Palantir (NYSE: PLTR) stock price has jumped sharply this week after receiving a rating upgrade from Argus analysts. It soared by over 6% and reached its highest level since May 6th. It has jumped by more than 318% from the lowest point in 2023, giving it a market cap of over $52 billion.

Analysts are pessimistic

Palantir Technologies shares have jumped sharply in the past few months, helped by the rising defense spending and artificial intelligence (AI) investments. It has also started to gain more commercial clients who are interested in its AI solutions.

The most recent results revealed that Palantir’s business was doing well this year. Revenue rose by 21% in the first quarter to $634 million. Most importantly, the commercial revenue in the US rose by 40% to $140 million.

Palantir believes that its business has more room to grow. The expectation is that its revenue will grow to between $2.67 and $2.68 billion this year, an increase from the $2.2 billion it made in 2023.

The commercial revenue will grow by 45% to over $661 million and the trend will continue as companies take advantage of its AI solutions.

Wall Street analysts have a neutral rating on the PLTR stock price. Argus, a leading advisory firm, initiated the stock’s coverage, citing the dramatically improving profitability.

Those at HSBC have a hold rating on Palantir while Citigroup and DA Davidson have a neutral rating. On the other hand, analysts at RBC Capital and Deutsche Bank have an underperform and sell rating, respectively.

The average Palantir stock price rating is $25, a few points below the current $21.45. Another compilation by TipRanks shows that the average estimate is $22.11, lower than the current $25.

Analysts are mostly concerned about the company’s pricey valuation. It trades at a forward PE ratio of 152 and a forward EV to EBITDA multiple of 53, higher than the sector median of 14.

Palantir stock price forecast

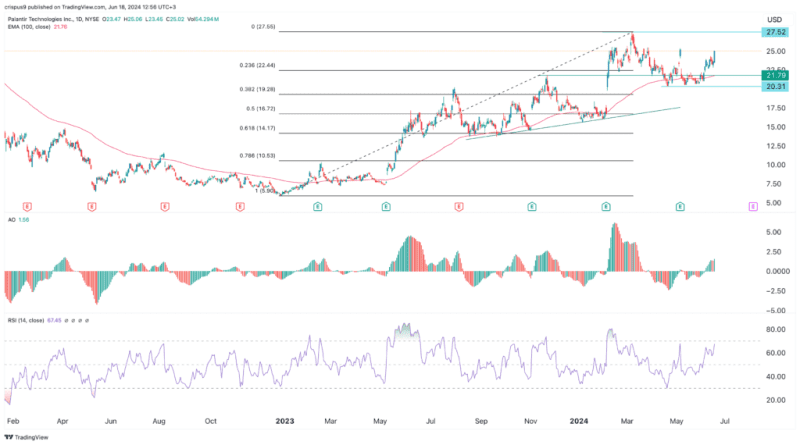

The daily chart shows that the PLTR share price bottomed at $20.3 in May and has now rebounded to over $25. It has remained above the 23.6% Fibonacci Retracement point.

The stock has also moved above the 100-day moving average while the Awesome Oscillator has risen above the neutral point. The Relative Strength Index (RSI) is nearing the overbought point at 70.

Therefore, the short-term outlook for the stock is bullish, with the next point to watch being the year-to-date high of $27.52, which is about 10% above the current level.

The post Analysts are pessimistic on the Palantir stock price: should you? appeared first on Invezz