The Arbitrum (ARB) STEP Committee has endorsed plans to diversify 6 million ARB coins, worth around $4.5 million at the current price, from the Treasury into Ondo’s USDY.

Ondo Finance is among the leading projects in the real-world asset tokenization industry, and Arbitrum’s significant validation means a lot in expanding its adoption.

Meanwhile, the Committee’s suggestion includes six products, particularly those with $100 million in assets under management.

“To not spread the amount too thinly and increase operational or default risk causing loss of principle, we selected only 6 products from the shortlist of 17 shared earlier. Specific amounts to each provider were mostly on the basis of existing AUM (the three tiers were below 100 million, above 100 million, and the topmost.”

Ondo Finance’s USDY satisfied the criteria and secured more than 17% of Arbitrum’s allocation.

The notable allocation places USDY second to BUILD by BlackRock, which received ARB worth around $8.25M (11 million coins).

That underscores the notable reputation Ondo’s treasuries product is attaining.

While expressing enthusiasts regarding the development, the RWA platform stated that USDY’s high-quality nature attracts adoption.

“We are proud that the high-quality nature of USDY has been recognized and appreciate the committee’s thorough diligence process.”

Besides BUILD and USDY, other winning applicants include Backened Finance’s Bib01, OpenEden’s TBILL, Superstate’s USTB, and Mountain USDM.

The move matches the Arbitrum Committee’s plan of enhancing growth in the RWA tokenization space.

Furthermore, the project plans a RWA yearly event for diversifying 1% of the treasury.

ARB price outlook

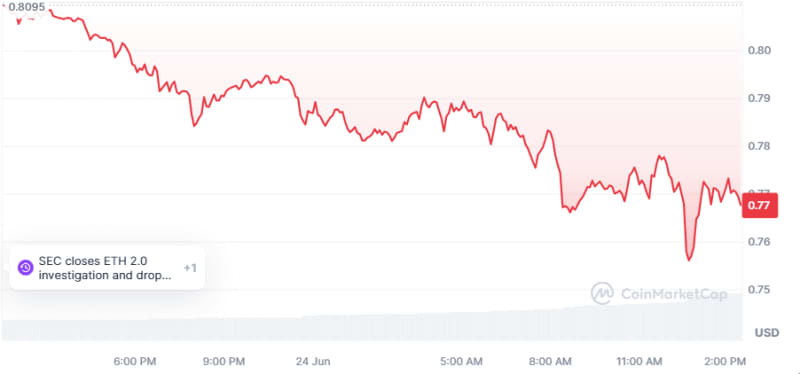

The altcoin lost over 5% in the last 24 hours to hover at $0.771. Its daily trading volume increased by 125%, underscoring increased seller activity in the past day.

The current outlook suggests struggles for ARB as it plunged beneath the vital $1 area.

Losing this psychological zone set Arbitrum’s native token for massive dips.

Arbitrum bears intensified on 13 May when the alt surrendered $1 and has lost approximately 90% from ATHs.

Further, the latest 92.65M token unlock magnified the downward pressure, triggering more price dips for ARB.

The broad market outlook paints a grim picture for the alt’s trajectory.

Bitcoin saw a sudden dip towards $60K on Monday amid economic uncertainty and amplified EFT outflows.

BTC changed hands at $60,938 during this writing, and recoveries towards the $70K mark remain essential for solid uptrends in the altcoin market.

The post Arbitrum to diversify $4.5M worth of ARB to Ondo Finance’s USDY appeared first on Invezz