The Direxion Daily Semiconductor Bull ETF (SOXL) has done well in the past decade as it outperformed most popular funds like those tracking the Nasdaq 100 and S&P 500 indices. It has soared by over 564% in the past five years while the Invesco QQQ (QQQ) and the SPDR S&P 500 (SPY) ETFs.

Micron earning ahead

The SOXL ETF has surged in the past decade because of the strength of the semiconductor industry. Nvidia, its biggest constituent, has recently soared and become the third-biggest company in the world with a market cap of over $3.13 trillion.

Taiwan Semiconductor, the biggest fabrication company in the world, has attained a market cap of over $900 billion and will soon hit $1 trillion. TSMC has now become bigger than Taiwan, where it is headquartered.

Meanwhile, Broadcom, another semiconductor company, has achieved a market cap of more than $770 billion while Samsung is valued at more than $381 billion.

This growth has happened because of the ongoing adoption of technology around the world. Today, technologies like artificial intelligence, machine learning, cloud computing, and blockchain have become more popular, leading to more demand for chips.

Analysts believe that most semiconductor companies have more room to run as demand remains elevated. For example, Nvidia has a forward revenue growth estimate of almost 100, a remarkable feat for a company that was started decades ago.

Looking ahead, the key catalyst for the SOXL ETF will be the upcoming Micron earnings, which are scheduled for Thursday. These results will provide more details about the company’s growth and profitability.

Analysts believe that Micron’s revenues rose to over $6.6 billion in the last quarter. They also expect its annual revenue will rise by 60% to $24.74 billion followed by $36 billion in 2025.

Still, there are concerns about the valuation of semiconductor companies. The iShares Semiconductor ETF (SOXX) has a P/E ratio of 32, higher than the S&P 500 metric of 21. Nvidia, the key driver to SOXL’s growth has a forward P/E multiple of over 80, which is substantial.

The risk is that these chip companies will suffer a harsh reversal as growth in the industry fades. We have seen this reversal happen in the past. Most recently, Tesla and other EV stocks have tumbled amid rising competition, slow growth, and thinning margins.

Similarly, many solar energy stocks like Sunrun and Sunnova Energy have plunged after their hype in 2023.

Potential catalysts for SOXL ETF

On the positive side, two main catalysts could push the SOXL ETF higher. First, there are signs that the Federal Reserve will start cutting interest rates later this year, a move that will lead to more demand for risky companies like those in the semiconductor industry.

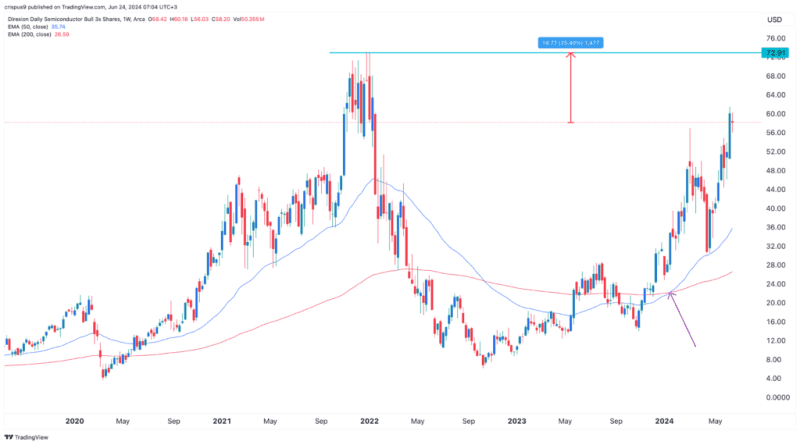

SOXL ETF chart

Second, as shown on the weekly chart above, the SOXL ETF has been in a strong bull run in the past few months. It formed a golden cross in January and has constantly remained above the 50-week and 200-week moving averages.

The momentum indicator has also continued rising. Therefore, there is a likelihood that the stock will continue rising as buyers target the key resistance point at $72.91, which is about 25% above the current level.

The post SOXL ETF is overvalued but technicals point to a 25% upside appeared first on Invezz