Accenture (NYSE: ACN) stock price has nosedived since March as investors focus on the upcoming earnings. It has dived by more than 26% from its highest point this year, meaning that it has moved into a deep bear market. Other IT consulting companies like Infosys and Wipro have also dived.

Accenture earnings ahead

Accenture, one of the biggest consulting companies in the world, will be in the spotlight on Thursday as it delivers its quarterly results. These results will provide more information about the state of IT spending globally.

The most recent financial results showed that its new bookings jumped to a record high of $21.6 billion in the second quarter. This growth was mostly driven by a $600 million increase in generative AI.

Its revenue remained at $15.8 billion as consulting business brought in $8 billion while its managed services revenue soared to $7.8 billion.

In that report, Accenture estimated that its revenue in the third quarter would be between $16.25 billion to $16.85 billion. That will be a drop of 1% and 3%. Analysts expect that the company’s revenue will be $16.5 billion while its annual revenue is expected to be $64.54 billion.

Analysts are relatively bullish about Accenture stock. The average estimate of the stock is $356, which is significantly higher than the current $285. Some of the most bullish analysts are from Mizuho, Barclays, and Stifel.

Still, some analysts are bearish about the stock. In a note on Tuesday, a WedBush analyst slashed the company’s estimate to $350, citing the slowdown of global IT spending.

There are also concerns that Accenture is still highly overvalued. While its stock has plunged hard, it still trades at a forward PE multiple of 24.50, which is higher than the forward S&P 500 multiple of 21. Its forward EV to EBITDA ratio of 14.45 is also higher than the sector median of 14.

Accenture stock price forecast

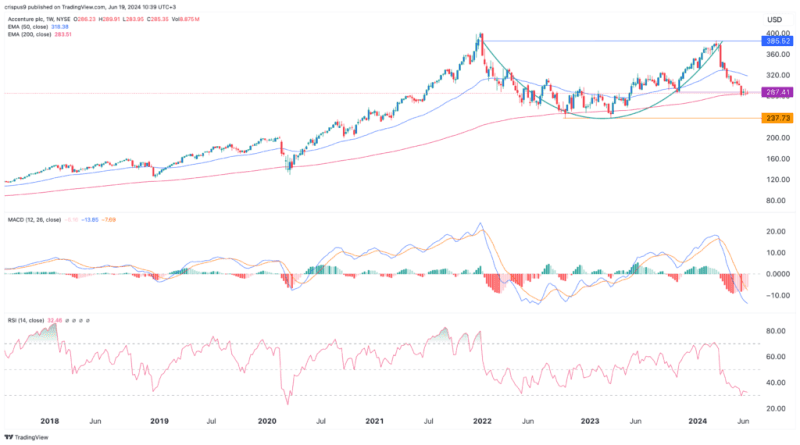

The weekly chart shows that the Accenture stock price has plunged hard in the past few weeks. It has recently invalidated the cup and handle chart pattern, a popular continuation sign. The stock has also formed a double-top pattern at $385, which is a popular bearish sign.

Accenture’s MACD has moved below the neutral level while the Relative Strength Index (RSI) has moved to the oversold level. It has also moved below the 50-week moving average. Therefore, the stock will likely rebound slightly and hit $300 after earnings. In the longer term, however, it will likely resume the bearish trend.

The post Accenture stock forecast and Q3 earnings preview appeared first on Invezz