The Nifty 50 index continued its spectacular rally this week as the political temperatures in India cooled. It soared to a high of ₹23,630 on Friday, higher than the year-to-date low of ₹20,620. It has surged by more than 212% from its lowest point in 2020.

Most Indian stocks are soaring

Most companies in the Nifty 50 index have jumped sharply this year. Mahindra & Mahindra, a leading automobile company, has surged by over 65% this year, making it the best-performing firm in the index.

Adani Ports & CEZ stock has jumped by more than 44% while the Shiram Finance, Hero MotoCorp, Cipla, and Bharti Airtel have all soared by over 30% this year.

On the other side, some of the worst-performing companies in the Nifty 50 index this year are Bharat Petroleum, Hindustan Unilever, ITC, and LTIMindtree.

Indian stocks have jumped for three main reasons. First, India has become the fastest-growing country in the emerging markets this year. Estimates are that the economy will grow by over 7% this year, beating the likes of Indonesia and China.

Second, there are signs that the Reserve Bank of India (RBI) will start cutting interest rates in the coming months. While inflation has remained stubbornly high because of food prices, mosy analysts expect that the RBI will deliver at least one cut this year.

The BoJ will join other global central banks that have either started to cut or have pointed to cuts later this year. In Europe, the European Central Bank (ECB), Riksbank, and the Swiss National Bank have all slashed rates this year.

Similarly, in the United States, the Fed has pointed to at least rate one cut this year. Fed rate cuts would be good for Indian stocks because they will lead to more inflows from American investors.

Another potential catalyst for the Nifty 50 index is that Narendra Modi won the recent election even though the margin was slimmer than expected. In the past few years, Modi has focused on making India a leading economy by increasing investments in key areas like infrastructure.

Nifty 50 index forecast

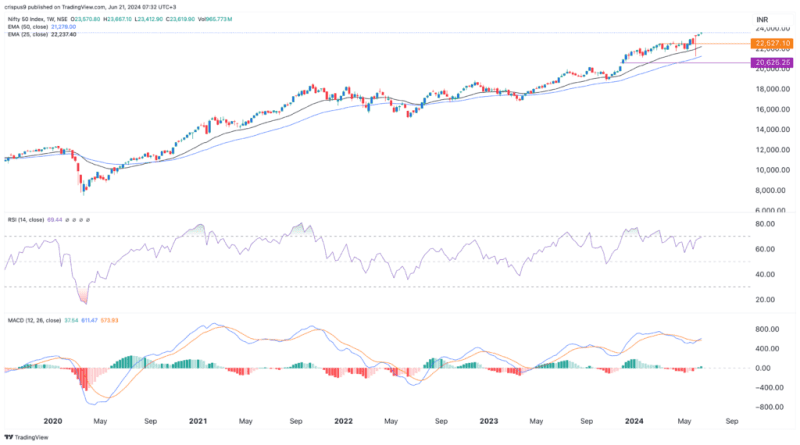

The weekly chart shows that the Nifty 50 index has been in a strong bull run in the past few months. It recently crossed the important resistance level at INR 22,527, its highest level on March 11th.

The index has continued rising above the 50-week and 25-week Exponential Moving Averages (EMA). At the same time, the Relative Strength Index (RSI) has tested the overbought point of 70 while the momentum oscillator is rising.

Therefore, the path of the least resistance for the Nifty 50 index is extremely bullish, with the next point to watch being at ₹25,000.

The post India’s Nifty 50 index path to ₹25,000 gets clearer appeared first on Invezz