Palo Alto Networks (PANW) stock is still undervalued according to analysts' price targets. It continues to make sense to short out-of-the-money put options for investors to gain income and set a buy-in target.

Today PANW stock is trading at $321.16, up from its recent low of $290.09 on June 4. However, as will be seen below many analysts have much higher price targets.

I discussed the cybersecurity company's value in a May 21 Barchart article, “Palo Alto Networks' Results Today Show Strong Free Cash Flow and FCF Margins - PANW Stock Looks Cheap.”

Price Target Using FCF Margin Estimates

I showed how PANW stock could be worth $385.57 per share based on its free cash flow (FCF) and FCF margins. The latter is quite high, over 38.75% of sales. Applying that margin to sales estimates of $9.12 billion shows that it could make as much as $3.55 billion in FCF going forward.

Applying a 3.0% FCF yield metric means that PANW stock could have a $118.3 billion market value (i.e., $3.55b/0.03 = $118.3b). This is still 13.9% higher than its existing $103.93 billion market cap. That implies that PANW stock is worth at least $365.80 per share.

Moreover, using a slightly lower 2.85% yield metric gives it a market value of $124.6 billion, or 20% more. That gives the stock an upside price target of $385.39 per share.

Other Analysts Agree

Other analysts see a higher price for PANW stock. For example, the average of 44 analysts' price targets surveyed by Barchart is $339.58. Yahoo! Finance's survey of 45 analysts is $339.88 per share.

Moreover, AnaChart, a new sell-side analyst tracking service, reports that 38 analysts who have recently written on the stock have an average price target of $350.92 per share. The bottom line is that most analysts see a much higher price for PANW stock over the next year.

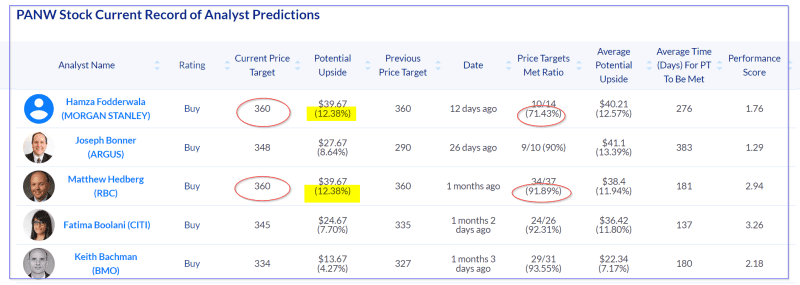

In fact, some analysts with great track records analyzing PANW stock have much higher price targets. The table below from AnaChart shows this.

It shows that two analysts, from Morgan Stanley and RBC, have $360 target prices. Note that their “Price Targets Met Ratio” metrics are very high. For example, the Morgan Stanley analyst has met his price target over 71% of the time. The RBC analyst has met his price target on PANW stock almost 92% of the time.

That should give investors in the stock a good sense that PANW stock may be undervalued here.

One way to play this is to sell short out-of-the-money (OTM) puts.

Shorting OTM Puts in PANW Stock

In my last Barchart article, I suggested selling short the $300 strike price put option that was to expire on June 14, which was 3 weeks away. This provided a 1.20% yield (i.e., $3.60/$300) to the short seller at a strike price that was 5% out-of-the-money (i.e., below the spot price of $317.50).

That worked out fine for the investor. The stock closed at $317.31 on June 14, close to where it was at the time of the short sale recommendation. In other words, the short seller kept all the income and had no obligation to buy the shares.

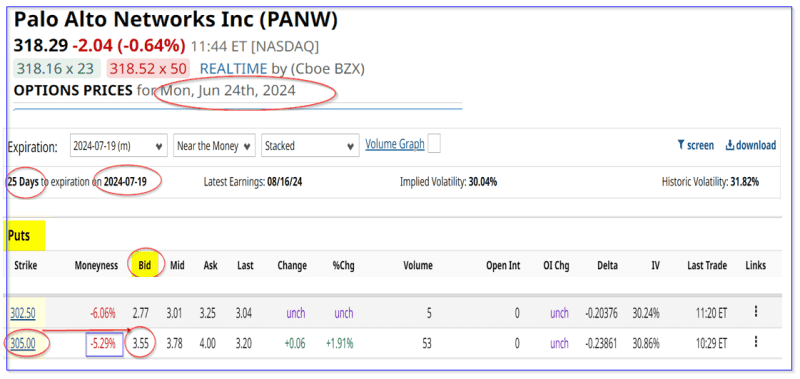

This can now be repeated. For example, look at the July 19 expiration period, a little over 3 weeks from now. It shows that the $305 strike price put option trades for $3.55 on the bid side.

That provides an immediate yield of 1.16% to the short seller for a strike price that is still 5%+ below the spot price.

An investor can repeat the prior yield play (1.20% last time). In effect, the investor stands to make 3.36% over the 7-week period, even though the stock may not have moved that much.

It also provides a good way for an investor to set a good buy-in target. If the stock falls to $305 on or before July 19, at least the investor will have received $3.55 this time and possibly $3.60 last time, or $7.15 total over the total period. That lowers their breakeven price to $297.85 (i.e., $305-$7.15).

Moreover, existing investors get to keep this income and any potential upside in the stock. The income also helps cover any unrealized losses in the stock while they are holding it.

So, the bottom line is that PANW stock looks cheap here, based on many analysts' price targets. One good way to play this is to sell short OTM puts for both income and as a buy-in method.

More Stock Market News from Barchart

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.