Realty Income (NYSE: O) stock price has underperformed the market this year. It has retreated by more than 7.4% this year while the S&P 500 and Nasdaq 100 indices have surged to their record highs.

Realty Income is one of the most popular dividend companies in Wall Street, thanks to its long track record of generating returns for shareholders. It is a dividend aristocrat that has raised its dividends for 26 years and this trend will likely continue for a long time.

The company also has a quality dividend yield of 5.95% and a payout ratio of 73.%, meaning that its free cash flow can cater for its dividends and buybacks. Its yield is also higher than other companies in the REIT industry. Still, there are two main reasons why I would never buy Realty Income stock.

There are better alternatives

The first reason why I’d never buy the Realty Income stock is that there are better alternatives in the market if you are interested in regular income.

First, one can invest in master limited partnerships (MLPs), which gather, transport, and process energy in the US and other countries. Most of these companies provide a better yield than Realty Income.

Energy Transfer yields 8% while Enterprise Energy Products (EPD) and MPLX yields 7.2% and 8.21%, respectively. The icing on the cake is that these companies operate as partnerships, meaning that their taxes are deferred.

There are other popular alternatives in the market. Closed-end funds, which are almost similar to ETFs, generate substantial returns to their investors. The PIMCO Dynamic Income Fund (PDI) yields 14% while the Nuveen Preferred & Income Fund (JPC) yields 10.9%.

Other popular funds are the Guggenheim Strategic Opportunities Fund (GOF) and Cornerstone Strategic Value Fund (CLM) yields over 15%.

Therefore, if you are interested in yields, there are many alternatives to Realty Income and other REITs.

Focusing on total return

The other reason why I am not investing in Realty Income is that despite its high yield, it has a record of underperforming the market. As I have written before, it is always important to focus on total return instead of dividend or stock return.

In the past five years, Realty Income’s stock has crashed by 24% while the SPY and QQQ ETFs have jumped by 85% and 154%, respectively. With dividends included, Realty Income has crashed by 4.3% in the past five years while SPY and QQQ have risen by 100% and 163%.

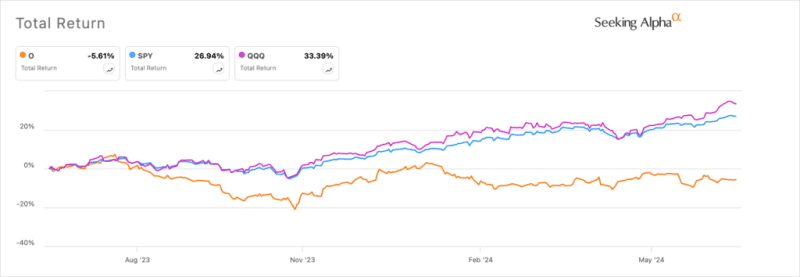

The same trend has happened in all other periods. Realty Income’s total return has dropped by 5.6% while the two ETFs have risen by 26% and 33%, respectively in the past 12 months.

Realty Income vs QQQ vs SPY

Therefore, while making investment decisions, it is always important to consider the total return instead of the dividend or price return. As such, I believe that investing in generic funds like QQQ, XLT, and SPY is a better alternative to Realty Income.

The post Realty Income is a good dividend stock: 2 reasons I’m not buying appeared first on Invezz