The adoption of artificial intelligence (AI) has catalyzed transformative changes across industries, providing companies with unprecedented opportunities for growth and innovation. Among the standout success stories in this AI-driven landscape is chip designer Arm Holdings plc (ARM).

Since its public debut last year, Arm has captivated significant investor interest, propelled by its pivotal role in the AI ecosystem. The company further came into the spotlight a few months back when AI king Nvidia Corporation (NVDA) disclosed a $147 million investment in Arm in its debut 13-F filing, underscoring the chip giants' strong faith in Arm’s prospects.

That said, with Arm Holdings projecting a monumental milestone of 100 billion AI-ready devices by the next year’s end, investors are undoubtedly eyeing the company's stock with keen interest. But is the stock a wise investment choice ahead of this significant rollout? Let’s find out.

About Arm Holdings Stock

Founded in 1990 and headquartered in Cambridge, UK, Arm Holdings plc (ARM) is revolutionizing the future of computing with its high-performance, low-cost, and energy-efficient IP solutions for CPUs, GPUs, NPUs, and interconnect technologies. Valued at $142.6 billion by market cap, the company’s energy-efficient processors and innovative software platforms have powered over 280 billion chips, fueling everything from sensors and smartphones to supercomputers.

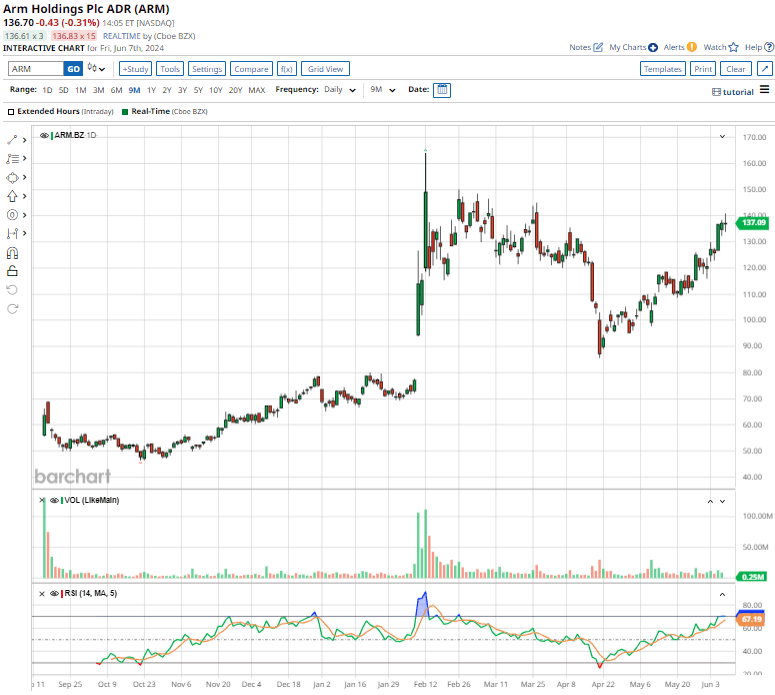

The chip design company went public last September, with its shares skyrocketing an impressive 25% on the very first day of trading. On a YTD basis, the stock has soared 83.6%, easily outpacing the broader S&P 500 Index’s ($SPX) return of 12.7% over the same time frame.

However, priced at 148.07 times forward earnings, the stock trades much higher than its industry median. Even with an above-average earnings growth projection over the next three to five years, this valuation appears expensive.

Arm's Strong Q4 Earnings Beats Wall Street Projections

Following a standout Q3 financial performance in February that caught investors' eyes, the company's fiscal Q4 earnings results, unveiled on May 8, failed to ignite the same level of excitement. Arm's total revenue of $928 million surged an impressive 46.6% annually, surpassing estimates by 5.7%. Moreover, its non-GAAP EPS of $0.36 outpaced projections by a notable margin of 17.9%. Both top and bottom-line figures exceeded the company’s higher-end Q4 guidance.

During the quarter, Arm’s licensing business grew a remarkable 60% year over year to $414 million, driven by a combination of multiple high-value agreements and heightened demand for Arm's power-efficient AI technology in data processing. Meanwhile, Arm's royalty revenue surged by 37% year over year to $514 million, fueled by the expanding adoption of its recently introduced Armv9-based chips, known for their higher margins.

However, despite this strong Q4 performance, it was Arm's guidance that fell short of analyst targets, leaving investors underwhelmed. For fiscal 2025, management expects revenue to range between $3.8 billion and $4.1 billion, while non-GAAP EPS is projected to be between $1.45 and $1.65.

The low end of that guidance came in softer than Wall Street expected, as the consensus was predicting 2025 adjusted EPS of $1.53 on $3.98 billion in revenue.

Arm's Ambitious AI Endeavors

Despite the lukewarm reception to the company's Q4 earnings results, investor optimism toward the stock surged again on June 3. Arm's shares shot up by an impressive 5.5%, ignited by CEO Rene Haas's ambitious pledge at Computex to have 100 billion of its devices globally equipped for AI by the end of 2025. This visionary goal resonated strongly with investors, injecting fresh excitement into the company's trajectory and highlighting its commitment to shaping the future of AI-powered technology.

Apart from this device rollout plan, Hass revealed the company's ambitious plan to secure over 50% of the Windows PC market within the next five years. This optimism stems from Microsoft (MSFT) and its hardware partners' preparations to unveil a new wave of AI-powered PCs fueled by Arm-designed chips. This move has the potential to revolutionize the traditionally Intel (INTC)-dominated industry landscape.

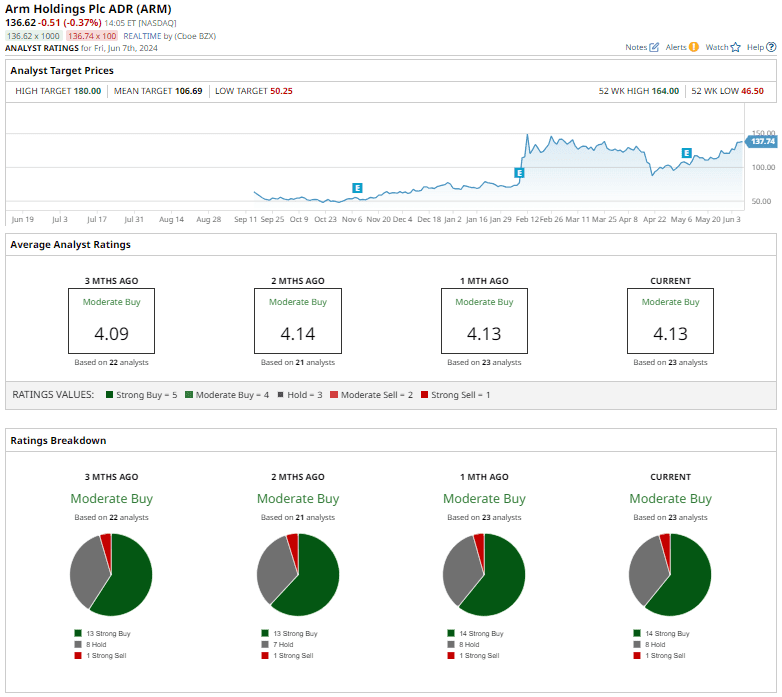

What Do Analysts Expect For Arm Holdings Stock?

Analysts remain optimistic about the stock’s prospects. Arm Holdings stock has a consensus “Moderate Buy” rating overall. Out of the 23 analysts covering the stock, 14 suggest a “Strong Buy,” eight recommend a “Hold,” and the remaining one gives a “Strong Sell” rating.

While the stock is presently trading above its average analyst price target of $106.69, the Street-high price target of $180 - reiterated by Rosenblatt Securities last month - suggests that Arm could rally as much as 31.5% from the current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.