ETF (WOOD) owns WY shares and other companies that tend to move higher and lower with lumber prices.

- The Invesco MSCI Global Timber ETF (CUT) has fewer assets under management than WOOD, but similar holdings and sensitivity to lumber prices.

Lumber futures are like a roach motel; getting into and out of profitable positions can be more than challenging, but losses can mount quickly as low liquidity increases risk dynamics to irrational levels. Meanwhile, WY, WOOD, and CUT are far more liquid assets that tend to correlate positively with wood prices over time.

Lumber prices are stuck in neutral, for now. When they decide to move, watch out, as another period of explosive and implosive price action will likely follow.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.