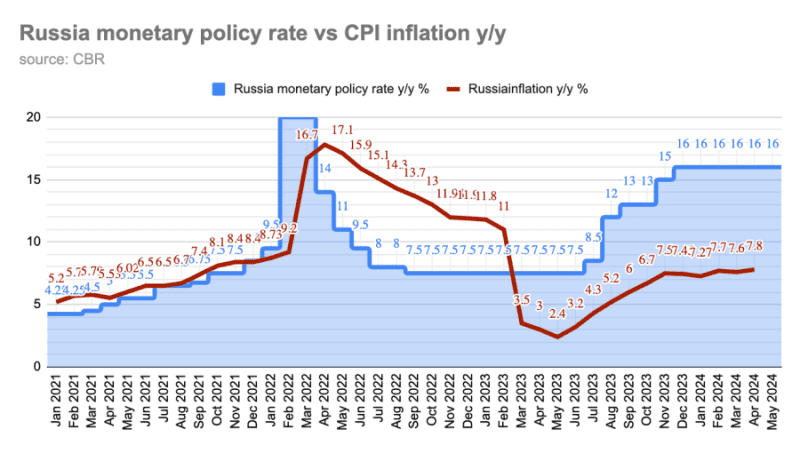

The board of the Central Bank of Russia (CBR) at the June 7 policy meeting resolved to keep the key interest rate unchanged at 16%, making a neutral rate decision for the fourth consecutive time. (chart)

As followed by bne IntelliNews, ahead of the meeting about a third of the analysts in the consensus forecasts expected the CBR to ramp up the key rate to 17% due to the continuing overheating in the economy, the acceleration of inflation in annual terms, the growth of inflationary expectations of the population and high rates of retail lending.

Most recent reports suggested that as inflationary pressures continued to build up in May, Russian banks also prepared for another key rate hike by raising the deposit interest rates.

Although the CBR defied expectations, remained moderate and kept the rate unchanged, the regulator issued a tough signal on the monetary policy going forward.

“The current rate of price growth has stopped declining and remains near the values of the first quarter of 2024. The growth of domestic demand continues to significantly outpace the possibility of expanding the supply of goods and services. The CBR admits the possibility of raising the key rate at the next meeting,” the press release accompanying the June rate decision reads.

The CBR also reiterated that a return of inflation to target 4% “will require a significantly longer period of maintaining tight monetary conditions in the economy than was forecasted in April”. At the same time, the CBR still expects annual inflation to return to the target in 2025 and to remain near 4% thereafter.

The seasonally adjusted core inflation rate stood at 8.3% year-on-year in April after averaging 7.1% in the first quarter. Annual inflation as of June 3 rose to 8.1% after 7.8% posted in April.

The regulator also noted that retail lending remains high despite the high key interest rate. In May, retail loan issuance reached RUB659.9bn, a record-high since August 2023, according to data from the Frank RG analytical company cited by RBC business portal.

“Unsecured consumer lending is supported by the growth of household incomes. State support programmes continue to make the main contribution to the growth of the mortgage portfolio of banks, while the dynamics in the market segment is restrained,” according to the CBR.

The regulator also maintains its stance on the economic overheating, noting that GDP in the 1Q24 grew by 5.4% versus 4.6% forecasted by the CBR.

In addition, the economy continues to grow rapidly, notes the Central Bank. It is in a state of overheating, there is still a tense situation in the labour market, noted the SPIEF participants. GDP growth in the first quarter of 2024 was 5.4% versus the Central Bank's forecast of 4.6%. As followed by bne IntelliNews, the unemployment rate in April 2024 declined even further to the record-low of 2.6%.

“On the medium-term horizon, the balance of risks for inflation has shifted even more towards pro-inflationary risks. The main pro-inflationary risks are associated with changes in foreign trade conditions (including under the influence of geopolitical tensions), with the persistence of high inflation expectations and deviation of the Russian economy from the trajectory of balanced growth,” the CBR warns.

As for the most recent tax hikes announced by the government, the CBR sees the proposed combination of tax changes with parallel growth of expenditures is most likely neutral for inflation.

Kommersant daily reminds that prior to the policy meeting the CBR named four main factors behind the key interest rate decisions: steady decline in inflation, cooling of consumer lending and consumption activity, reduction of labour market rigidity and absence of pro-inflationary risks from the budget or external conditions.

While none of these factors (except for the tax/fiscal components) have eased, the market is likely to continue expecting a key rate hike at the next meeting to be held on July 26.