Vodafone (LON: VOD) share price has been in a steep meltdown in the past few years as concerns about its growth and huge debt burden continues. It has crashed by over 51% from its highest point in 2017 and is hovering near its lowest swing since 2013.

BT Group (LON: BT.A) stock price has also dived hard in the past few years. After peaking at 340p in November 2015, it has plummeted by 62% to the current 129p. These drops have erased billions of pounds worth of value.

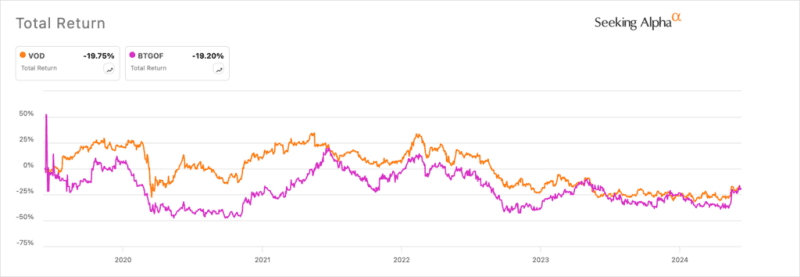

Notably, an investment in the FTSE 100 index would have yielded a better return than Vodafone and BT Group.

BT Group vs Vodafone

Strong dividend yields

Vodafone and BT Group’s stock crashes has produced substantially higher dividend yields, which is a good thing for income-focused investors.

BT Group has a dividend yield of about 6.6% while Vodafone yields 10.70%. In theory, this means that a £100k investment in the two companies will bring in £6,600 and £10,700 annually if the stock remains steady.

However, these companies have had erratic dividend policies in the past because of their capital-intensive businesses. BT Group suspended its dividend payouts in 2020 to deal with the Covid-19 pandemic and to boost its 5G and broadband investments.

Most recently, Vodafone said that it would halve its dividends to boost its mobile networks. The company paid a 9 pence dividend, which will move to 4.5p in 2025 as its investments continue.

Despite these moves, BT and Vodafone are still steady companies that have sustainable revenue and profitability metrics. This means that investors should expect a decent dividend return in the next few years.

Slow growth companies

The main risk for both BT Group and Vodafone is that they are both slow-growth companies. Vodafone’s results showed that its annual revenue dropped by 2.5% to 36.7 billion euros even as its German business returned to growth. It attributed this slowdown to the sale of its Hungarian and Ghanaian businesses.

BT Group also reported weak financial results as its revenue rose by just 1% to £20.7 billion. Its profit after tax dived by 55% to £855 million, signaling that the company is not doing well. This slowdown was mostly because of its business segment whose revenue dropped by 2%.

BT and Vodafone have taken measures to address their key issues. Vodafone has sold its Spanish business in a 5 billion euro deal and is in the process of buying Three in a bid to boost its British business.

They are also slashing costs. BT has pledged to cut 55k jobs by 2030 while Vodafone is in the process of cutting 11k jobs by 2026. These cuts, while painful, will help the companies control their costs and boost profitability.

So, which is a better buy between BT Group and Vodafone? Vodafone is clearly the better stock to buy than BT for income investors because of its high dividend yield. It is also taking measures to simplify its organisation.

As I have written before, BT has its benefits over Vodafone. The biggest one is that it is a simpler organisation since it is primarily a British company. Vodafone is a more complex company that operates in over 20 countries globally.

Still, from a total return perspective, I would avoid BT and Vodafone because of their high debt levels, slow growth, and history of weak performance.

The post Vodafone yields 10.70%, BT Group 6.6%: better shares to buy? appeared first on Invezz