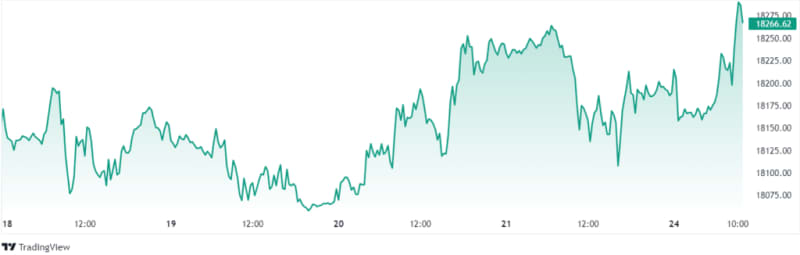

The DAX has started to pick up pace again on Monday morning, after a mixed-bag performance late last week resulted in the index gaining 1%, then losing half of it, within the space of 24 hours.

On the morning of June 24, within the first couple of hours of German markets opening, the index had gained 0.53% to trade at around $18295.61.

The DAX was at approximately $18271.61 at the time of this article going to press.

This reversed losses when the DAX fell 0.50% to 18,164 points on Friday June 21, after rising 1.03% to 18254.18 points on June 20.

The IFO Business Climate Index

Crucial for DAX performance this week will be good news on June 26, when the IFO Institut releases its latest monthly figures for Germany’s business climate expectations.

Expectations for June’s business confidence are muted, with analysts broadly anticipating an 89.7 reading for the month, up only marginally from 89.3 in May.

After a positive April 2024, in which the expectations index hit 89.9 – its highest reading in a year and significantly above expectations of around 88.9 – German business confidence stalled somewhat.

May 2024’s figures showed little to no change, with the IFO Business Climate Index remaining flat at 89.3 points on May 27, its last reading before today.

According to the Institut in May:

Companies were less satisfied with their current business situation, but expectations brightened. The manufacturing, trade, and construction sectors are recovering, although the service sector took a slight hit. Germany’s economy is working its way out of the crisis step by step.”

A disappointing summer ahead

Also released recently was the German summer forecast by the IFO Institut, on June 20.

Its prognosis was grim in the short-term, saying that:

Economic output in the second quarter will grow by 0.3% and hence only slightly faster than in the previous quarter. Manufacturing with its export business is bolstering the economy, while construction will probably continue its downward trend and suffer a strong setback. According to the available economic indicators, private consumption is likely to initially still stagnate.”

The forecast added that “the European Football Championship being held in Germany will not change that either and will not bring about a summer fairytale for the German economy. Although sales in the hospitality and food retail sectors will pick up briefly during the Championship, domestic consumers will probably reduce their spending elsewhere, so that private consumption as a whole will likely remain unaffected.”

Europe’s largest economy to finally beat inflation?

However, the IFO summer forecast brought some heartening news. In terms of both inflation and interest rates.

In the remainder of the year, after the summer, things are likely to get better, according to the Institut.

One material way is that Europe’s largest economy is likely to get its inflation down to the EU’s target level for the first time in years:

Inflation will fall below the 2% mark in the summer for the first time since March 2021.”

The IFO Institut also forecast that it expects two more interest rate cuts from the European Central Bank this year, after its first cut in June.

The lower interest rates in later 2024, it foresees, will help to encourage spending and stablise the labour market in Germany, while simultaneously helping to get “construction back on its feet”.

After all this, it’s assumed that consumer confidence will rise again in Europe’s biggest financial nation – but, until then, Germans may have to hunker down and endure.

The post DAX gains after last week, as Germany eyes Business Climate Index figures appeared first on Invezz