Investors with a lot of money to spend have taken a bearish stance on MongoDB (NASDAQ:MDB).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MDB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 29 uncommon options trades for MongoDB.

This isn't normal.

The overall sentiment of these big-money traders is split between 37% bullish and 58%, bearish.

Out of all of the special options we uncovered, 12 are puts, for a total amount of $805,428, and 17 are calls, for a total amount of $1,129,775.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $160.0 and $300.0 for MongoDB, spanning the last three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for MongoDB options trades today is 252.42 with a total volume of 9,168.00.

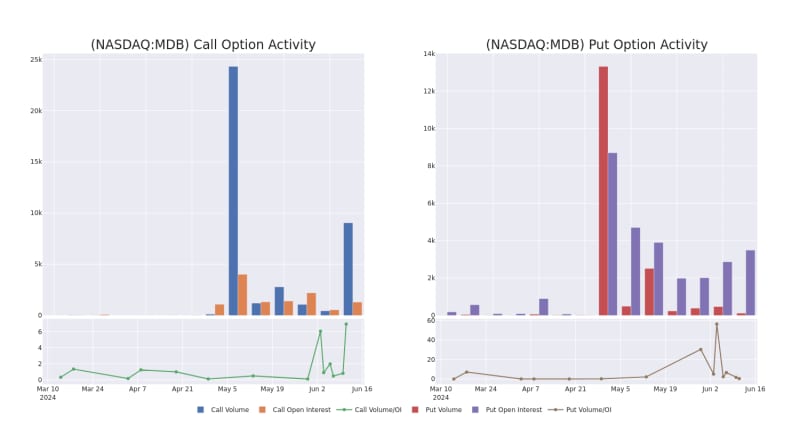

In the following chart, we are able to follow the development of volume and open interest of call and put options for MongoDB's big money trades within a strike price range of $160.0 to $300.0 over the last 30 days.

MongoDB Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Having examined the options trading patterns of MongoDB, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

MongoDB's Current Market Status

- Currently trading with a volume of 1,017,473, the MDB's price is up by 0.86%, now at $226.55.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 79 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MongoDB options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.