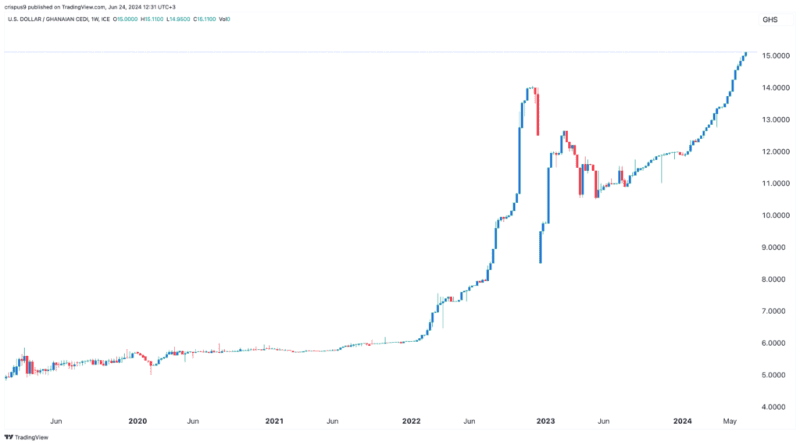

The Ghanaian cedi continued its freefall this week after the country reached a deal with its Eurobond creditors. The USD/GHS exchange rate has risen for 13 straight months and is now sitting at a record high of 15. It has soared by more than 164% from its lowest level in 2021, making it one of the worst-performing currencies in Africa.

USD/GHS weekly chart

The Ghanaian cedi plunged after the country reached a deal in principle with its Eurobond to restructure about $13 billion of its debt. According to the deal. The creditors will take a 37% haircut and choose between two instruments. One of the options will pay an initial 5% interest rate while the other will pay 1.5% rate.

The agreement comes a few years after Ghana unilaterally suspended payments on external debts to fulfil the requirements of a $3 billion IMF loan. It also came a few weeks after the IMF rejected a deal between the government and bondholders.

Ghana, like other African countries, has been under intense pressure because of its substantial external debts. The situation has worsened recently after the cedi plunged to a record low, increasing the amount of money the government is required to pay.

Other African countries have come under intense pressure this year. Zambia, one of the biggest countries in the copper industry, recently agreed to a similar arrangement with external creditors. The Zambian kwacha has stabilised a bit since that deal was announced and was trading at 25.60 against the US dollar.

Similarly, the Nigerian naira has continued plunging and was trading at 1,500 on Monday. Other currencies like the Rwandan franc and Ethiopian birr have also plummeted in the past few years.

The Ghanaian cedi crash has also been supercharged by the performance of the US dollar. Data shows that the US dollar index (DXY) has jumped to over $105.50 and is at the highest point in weeks.

The dollar has soared because of the Fed’s hawkish stance. In its latest meeting, the Fed decided to leave interest rates unchanged between 5.25% and 5.50%. It also hinted that it will maintain higher rates for longer since inflation has remained stubbornly high.

The risk is that the crashing cedi will lead to higher inflation. Recent data showed that the headline Consumer Price Index (CPI) came in at 23% in May, down from the previous month’s 25%.

The post USD/GHS: Ghanaian cedi hits all-time low after Eurobond deal appeared first on Invezz