Whales with a lot of money to spend have taken a noticeably bearish stance on Take-Two Interactive.

Looking at options history for Take-Two Interactive (NASDAQ:TTWO) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $103,500 and 12, calls, for a total amount of $463,838.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $140.0 to $190.0 for Take-Two Interactive over the last 3 months.

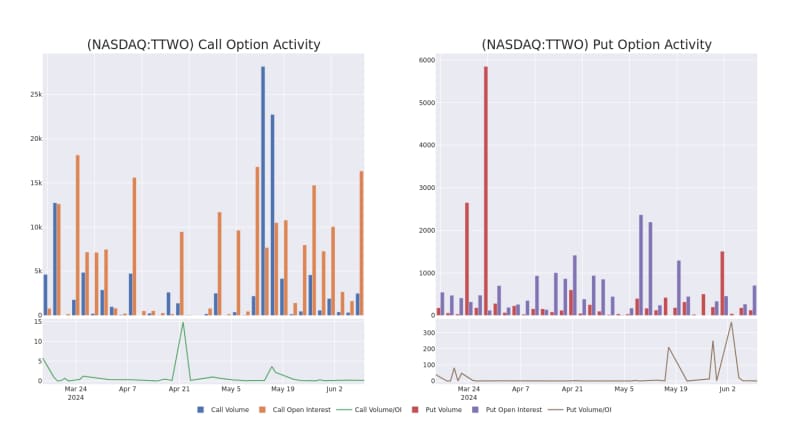

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Take-Two Interactive's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Take-Two Interactive's significant trades, within a strike price range of $140.0 to $190.0, over the past month.

Take-Two Interactive Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

About Take-Two Interactive

Found in 1993, Take-Two consists of three wholly owned labels, Rockstar Games, 2K, and Zynga. The firm is one of the world's largest independent video game publishers on consoles, PCs, smartphones, and tablets. Take-Two's franchise portfolio is headlined by Grand Theft Auto and contains other well-known titles such as NBA 2K, Civilization, Borderlands, Bioshock, and Xcom. Zynga mobile titles include Farmville, Empires & Puzzles, and CSR Racing.

In light of the recent options history for Take-Two Interactive, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Take-Two Interactive

- Trading volume stands at 948,268, with TTWO's price down by -2.73%, positioned at $160.28.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 57 days.

Professional Analyst Ratings for Take-Two Interactive

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $177.2.

- In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $200.

- Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Take-Two Interactive with a target price of $172.

- Showing optimism, an analyst from B of A Securities upgrades its rating to Buy with a revised price target of $185.

- In a cautious move, an analyst from HSBC downgraded its rating to Hold, setting a price target of $154.

- Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on Take-Two Interactive with a target price of $175.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Take-Two Interactive, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.