Much has been said about the potential for artificial intelligence (AI) to affect individual privacy and safety, but comparatively little has mentioned the potential havoc AI could cause to financial markets themselves.

All that changed recently when International Monetary Fund (IMF) deputy managing director Gita Gopinath gave a speech at the AI for Good Global Summit in Switzerland.

“The world economy will see another downturn—that much is certain. The widespread use of AI could turn an ordinary downturn into a deep and prolonged economic crisis by causing large-scale disruptions in labor markets, in financial markets, and in supply chains,” she said.

Job losses just the beginning

According to Gopinath, economic downturns are characterised by widespread layoffs – which, in our age of ever-growing AI, means that more of the workforce than ever before is replaceable with artificial intelligence substitutes.

“Research by Jaimovic and Siu shows that since the mid-1980s nearly 90% of automation related job losses in the U.S. have occurred in the first year of recessions,” she said. “AI threatens to accentuate this dynamic. In the next downturn, AI is likely to threaten a wider range of jobs than in past cycles, including higher-skilled cognitive jobs.”

Gopinath concluded that:

An estimated 30% of jobs in advanced economies are at risk of being replaced by AI. That figure is 20% for emerging markets and 18% for low-income countries.”

A coming stock market crash?

That’s not all – according to Gopinath, if this happened suddenly and in an unexpected, volatile manner, AI-powered algorithmic systems already common in financial markets trading could make the problem much, much worse. Stock market crash worse.

“There are also dark sides to AI-powered investment decisions. In a future downturn characterized by unfamiliar patterns—including unfamiliar patterns of job losses—AI systems could struggle to respond. This is because AI has been shown to perform poorly when faced with novel events—that is events that differ markedly from the data they have been trained on. As a result, they might quickly and simultaneously become overly conservative and rebalance portfolios toward safe assets. The models’ decision to leave other assets will then be rewarded as their prices fall, and a self-confirming spiral of fire-sales and collapsing asset prices across different financial markets could ensue.”

If this were to prove accurate, it would be a tricky one for the financial markets to mitigate in its current state. The average Wall Street trader – never mind day traders speculating at home – are not experts in understanding AI systems and how to override them if necessary.

Most people entrusted with the highest levels of responsibility over portfolio decisions and the like are pros at understanding the patterns of markets – not computers. What Gopinath calls “the ‘black box’ nature of AI” is still something of an unknown quantity to the vast majority of the financial world and its systems.

A recession waiting to happen

Gopinath’s comments have eerie timing. Many economists and other market specialists are predicting a coming United States recession beginning end of 2024 or early 2025.

Not just that, but large-scale AI adoption – and the differences world leaders have in opinion around it – seems to have accelerated overnight – quite literally.

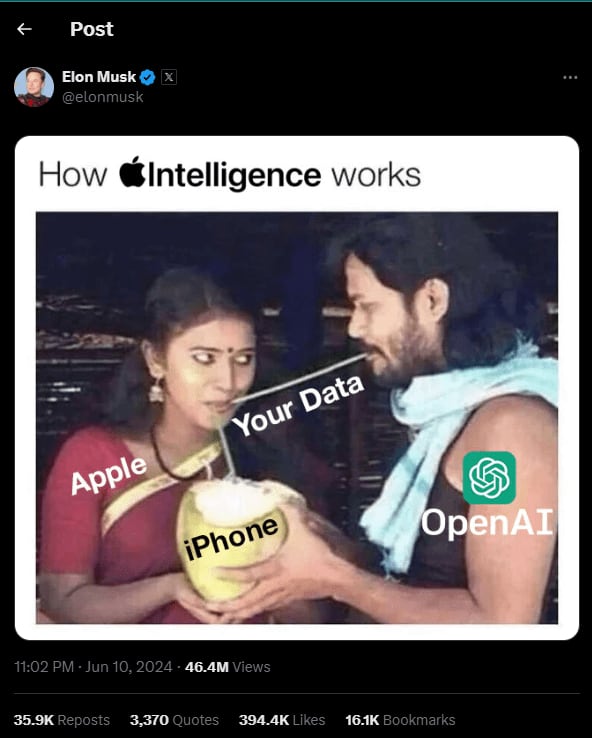

Yesterday, Apple hosted its annual Worldwide Developers Conference, at which CEO Tim Cook unveiled the news of a coming ‘Apple intelligence’, which will see its new devices fully integrated with OpenAI’s ChatGPT, which the Magnificent 7 company has entered into a new partnership with.

The news was met with mixed reactions. Tesla and X CEO Elon Musk took to his social media platform to tweet that he would ban Apple phones from all his companies if Apple followed through with fully integrating their devices with ChatGPT, calling it “an unacceptable security violation”.

The post IMF: AI could cause stock market crash or other economic crises, with over 50% of the world’s jobs at risk appeared first on Invezz