Medical Properties Trust (NYSE: MPW) stock price has erased some of its year-to-date gains as concerns about its business continued. It has crashed by over 24% from its highest point this year, moving into a deep bear market. It was trading at $4.80, its lowest level since May 28th.

Short-squeeze slows

Medical Properties Trust has been the most shorted Real Estate Trusts (REIT) this year, with over 36% of its outstanding shares being held by short sellers. The other most shorted companies in the industry are SL Green, Office Properties Trust, and Pebblebrook Hotel Trust.

It is easy to explain why many investors are short the company. As I have written before, Steward Healthcare, its biggest tenant, has been in trouble and has failed to pay its loans several times.

This culminated in the company filing for bankruptcy, as I had predicted a few months before. Its bankruptcy was a big deal because Medical Properties Trust had evolved to becoming one of its biggest shareholders. Steward accounted for about 18% of MPW’s revenues.

While the bankruptcy was a bad thing for MPW, it also gave it clarity about the future. MPW will likely receive some of its lease funds as the bankruptcy proceedings continues. Indeed, the management continues to “believe that these investments are fully recoverable at this time.” Still, Steward’s bankruptcy led the company to declare impairment charges.

Now, investors hope that Medical Properties Trust will continue with its turnaround efforts as it focuses on the remaining healthcare facilities like Circle Health, Priory Group, and Prospect Medical Holdings. MPW has continued to collect 100% of its rental collections from all these tenants.

At the same time, there are two potential outcomes for Steward. First, it could manage to move from Chapter 11 bankruptcy as a leaner organisation. We have seen several companies like WeWork emerge from bankruptcy recently.

Second, as part of the bankruptcy, Medical Properties may decide to lease its facilities to other healthcare companies. All this means that the company may have bottomed after Steward’s bankruptcy.

Still, MPW has other risks that could affect its stock. The biggest one is that it faces a mountain of maturities in the next few years. $483 million will mature this year followed by $1.42 billion in 2025 and $3.2 billion in 2026. As such, the company will need to put more effort to restructure and extend these loans.

Medical Properties Trust stock forecast

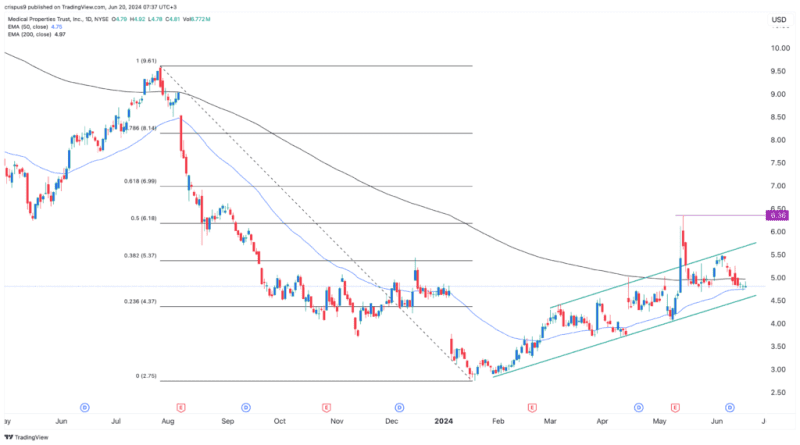

Turning to the daily chart, we see that the MPW share price has pulled back in the past few days. In this period, it has moved below the 38.2% Fibonacci Retracement point. It has also formed an ascending channel and is nearing its lower side.

The stock is also oscillating at the 200-day and 50-day moving averages. Therefore, the outlook for the MPW share price is neutral with a bullish bias. If this happens, it will likely retest the upper side of the channel at $5.50. The alternative scenario is where it drops to the support at $4.

The post How is the Medical Properties Trust (MPW) stock fairing? appeared first on Invezz