While artificial intelligence (AI) has dazzled investors, driving the broader market indexes to record highs this year, other promising industries can also yield substantial benefits for investors. In this context, analysts have spotlighted sports betting giant DraftKings Inc. (DKNG) and used-car retailer Carvana (CVNA) as two of their top stock picks this month.

Morgan Stanley's (MS) optimistic stance on DraftKings is rooted in its resilience amid regulatory hurdles, with the firm highlighting its robust business model and ability to capitalize on favorable market conditions. Meanwhile, JPMorgan Chase & Co. (JPM) sees Carvana's strategic positioning as a significant advantage, capable of yielding substantial benefits regardless of broader industry challenges.

Furthermore, amid the widespread excitement over AI stocks, both DraftKings and Carvana have significantly outperformed the broader S&P 500 Index’s ($SPX) return over the past year, as well as on a YTD basis. Let’s take a closer look at these two “top picks.”

Growth Stock #1: DraftKings

Valued at $36.5 billion by market cap, Massachusetts-based DraftKings Inc. (DKNG) is a global leader in digital sports entertainment and gaming. The company offers a variety of products, including online sports betting, casino games, daily fantasy sports, and other consumer-focused media and entertainment services. Additionally, DraftKings specializes in designing and developing cutting-edge sports betting and casino gaming software for both online and retail platforms, as well as iGaming operators.

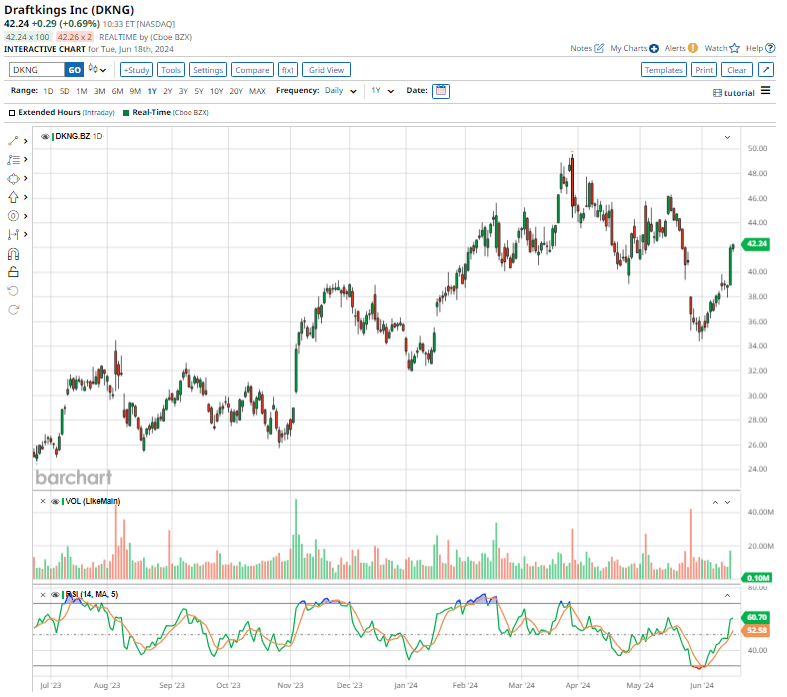

Shares of this sports betting giant have surged about 71% over the past 52 weeks, overshadowing the SPX’s gain of 24.3% during the same time frame. Plus, on a YTD basis, DKNG stock is up nearly 19%, compared to the SPX’s 14.9% return.

Priced at 9.23 times sales, the stock trades at a discount to its own five-year average of 16.71x.

On May 2, DraftKings reported its Q1 earnings results, which sailed past Wall Street’s forecasts on both the top and bottom lines. Revenue of $1.2 billion showed a strong 52.7% annual improvement, outpacing estimates by 4.6%. This solid revenue growth was fueled by robust customer engagement, effective customer acquisition, expansion into new sportsbook markets, increased sportsbook profitability, and enhanced promotional strategies in Sportsbook and iGaming.

On an adjusted basis, the company earned $0.03 per share versus a loss of $0.51 per share in the same period last year. Adjusted EBITDA during the quarter totaled $22.4 million, compared to a negative adjusted EBITDA of $221.6 million in the year-ago quarter.

Commenting on the company’s Q1 performance, CEO Jason Robins stated, “DraftKings’ performance in the first quarter of 2024 was outstanding, reflecting healthy revenue growth and a scaled fixed cost structure that positions us to drive rapidly improving Adjusted EBITDA.”

Encouraged by this strong Q1 performance, management upwardly revised its fiscal 2024 revenue guidance, and now expects its top line to arrive between $4.8 billion and $5 billion, up from the previous range of $4.7 billion and $4.9 billion. Additionally, adjusted EBITDA is projected to land somewhere between $460 million and $540 million, compared to the earlier range of $410 million to $510 million.

Analysts tracking DraftKings predict the company’s GAAP loss to narrow by87.9% year over year in fiscal 2024, before swinging to a profit of $0.86 per share in fiscal 2025.

In a June 10 note, Morgan Stanley wrote, “We add DKNG back as our Top Pick in North America Gaming & Lodging as we see positive catalysts alleviating recent pressure from the recent tax headlines: 1) capital return being announced on the 2Q release as FCF is still poised to inflect; and 2) reiterating guidance even with the headwind from IL, reflecting strong underlying market growth & a rational promotional environment. We also see limited-to-no new legislation this year acting as a soft catalyst, particularly if NJ does not include gaming taxes in its June budget.”

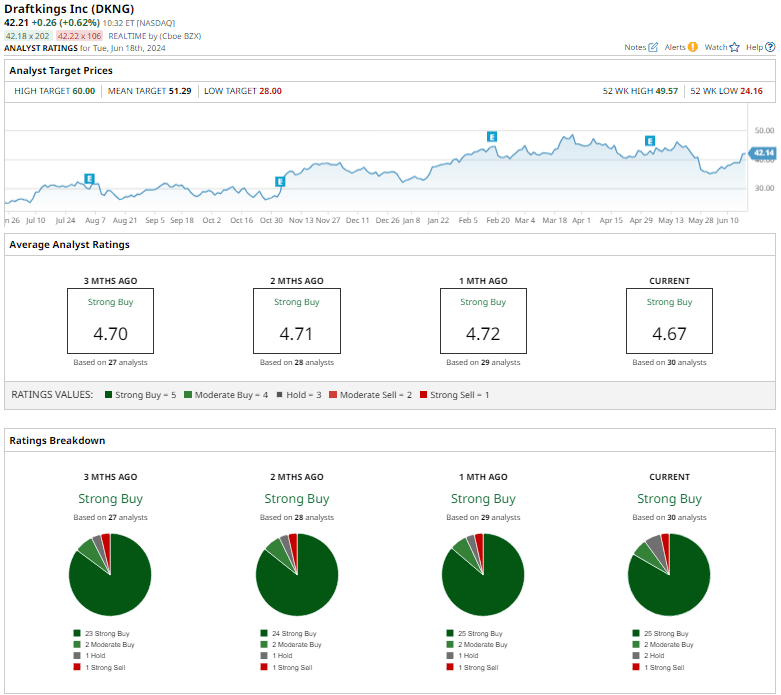

DKNG stock has a consensus “Strong Buy” rating overall. Out of the 30 analysts offering recommendations for the stock, 25 suggest a “Strong Buy,” two advise a “Moderate Buy,” two recommend a “Hold,” and the remaining one gives a “Strong Sell” rating.

The average analyst price target of $51.29 indicates a potential upside of 21.6% from the current price levels, and is in line with Morgan Stanley’s $51 target. The Street-high price target of $60 suggests that DKNG stock could rally as much as 42%.

Growth Stock #2: Carvana

With a market cap of about $22 billion, Arizona-based Carvana (CVNA) has transformed the used-car market with its innovative e-commerce platform, simplifying every aspect of buying and selling vehicles online. This end-to-end model includes sales, financing, logistics, inspections, repairs, and software development, making traditional dealership visits unnecessary. By leveraging Carvana’s platform, customers can easily browse a vast inventory of high-quality used cars, view detailed images, and purchase their chosen vehicle from the comfort of their homes.

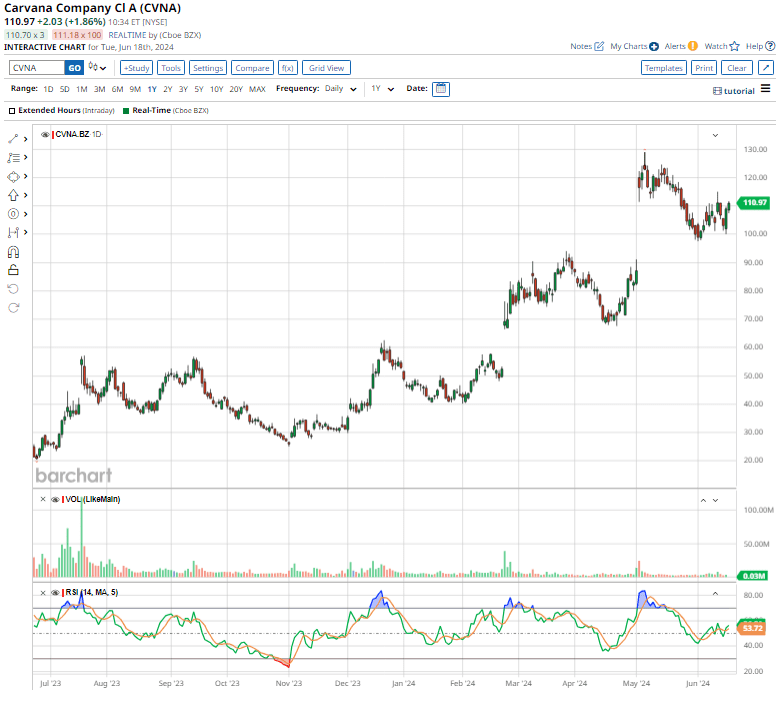

Shares of Carvana have rallied almost 335% over the past 52 weeks and are up 108% on a YTD basis, easily dwarfing the SPX’s gains during both periods.

In terms of valuation, the stock trades at 1.94 times sales, roughly in line with its own five-year average.

Following the release of its better-than-expected Q1 earnings results after the close on May 1, Carvana shares climbed nearly 33.8% in the subsequent trading session. The used car retailer’s total revenue of $3.1 billion jumped 17.5% year over year and topped Wall Street’s forecasts by a 13.6% margin. Additionally, Carvana achieved profitability during the quarter, reporting a profit of $0.23 per share, compared to a loss of $1.51 per share in the same period last year.

During the quarter, the company also achieved a record adjusted EBITDA of $235 million, a dramatic improvement from its negative adjusted EBITDA of $24 million in the previous year. The company's total gross profit per retail unit (GPU), a critical metric for investors, reached $6,432.

Looking forward to Q2, management expects sequential increases in its year-over-year retail unit growth rate and adjusted EBITDA. Analysts tracking Carvana expect the company to achieve GAAP profitability on a full-year basis in fiscal 2025.

According to JPMorgan analyst Rajat Gupta, the used car market continues to face significant challenges, impacting both independent and franchise dealerships. Given the lingering supply chain constraints, “we pivot our rating preference to companies that have a more visible positive earning revision backdrop driven by company-specific execution opportunities and/or unique secular tailwinds,” wrote Gupta, who named CVNA his top retail pick with a $150 price target.

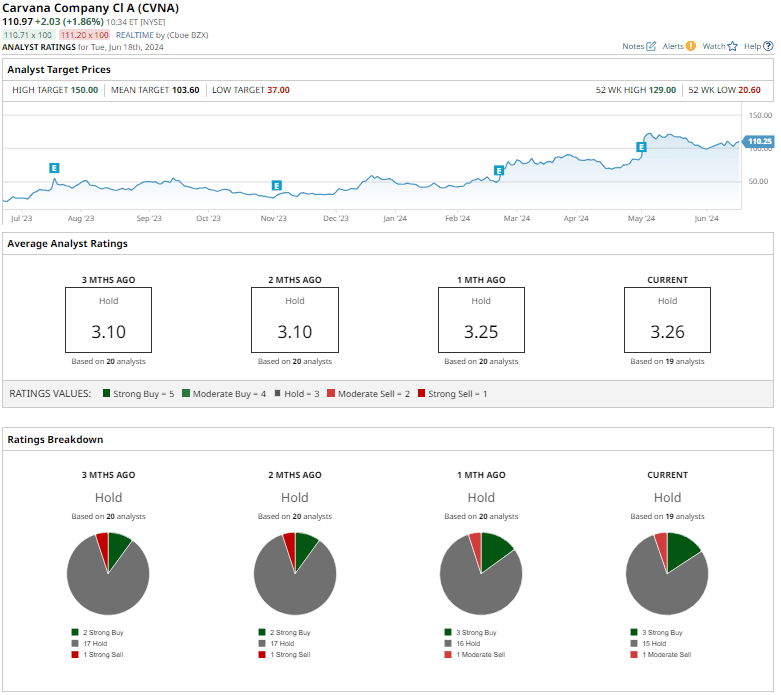

CVNA stock has a consensus “Hold” rating overall. Out of the 19 analysts covering the stock, three suggest a “Strong Buy,” 15 recommend a “Hold,” and the remaining one gives a “Moderate Sell” rating.

While CVNA stock is trading above its average analyst price target of $103.60, Gupta’s Street-high target of $150 implies a potential upside of 36.4% from the current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.