While the dividend yield of the S&P 500 Index ($SPX) is just about 1.35%, which is lower than the historical averages, some index constituents yield over 6%. That’s quite an attractive yield, especially for someone looking to generate regular income from their investments. In this article, we’ll look at some of the highest-yielding S&P 500 stocks, and analyze which ones look good buys.

Which S&P 500 Stocks Pay Good Dividends?

Unsurprisingly, the highest-yielding stocks in the S&P 500 index are from similar industries; REITs, telecom, utilities, and infrastructure. Banks and consumer staple companies like Coca-Cola (KO) are next on the list, with dividend yields roughly twice that of the S&P 500 Index.

The highest yielding S&P 500 stock is Altria (MO), which makes the iconic Marlboro cigarettes. The company has increased its dividends annually for over half a decade, and its current dividend yield is 8.4%. While the company’s dividend yield is quite attractive, and has been so for quite some time now, we’ll leave it out of this analysis, as the tobacco space is regarded as a “vice” industry, and many investors choose to refrain from investing in it.

Many Dividend Names Have Not Created Wealth for Investors

Notably, many stocks that pay high dividends are in industries that are either growing at a very slow pace, or simply witnessing negative top-line growth. Many stocks with a high dividend yield haven’t created much wealth for investors over the last five years in terms of total returns, as their stock prices have sagged.

Incidentally, a lower stock price bumps up the dividend yield, as it reduces the denominator in the equation. Simply put, the dividend yield looks high not necessarily because of rising dividends, but due to the falling stock price.

For instance, Verizon (VZ), AT&T (T), and Crown Castle (CCI) – all of which pay a dividend yield of over 6% - have respectively lost 30%, 26%, and 22% over the last five years. Even Kinder Morgan (KMI), whose dividend yield is just short of 6%, has lost 5% over this period.

Pfizer Pays a Dividend Yield of Over 5%

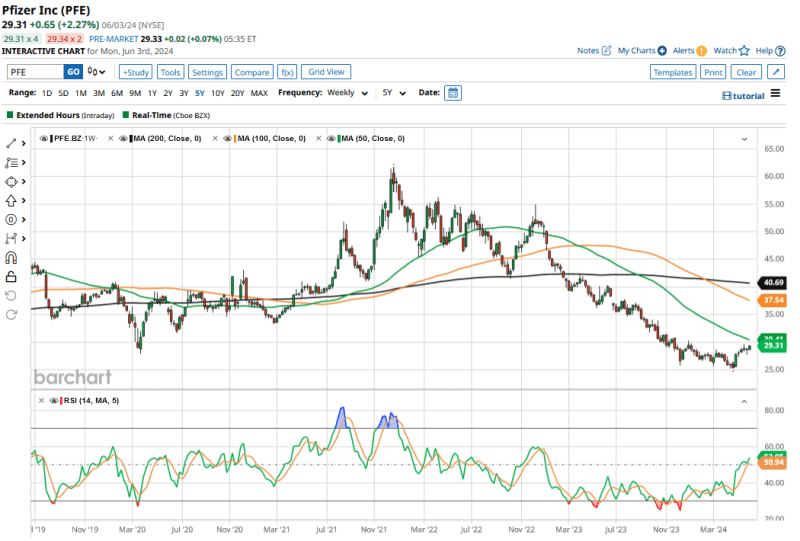

Pfizer (PFE) has a dividend yield of 5.7%, but the stock has lost over 31% in the last five years. The company also happens to be the only pharma name among the top dividend-paying S&P 500 Index stocks.

Pfizer’s fortunes have whipsawed over the last few years. The company made billions of dollars in profit selling the vaccine for COVID-19, and the market rewarded the stock appropriately. However, the demand for its COVID-19 vaccine, Comirnaty, and the Paxlovid pill used to treat active infections has since waned, which is also reflected in its price action.

Why is PFE Stock Underperforming?

Pfizer’s troubles go beyond its COVID-19 portfolio. In December, it halted the development of its twice-daily oral weight-loss drug, danuglipron, after adverse side effects. The company’s new vaccine against respiratory syncytial virus (RSV) also had a disappointing launch; the product’s sales came in at a mere $145 million in Q1, which was less than half of what analysts expected.

Also, Pfizer’s balance sheet looks bloated after it added $31 billion in debt to fund the Seagen acquisition.

Is Pfizer a Dividend Stock Worth Betting On?

Most high-yielding dividend stocks have been underperforming for years, but I believe Pfizer is one name that can offer reasonable capital appreciation over the next five years and maintain its generous payout to shareholders. Here’s why.

- While the sales of Pfizer’s COVID-19 portfolio are falling, CFO Dave Denton stressed during the Q1 earnings call, “We expect our COVID products will continue to be significant contributors to revenues and cash flows for the foreseeable future.” Also, the non-COVID portfolio is doing reasonably well, with 11% YoY operational revenue growth in Q1.

- Pfizer is doubling down on efficiencies, and announced a multi-year $1.5 billion cost-saving program last month, which is on top of the $4 billion plan that it announced in 2023.

- From a product pipeline perspective, Pfizer is working on many cancer treatment medicines. The company expects to double the number of patients treated with its cancer medicines by 2030. Cancer care is among the most rapidly growing sections of the pharma market, and if Pfizer can capture the kind of market share it is touting, it would help the company grow its earnings.

- Importantly, Pfizer’s valuations look quite attractive. The company raised its 2024 adjusted earnings per share (EPS) guidance to between $2.15-$2.35, which at the top end implies a 2024 price-to-earnings (PE) multiple of 12.5x.

Pfizer Stock Forecast

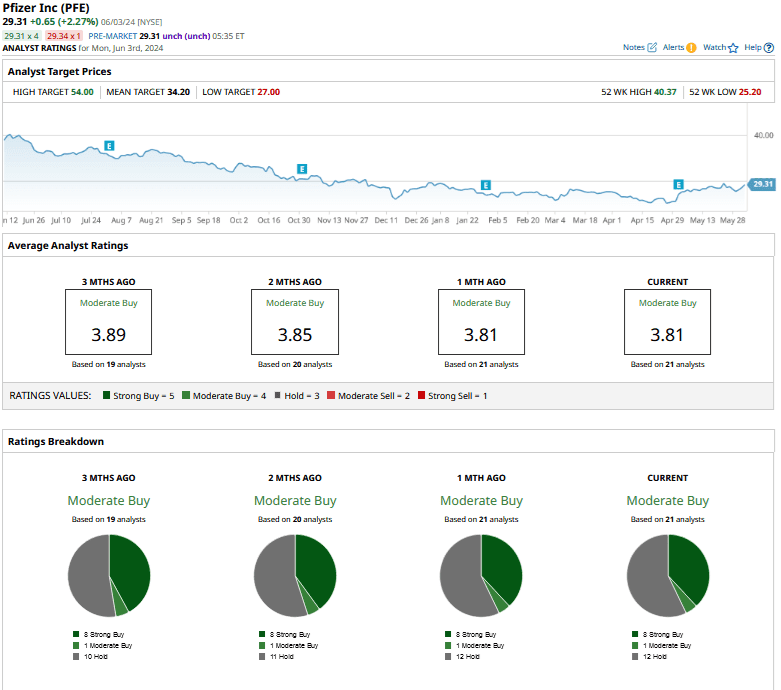

Pfizer has a consensus rating of “Moderate Buy” from the 21 analysts that cover the stock. Its mean target price of $34.20 is 15.6% higher than today’s closing prices, while the Street-high target price of $54 is 82% higher.

Even though I don’t expect miracles from PFE stock in the short term, it is still a quality dividend stock for patient investors. The company has a strong product pipeline, which should lead to better days ahead - quite unlike some of the other high-yielding S&P 500 Index constituents, where the possibility of decent capital appreciation seems quite subdued.

On the date of publication, Mohit Oberoi had a position in: PFE . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.