Silver (SIN24), like its lustrous cousin gold (GCQ24), holds a special allure in the world of metals. Beyond its use as jewelry, silver shines as a beacon of stability amid global uncertainties and, like gold, offers appeal as a safe-haven investment. Plus, since silver powers electronics, solar panels, and many more industrial uses, its demand is poised to skyrocket amid rising usage for clean energy, AI, and automotive applications.

Bank of America (BAC) metal strategist Michael Widmer forecasts silver prices to average $35 an ounce by 2026, driven by multiple bullish catalysts, including the rising tide of the gold market. Noting that “'pure' silver exposure via mining equity investments is difficult to find,” the analyst recommends Canada-based Pan American Silver Corp. (PAAS) and Wheaton Precious Metals Corp. (WPM) as top buys for investors seeking robust silver exposure. Here's a closer look at why.

Silver Stock #1: Pan American Silver

Pan American Silver Corp. (PAAS), with a market cap of $7.2 billion, is a major player in the mining sector. The company operates across Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil, focusing on the exploration, development, extraction, and processing of silver alongside gold, zinc, lead, and copper (HGU24).

Founded in 1979 and originally known as Pan American Minerals Corp., the company rebranded in 1995 to underscore its commitment to silver. With a mission to lead in low-cost silver production and exploration, Pan American Silver aims to be the premier choice for investors seeking significant exposure to silver prices.

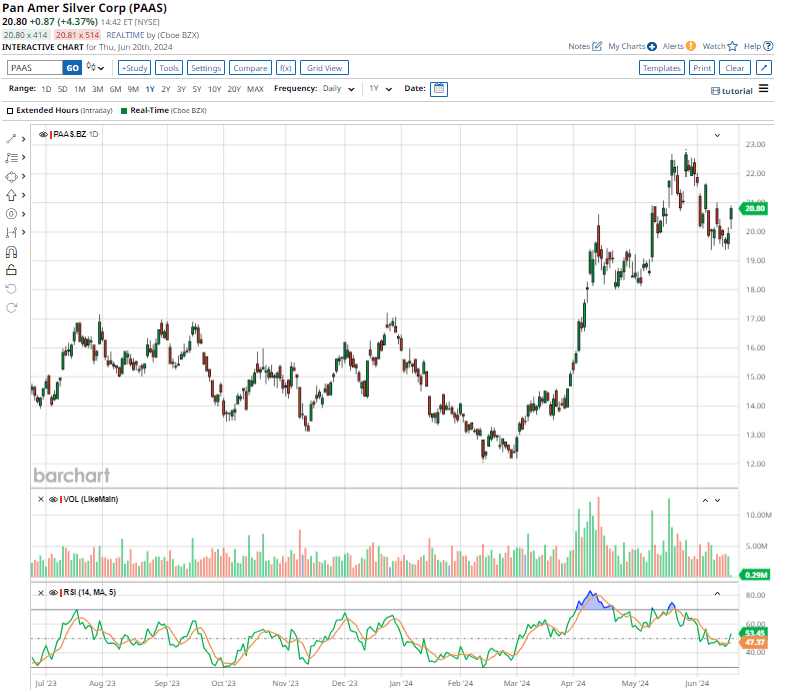

Shares of Pan American Silver have gained 26.9% on a YTD basis, nearly keeping pace with the gains in silver so far this year.

The silver mining company paid a quarterly dividend of $0.10 per share on June 3. Its annualized dividend of $0.40 translates to a 2.01% forward yield. Pan American Silver has paid dividends for 13 consecutive years.

The stock is currently trading at 48.04 times forward earnings and 3.07 times sales, significantly lower than its peers, like Hecla Mining Company (HL), and also lower than its own five-year averages.

The stock’s impressive double-digit YTD gains are partly due to Pan American Silver's positive Q1 earnings results on May 8, which beat Wall Street’s estimates. PAAS stock jumped 10.7% in the subsequent trading session. Its total revenue increased 54.1% year over year to $601.4 million, beating the estimate of $591.7 million. The miner reported a surprise profit of $0.01 per share, compared to consensus estimates for a loss of $0.06.

Pan American Silver is boosting its game in silver production, hitting 5.01 million ounces in Q1, a 28.7% annual rise. Its La Colorada Skarn project shines with drill results like 22.5 meters at 1,435 grams per tonne of silver, and management is eyeing partnerships on the project, which has silver output estimated at 17.2 million ounces annually in the first decade. This move cements Pan American Silver’s status as a top silver producer. In fact, most recently, at La Colorada, the company discovered an entirely new set of vein structures with high silver grades to the east and southeast of the main NC2 vein.

Pan American Silver projects full-year silver production between 21 million and 23 million ounces, up from 20.4 million ounces in 2023. This boost factors in full-year production at El Peñon and increased output at La Colorada following the completion of ventilation improvements that should allow for higher mining rates in the latter half of 2024.

Analysts tracking Pan American Silver expect EPS to grow 241.7% to $0.41 in fiscal 2024 and then another 148.8% to $1.02 in fiscal 2025.

According to analyst Widmer, Pan American is "catalyst-rich, has a solid balance sheet, offers solid production growth with solid upside potential across various assets in the portfolio."

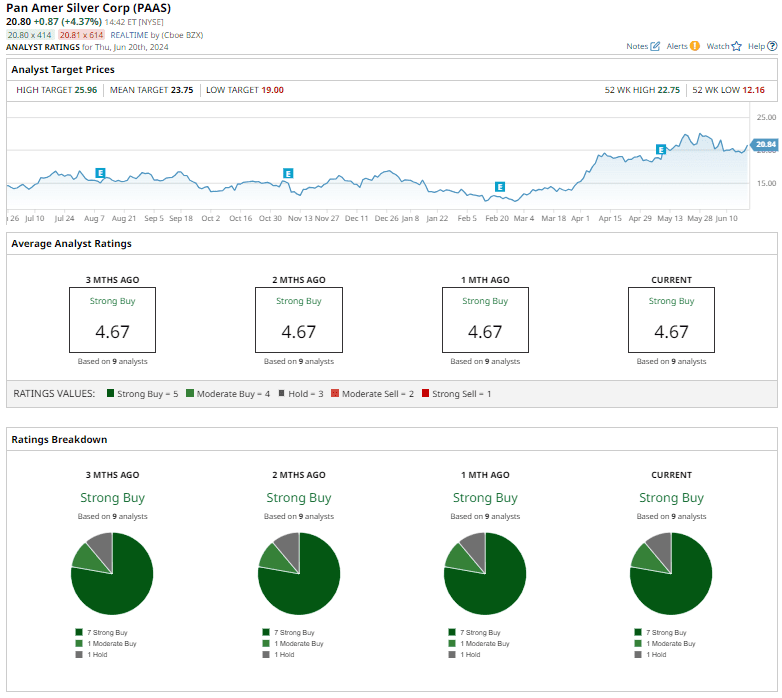

PAAS has a consensus “Strong Buy” rating overall. Of the nine analysts covering it, seven recommend a “Strong Buy,” one suggests a “Moderate Buy,” and the remaining one analyst is keeping it cool with a “Hold.”

The average analyst price target for Pan American Silver is $23.75, indicating a potential upside of 14.1%. The Street-high target price of $25.96 implies a 24.7% upside potential.

Silver Stock #2: Wheaton Precious Metals

Founded in 2004 as Silver Wheaton, Wheaton Precious Metals Corp. (WPM) reinvented itself in 2017 to reflect its broader focus. This Vancouver-based titan dominates the precious metals streaming industry. Instead of digging for treasure, it finances mining operations in exchange for buying future production at locked-in prices, often below market rates. This strategy lets Wheaton reap the rewards of rising metal prices without the hefty risks and costs of mine ownership.

According to BofA's Widmer, Wheaton "derives a sizable 36% of its [estimated] 2024 revenues from silver," making WPM a solid pick for investors seeking exposure to upside in silver prices specifically.

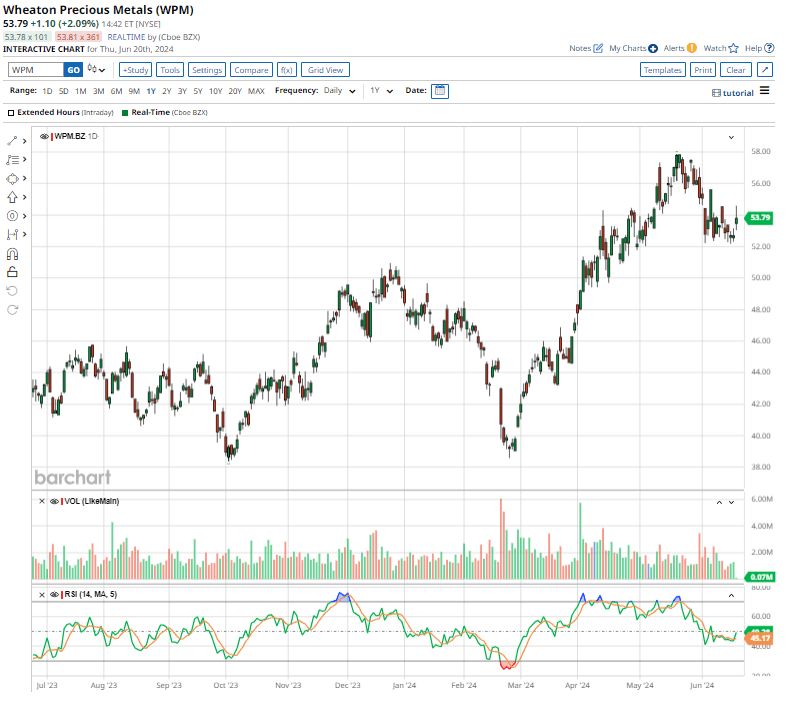

Currently, WPM carries a market cap of $23.9 billion, solidifying its spot as a heavyweight in the silver stock arena. WPM stock is up 8.9% on a YTD basis, and about 25% over the past 52 weeks.

On June 1, Wheaton paid its shareholders a quarterly dividend of $0.155 per share. Its annualized dividend of $0.62 per share now translates to a 1.18% yield. With a conservative payout ratio of 34.42%, the company has ample room for future increases, reinforcing its commitment to rewarding investors. The company has consistently rewarded its shareholders with dividends for 12 straight years.

Shares of Wheaton rose 2.6% on May 9 after a stellar Q1 earnings report. Its revenues improved 38.4% annually to $296.8 million, beating Wall Street’s projections by 4.7%. Silver revenue rose 12.8% to $96.7 million, making up 32% of the total. Its EPS surged 47.2% to $0.36, exceeding forecasts by 24.1%. Attributable silver production increased 6.7% year-over-year to 5.5 million ounces, with Peñasquito contributing 2.6 million ounces, up 27.3% due to higher grades.

Looking ahead, management projects 2024 attributable production to be between 18.5 and 20.5 million ounces of silver, up from 17.2 million ounces reported in the previous fiscal year.

Analysts tracking WPM expect the company’s profit to surge 9.3% to $1.29 per share in fiscal 2024 and rise another 14% to $1.47 per share in fiscal 2025.

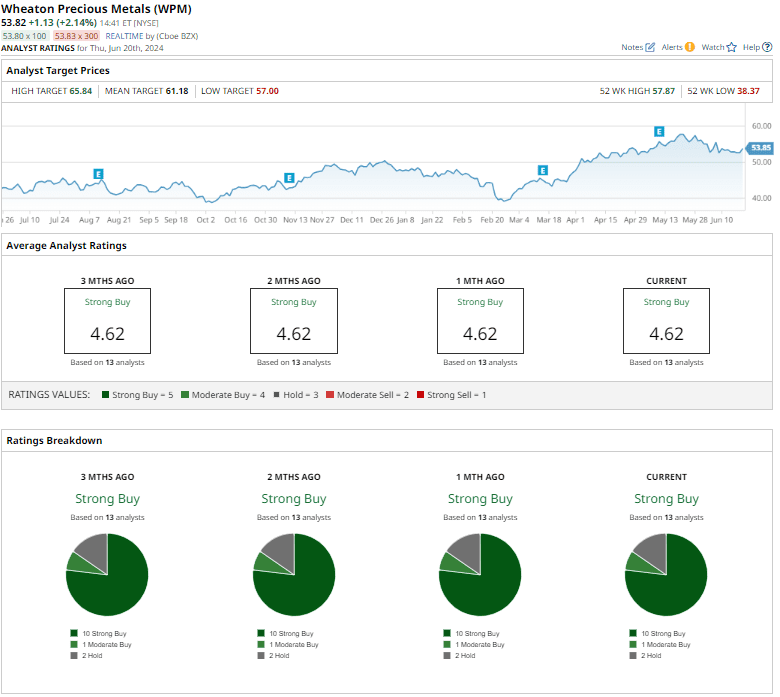

WPM stock has a consensus “Strong Buy” rating overall. Out of the 13 analysts offering recommendations, 10 suggest a “Strong Buy,” one advises a “Moderate Buy,” and the remaining two are playing it safe with a “Hold” rating.

The average analyst price target of $61.18 suggests that the stock has an upside potential of 13.6% to the current price levels. The Street-high price target of $65.84 suggests that WPM could rally as much as 22.3% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.