Lilium (NASDAQ: LILM) stock price has plummeted hard this week as demand for the electric vertical take-off and landing (eVTOL) shares waned. It collapsed to a low of $0.8250, its lowest swing since April 16th. It has plunged by over 40% from its highest point this year and by more than 56% from its highest level in 2023.

Good progress but balance sheet issues remain

Lilium’s shares have plunged hard in the past few years, pushing its market cap to about $520 million. At its peak, it had a market cap of over $2.1 billion as demand for eVTOL companies rose.

The recent crash happened as investors focused on its cash burn. Its annual loss jumped to $429 million in the last financial year, an increase from $271 million a year earlier. Altogether, its annual losses have jumped to over $1.5 billion in the past five years.

Lilium has made a lot of progress in the past few years. It has already started to manufacture its jets and battery pack. At the same time, the company is working on its testing as it aims to get its final piloted certification.

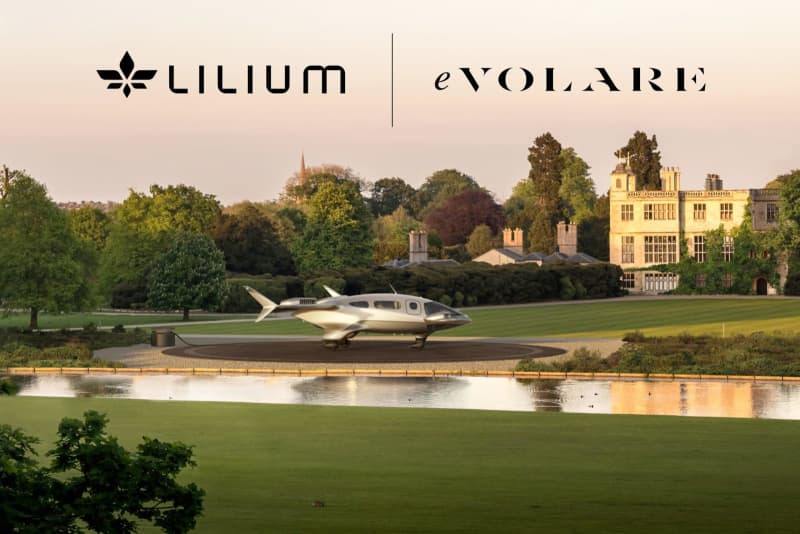

Most importantly, Lilium has received many orders in the past few years. The most recent order came from UrbanLink, which has ordered 20 jets. eVolare has also ordered 4 Lilium jets, bringing the total order pipeline to 780 jets.

A key concern among investors is that its cash burn is increasing and its balance sheet is getting strained. Even in this regard, the company has made progress. It is being considered for a state-backed loan worth about $100 million in Germany. It also raised $114 million in May and is being considered for another loan by the French government.

Therefore, with Lilium, we have a company that is making progress on its production and balance sheet. It has also made some substantial orders from around the world.

However, there are risks to be concerned about. First, competition in the eVTOL industry is rising, with the key contenders being Archer Aviation, Volocopter, Airbus, and Joby Aviation.

Second, there are concerns about the industry’s market size. Estimates are that the industry was worth $13 billion in 2023 and will get to $38 billion by 2032. However, the reality is that these are just estimates, which could be based on the wrong assumptions since this is a new industry.

Also, the company will still need more cash in the future, especially when it starts delivering its vehicles.

Lilium stock price forecast

The daily chart shows that the LILM share price has crashed hard in the past few months. It has crashed below the key support at $1.04, its highest swing on March 11th.

The stock is now hovering slightly above the key support at $0.7982, where it has struggled to move below this year. Also, the 50-day and 100-day Exponential Moving Averages (EMA) have formed a bearish crossover.

Therefore, a break below this support could point to more downside in the coming days. If this happens, the next point to watch will be at $0.60, its lowest swing in October last year. This price is about 27% below the current level.

The post Lilium stock analysis: good progress but it could crash 27% appeared first on Invezz