By Jack Mendel

House prices in the UK remained relatively stable in May on strong wage growth and an improving picture for the wider economy, with interest rate cuts on the horizon.

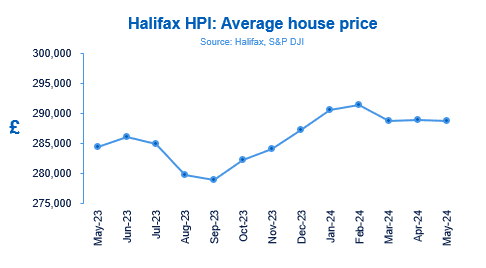

In Halifax’s latest house price index released today, the lender said the average price of a home in Britain was down just 0.1 per cent in May on a monthly basis.

It added that the annual rate of house price growth was up by 1.5 per cent, from 1.1 per cent in April.

London remained ahead of the country, with the median price of a house nationally at £288,688, compared to the capital which was £536,821, 0.2 per cent up on what it was last year.

This comes as the UK economic picture looks to be improving, with inflation falling to 2.3 per cent in April, down from 3.2 per cent in March, although the jump, was not as big as expected.

Last month borrowing also came in ahead of expectations, with mortgage costs still high due to raised interest rates and wage growth was also hotter than expected, coming in at six per cent between January and March.

Yesterday it was reported that rate cuts had been successfully squeezing out inflationary pressures from the economy, in a boost to the bank of England.

Amanda Bryden, Head of Mortgages, Halifax, said: “UK house prices were largely static in May, edging down slightly by -0.1 per cent or around £170 in cash terms.

“Market activity remained resilient throughout the spring months, supported by strong nominal wage growth and some evidence of an improvement in confidence about the economic outlook.”

This has been reflected in a broadly stable picture in terms of property price movements, with the average cost of a property little changed over the last three months.”

She added that “a period of relative stability in both house prices and interest rates should give a degree of confidence to both buyers and sellers.

“While homebuyers and those remortgaging will continue to respond to changes in borrowing costs, set against a backdrop of a limited supply of available properties, the market is unlikely to see huge fluctuations in the near term.”

The forthcoming General Election may also contribute to home-buyers holding off until the next government comes in, to see what policies they bring forward.

Yesterday arecovery in the construction sector was reported, as activity built to a two-year high.