Pfizer (NYSE: PFE) stock price has crashed hard in the past few years as demand for Covid-19 vaccines faded globally. It was trading at $28 on Monday, down from the pandemic high of $55.56. It has also underperformed the likes of Eli Lilly, Johnson & Johnson, and Amgen.

Pfizer’s history of acquisitions

Pfizer’s crash has brought focus on the company’s history of growth through acquisitions. In 2023, the company acquired Seagen in a $43 billion deal, a move that gave it access to cancer treatments. Seagen had over $2 billion in annual revenue in 2023 and has 113 drugs in its pipeline.

While Seagen was a big acquisition, it was not Pfizer’s biggest deal. In 2000, the company paid $90 billion to acquire Warner-Lambert, a deal that made it the biggest pharmaceutical company in the world at the time. That $90 billion in 2000 is now equivalent to $157 billion.

Pfizer then acquired Pharmacia in 2002 for $60 billion ($100 billion in today’s cash), a deal that gave it access to arthritis, impotence, and glaucoma drugs.

The company has implemented more acquisitions over the years. It acquired Wyeth in 2009 in a $68 billion deal and Biohaven in 2022 for over $11.6 billion, a company that focuses on migraines. It also acquired Global Blood Therapeutics in a $5.4 billion deal.

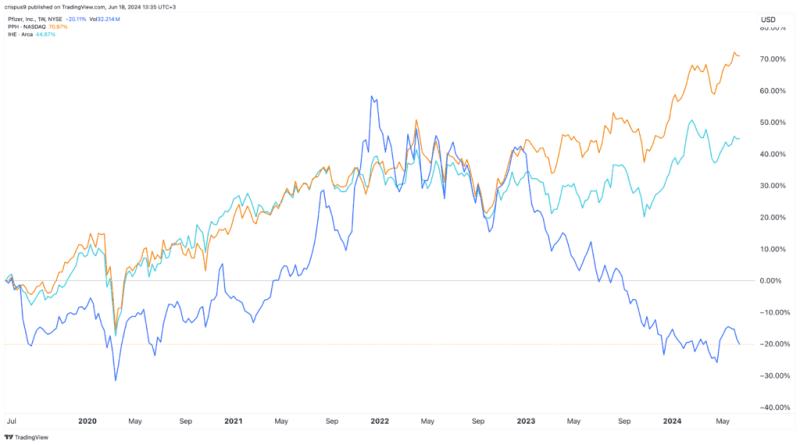

All these acquisitions would have made Pfizer a big and highly profitable company. However, Pfizer has not been a good investment. Since 2000, Pfizer’s stock has jumped by about 120% while the iShares Pharmaceuticals ETF (IHE) and the VanEck Pharmaceuticals ETF (PPH) have soared by 440% and 320%, respectively.

The same has happened in the past five years as Pfizer’s stock has plunged by 20% while the two ETFs have soared by over 40%.

Pfizer vs Pharmaceutical ETFs

Pfizer is now worth over $152 billion, an amount that is lower than the value of its acquired companies. These acquisitions have also left it highly indebted with over $69 billion in long-term debt.

The company has also had some spectacular failures in the past few years. For example, Pfizer scrapped its weight-loss drug pill program after patients lost weight but generated substantial side effects. Scrapping the deal left the company behind of other popular companies like of Novo Nordisk and Eli Lilly.

Pfizer has also become one of the cheapest major pharmaceutical companies in the industry. The company has a forward P/E ratio of 11.5 while Merck, Eli Lilly, and Novo Nordisk have multiples of 14.8, 64, and 40.5.

Pfizer stock price forecast

The weekly chart shows that the PFE share price has crashed hard in the past few years. It formed a golden cross where the 200-week and 50-week moving averages crossed each other in January.

The stock has formed a bearish flag chart pattern, which is a popular bearish sign. This means that it will continue falling as sellers target the lower side of the flag at $24 soon. A break below that level will point to more downside, possibly to $20.

The post Pfizer stock price analysis: how PFE became a fallen angel appeared first on Invezz