The USD/CHF exchange rate will be in the spotlight on Thursday as the Swiss National Bank (SNB) delivers its interest rate decision. It has crashed by over 4% from its lowest level this month and is now hovering near its lowest level since March.

SNB interest rate decision

The Swiss National Bank will deliver its monetary policy decision as the country’s inflation remains elevated and the economy slows.

Recent data showed that the headline Consumer Price Index (CPI) rose to 1.4% YoY in May, higher than March’s 1.0%.

While the CPI has remained below the SNB’s target of 2.0% and is lower than in other countries, it is still higher in Switzerland’s standards.

Therefore, most analysts believe that the bank will leave interest rates unchanged at 1.50% and hint at another cut later this year. The bank delivered its first 0.25% rate cut in its meeting in March, catching many economists by surprise.

Still, as in the past, the SNB could decide to slash rates in this meeting in a bid to supercharge the economy. In a recent statement, the State Secretariat for Economic Affairs (SECO) said that the economic growth will come below average.

SECO expects that the economy will grow by 1.2% this year and then normalise to 1.7% in 2025.

The SNB decision will come a week after the Federal Reserve delivered a moderately hawkish statement. It left interest rates unchanged between 5.25% and 5.50% and pointed to just one cut this year.

The Fed’s biggest concern is that the country’s inflation is not falling fast enough as it has constantly remained above 3%. As such, most economists believe that the Fed will deliver one cut, most likely in December.

The Fed will unlikely heed Mohamed El Erian’s call for a rate cut as soon as possible. El Erian argued that a rate cut will be necessary since leading indicators show that the US economy was slowing.

The implication of the Fed and SNB divergence is that it has made the USD/CHF pair a popular one among carry trade traders. Carry trade is a situation where people borrow in low interest rate countries to invest in high rates ones.

USD/CHF technical analysis

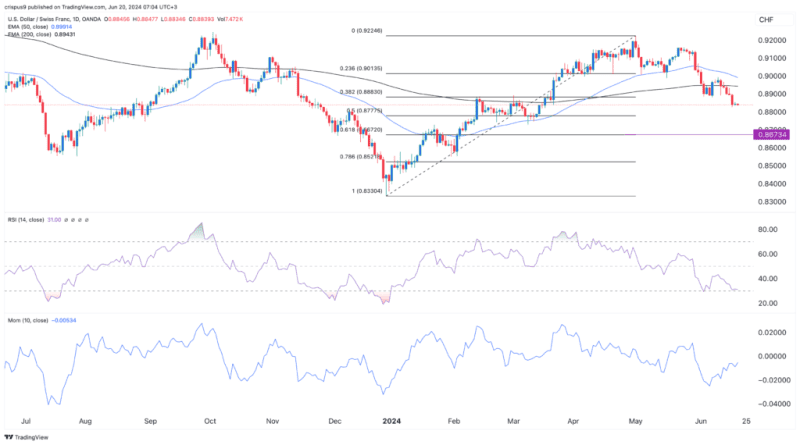

The USD/CHF exchange rate has dropped sharply in the past few weeks. It has moved from 0.9225 on May 1st to below 0.8900. The pair has also crashed below the 38.2% Fibonacci Retracement level.

The Relative Strength Index has moved to the oversold level while the momentum indicator has pointed upwards. Most importantly, the pair is about to form a death cross, where the 200-day and 50-day moving averages cross each other.

Therefore, the pair will likely continue falling as sellers target the 50% retracement point at 0.8775. A break below that level will bring the 61.8% retracement point at 0.8673 in play.

The post USD/CHF: death cross nears ahead of the SNB rate decision appeared first on Invezz