IAG (LON: IAG) share price has crashed hard in the past few weeks as airline stocks have retreated. The stock tumbled to a low of 167.15p on Tuesday, down by over 10% from its highest point this year, meaning that it has moved into a correction.

Airfares have dropped

Other airline stocks have also pulled back despite the solid summer bookings. EasyJet shares have retreated to 450p, down from May’s high of 591p while Ryanair has moved into a deep bear market after falling by over 21% from the highest level this year.

The same is happening with the likes of Delta Air Lines (DAL), United Airlines, and American Airlines that have lost the momentum.

IAG’S business is still doing well, helped by its transatlantic route. Its first-quarter revenue rose to over €6.4 billion from €5.8 billion in the same period in 2023. It also boosted its operating profit to €68 million.

It has also improved its balance sheet as its cash and cash equivalents jumped from over $6.8 billion to $8.7 billion. These numbers have positioned the company well at a time when its debt is not growing that much. It ended the last quarter with over €16.16 billion.

IAG stock price has crashed after data revealed that airfares were falling in most countries. In the United States, the most recent data showed that airfares plunged by 5.9% on a YoY basis.

The same trend is happening in Europe. A recent report by the American Expresss Global Business Travel Air Monitor predicted that prices on certain routes may drop by about 12% this year.

The other challenge for IAG and other airlines is that Boeing has been going through substantial challenges that has delayed its MAX planes deliveries. In 2022, the company confirmed an order of 50 737 MAX orders.

IAG share price forecast

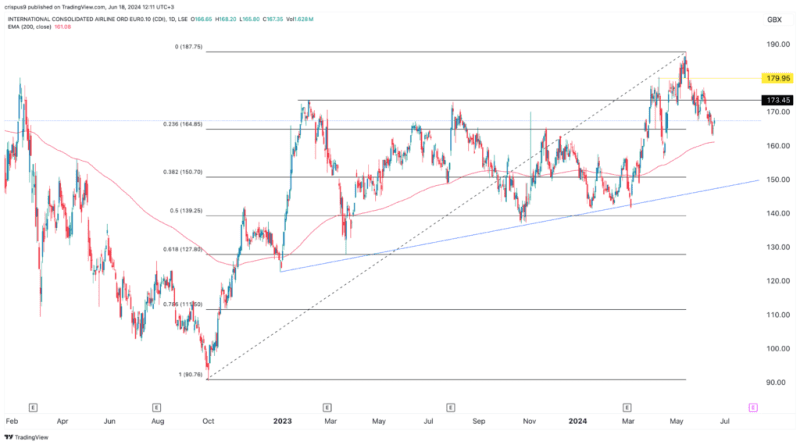

The daily chart shows that the IAG stock price has crashed hard in the past few weeks, moving to a correction. It has dropped from the year-to-date high of 187.75p to the current 167.30p.

The stock is hovering slightly above the 23.6% Fibonacci Retracement point and is slightly below the key resistance at 173.45p, its highest point in February and October last year.

It has remained above the 200-day Exponential Moving Average (EMA) while the MACD has drifted downwards. Therefore, the stock will likely bounce back as buyers target the key resistance at 180p, its highest swing on April 10th. A break above that level will lead to more gains to the YTD high of 187p.

The post IAG share price has moved into a correction: buy the dip? appeared first on Invezz