Oddity Tech (ODD) is a tech-enabled beauty and wellness company, currently valued at a market cap of $2.5 billion. The Israel-based company leverages artificial intelligence (AI) to develop a range of cosmetic products. Founded in 2018, it has already created a niche following with direct-to-consumer brands such as Spoiled Child and II Makiage.

Oddity's primary goal is to disrupt the legacy beauty market and replace the in-store experience by using data and AI tech to introduce brands and make personalized product recommendations. The company says its proprietary technology and the billions of data points collected from millions of users offer it a competitive moat.

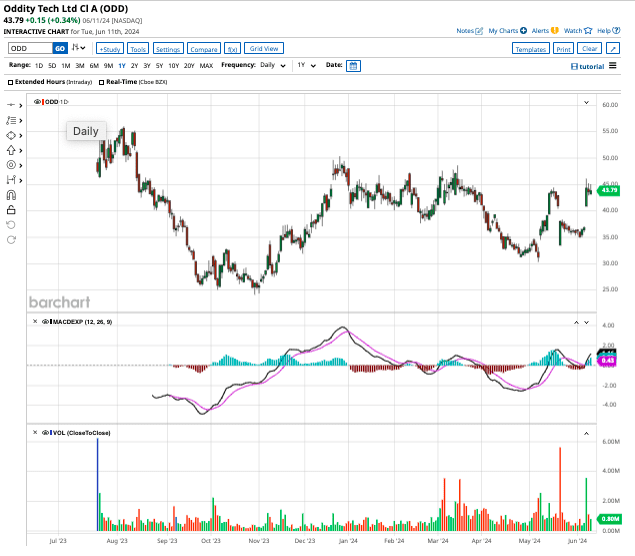

The tech stock went public last July, and priced its Nasdaq IPO at $35 per share, just above the top end of its expected range.

Soon after it went public, Oddity Tech shares touched an all-time high of $56, and closed Wednesday's session at $42.30. The stock is down about 9% YTD.

Oddity has increased revenue from $110.6 million in 2020 to $508.6 million in 2023. Unlike other growth stocks, Oddity is profitable, and ended 2023 with operating income of $74.3 million, up from $16.6 million in 2020.

The company recently announced a buyback plan, which suggests that management believes the stock is undervalued at current multiples. Let’s see if this growth stock is a good buy after its share buyback news.

Oddity Tech is in the Midst of a Controversy

Last month, a short seller accused Oddity Tech of several discrepancies, including operating undisclosed brick-and-mortar stores in Israel and overstating the capabilities of its AI product suite. Oddity confirmed it operates retail stores, but emphasized that these outlets account for less than 5% of total sales.

Soon after the short-seller report, Oddity Tech authorized a $150 million stock buyback program, which is sizeable for a mid-cap company. It also raised guidance for Q2, and now forecasts sales of $189 million in the June quarter, an increase of 25% year over year. Oddity also expects to end Q2 with an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $60 million, higher than its earlier guidance of $56 million.

It seems that the timing of the buyback program and updated Q2 guidance were provided to boost investor confidence following the short-seller report. Generally, growth stocks that recently went public tend to avoid repurchasing their shares, as they allocate funds towards organic growth projects, research and development, or expansion.

Oddity is a Quality Growth Stock

Investors should note that while a short-seller report may be a cause of concern, it should be taken with a pinch of salt, as the publisher generally has a short position on the stock.

Additionally, Oddity’s online operations and tech-powered business allow it to benefit from operating leverage and an asset-light model. It recently acquired a skincare lab to further gain traction in the skincare segment.

In Q1 of 2024, Oddity reported revenue of $212 million, an increase of 28% year over year. Comparatively, net income rose 68% to $33 million while free cash flow stood at $79 million, indicating a free cash flow margin of more than 37%. A company that consistently generates free cash flow at attractive margins has the flexibility to invest in acquisitions and lower balance sheet debt.

Is ODD Stock Undervalued?

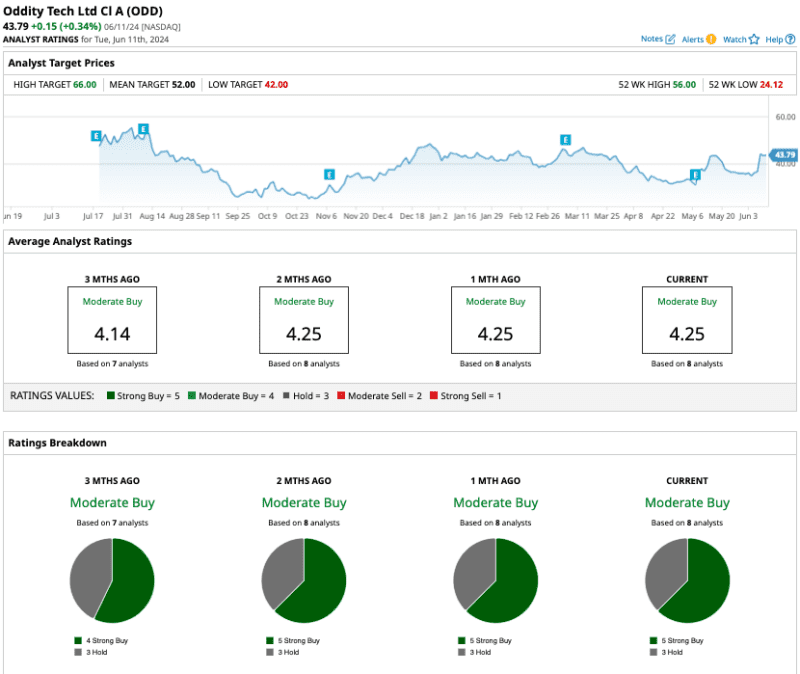

Out of the eight analysts covering ODD stock, five recommend “strong buy” and three recommend “hold.”

Analysts tracking Oddity Tech expect sales to rise from $508.6 million in 2023 to $634 million in 2024, with further growth to $766 million in 2025. Its adjusted earnings are forecast to expand from $1.31 per share in 2023 to $1.37 per share in 2024, and all the way up to $1.64 per share in 2025.

Priced at 32x forward earnings, ODD stock might seem expensive. However, a growth stock generally commands a premium valuation.

The average 12-month target price for ODD stock is $52, indicating an upside potential of nearly 23%.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.