The USD/TRY exchange rate drifted upwards this week after the Federal Reserve delivered a somewhat hawkish decision. It has also soared after a report showed that Turkey’s inflation continued soaring in May. It was trading at 32.50, a few points below its all-time high of 32.80.

Turkish lira crashes

The US inflation data and the Federal Reserve were the biggest catalysts for the USD/TRY pair this week. In a report on Wednesday, the Bureau of Labor Statistics (BLS) said that the headline and core inflation numbers dropped in June.

A few hours later, the Federal Reserve delivered what seemed like ahawkish statement. While the Fed said that inflation had made some modest improvements, it hinted that it will deliver just one rate cut this year.

A few months ago, the Fed was hinting that it would deliver as many as four rate cuts this year. Some analysts believe that the Fed will not cut rates this year unless inflation moves close to its 2% target, which is unlikely.

The other big catalyst for the USD/TRY pair was the recent Turkish inflation number, which was hotter than estimated. In a report, the statistics agency said that the country’s inflation rose from 69.80% in April to 75.45%, an increase that was bigger than estimates.

There are signs that Turkey’s inflation will remain at an elevated level for longer than expected. In a recent statement, the Central Bank of Turkey raised its end-of-the-year inflation target to over 35%,

Therefore, a combination of a hawkish Federal Reserve and rising inflation in Turkey means that the lira will likely continue falling. Besides, the spread between the country’s interest rates and inflation has continued to widen.

I believe that the Turkish lira will always remain under pressure as long as Erdogan is the president. While he has allowed interest rates to rise, most analysts expect that the CBT will start cutting them later this year.

USD/TRY technical analysis

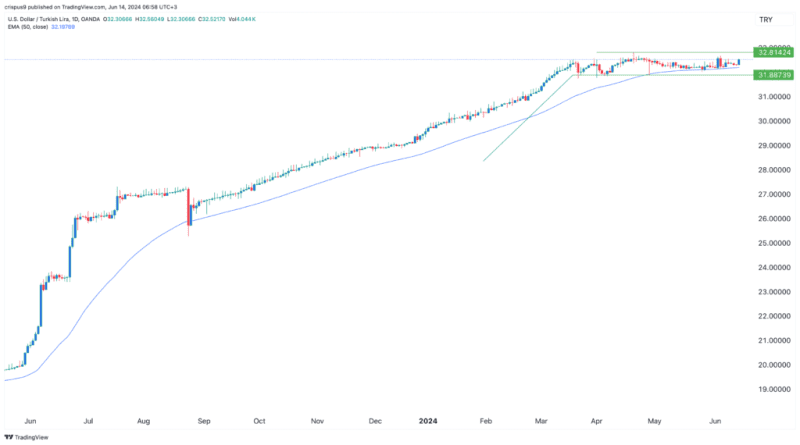

Turning to the daily chart, we see that the USD/TRY exchange rate has moved sideways in the past few months. It has remained inside the support and resistance levels at 31.88 and 32.81. The pair has also remained slightly above the 50-day Exponential Moving Average (EMA).

Most importantly, it has formed a bullish flag pattern, which is a positive sign. Therefore, I suspect that the pair will continue consolidating and then have a bullish breakout in the coming weeks. This upside will be confirmed if the pair surges above the resistance at 32.81. If it happens, the next point to watch will be at 33.50.

The post USD/TRY forecast: Brace for more Turkish lira plunge appeared first on Invezz