The cryptocurrency market displayed bearish activities over the past seven days as Bitcoin lost over 5.35% to its press time levels of around $62.59K.

Such sentiments saw Shiba Inu (SHIB) returning to the price value of $0.000018, hitting levels never explored since February.

SHIB plummeted further to the $0.00001696 low, weakening the upward impetus further.

The downward trend sent 13,190 addresses, holding 417.43 trillion Shiba Inu coins into the break-even point, according to IntoTheBlock.

Data shows holders acquired trillions of tokens at the $0.000017 – $0.000018 price range.

Shiba Inu at a decisive point

The over 417 trillion SHIB assets, held at $0.000017 average price, mark a vital threshold for Shiba Inu’s trajectory.

First and foremost, the stash is at a break-even level, with average investors neither in loss nor profit.

Moreover, the $0.000017 mark has the highest asset concentration compared to all accumulation zones.

Surprisingly, the region has the fewest addresses (13K wallets) despite having the highest volume.

Meanwhile, the 417T coins acquired at approximately $0.000017 remain crucial for SHIB’s near-term outlook.

What next?

Shiba Inu displays weakness, with bears targeting new lows. It trades at $0.00001695 at press time, down 7% over the past day.

Failure to reclaim $0.000017 in the near term will put 417.43 trillion Shiba Inu coins out of money.

That will trigger declines toward the support at $0.000014, where around 58K addresses hold 94 trillion coins at an $0.000016 average price.

SHIB will likely dip to $0.000014 as the few holders around the footing could fail to offset bearishness. Moreover, Bitcoin’s struggle at $62K could mean Shiba Inu surrendering $0.000017 for a while.

Meanwhile, indicators confirm robust bearishness. For instance, red candles dominate the weekly timeframe, suggesting massive seller activity.

The 24-hour Relative Strength Index fell beneath 25, a move never seen since the 2023 bearish phase, cementing the downward narrative for SHIB.

Moreover, the weekly Moving Average Convergence Divergence display magnified selling momentum.

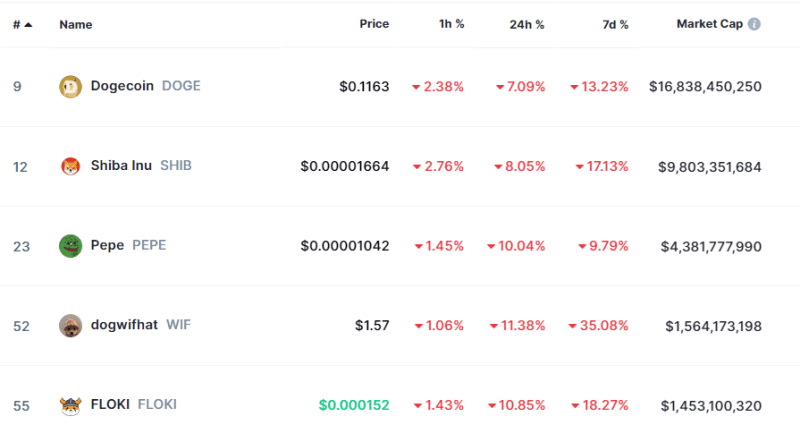

Further, bears tightened their grip in the meme coin space, with the sector losing nearly 10% of market cap over the past day.

Top themed digital coins displayed robust bearishness, and it could take some time for turnarounds.

Themed cryptocurrencies see fading interest and they seem to have hit a dead end as market players switch to assets with fundamentals.

Only broad-based bull runs might rescue the themed crypto from its bearish outlook.

Sudden recovery could send SHIB towards the resistance region at $0.000018 – $0.000019, where over 18K wallets hold 8.18 trillion assets.

Increased bullish actions would propel the altcoin to the next obstacle, where 114K wallets hold 67 trillion Shiba Inu tokens.

The post Shiba Inu outlook: What 417 trillion coins hitting break-even mean for SHIB price appeared first on Invezz