Digital payments have been one of the pillars of the global fintech revolution. With convenience, safety and speed being its hallmarks, the global digital payments market is forecasted to reach a staggering size of $16.62 trillion by 2028, based on a CAGR of 9.5% between 2024 and 2028.

The lucrative market has attracted legacy finance giants like Visa (V) and Mastercard (MA), as well as comparatively newer players, like Jack Dorsey-led Block (SQ) and long-ago eBay (EBAY) spinoff (PYPL). However, brokerage firm KeyBanc warns that tech giant Apple (AAPL), armed with new features for Apple Pay, is now set to shake up the fintech landscape.

For instance, with Tap to Cash, users can now conveniently transmit and receive Apple Cash by simply holding their iPhones together. Additionally, iOS 18 expands the functionality of Apple Pay, allowing secure online payments within desktop browsers like Chrome, Firefox, and Edge, extending its reach beyond Safari. This, along with some other features, prompted analyst Alex Markgraff to remark, “we see Apple Pay installment/BNPL announcements as net negatives to PayPal and Block.”

With the gauntlet effectively being thrown down by one of the biggest tech companies of the world, do Block and PayPal have the wherewithal to compete? Let's find out!

Block

Founded in 2009 by Jack Dorsey and based out of San Franciso, Block (SQ) \- formerly known as Square - operates as a financial services and technology company. They provide solutions for sellers (Square Point-of-Sale system) and individuals (Cash App for money transfers and investing). Its market cap currently stands at $38.86 billion.

Block stock is down 16.7% on a YTD basis.

In Q1 2024, Block's results were impressive, as the company surpassed expectations on both the revenue and earnings front. While net revenues for the quarter came in at $5.96 billion (up 19.4% YoY), adjusted EPS jumped to $0.85 from $0.43 in the prior year, comfortably outpacing the consensus estimate of $0.72. Notably, over the past five quarters, Block's EPS have missed expectations on only one occasion.

Block's cash generation prowess was reflected in the 66.2% growth of net cash from operating activities, which jumped to $489.39 million. Overall, the company closed the quarter with a cash balance of $7.2 billion, higher than its debt levels of $4.1 billion.

Further, Block's Q1 results boasted impressive growth across both Cash App and Square. Cash App's gross profits surged 25% year-over-year to a record $1.26 billion, while Square's point-of-sale payment services saw a healthy 19% increase to $820 million. This growth is particularly promising considering their target market - Millennials and Gen Z.

The company is particularly bullish on the Cash App Card, a customizable debit card with seamless integration for online and in-store purchases. This focus makes sense as the Cash App Card, with its easy money transfers, has already garnered 24 million active users and continues to experience growth.

Moreover, Block is the largest player in the cloud point of sale (POS) market, with a 27% share. This bodes well for Block, as the cloud POS market is rapidly growing.

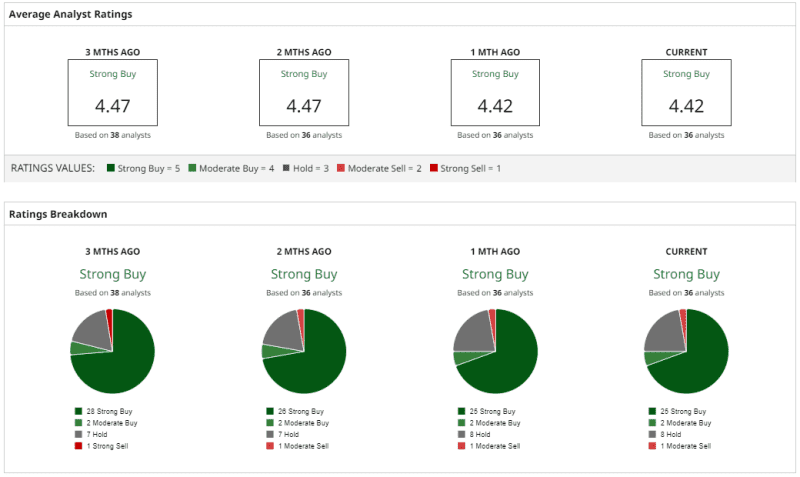

Overall, analysts have a consensus rating of “Strong Buy” for SQ stock, with a mean target price of $88.64, which denotes an upside potential of about 37.6% from current levels. Out of 36 analysts covering the stock, 25 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, 8 have a “Hold" rating, and 1 has a “Moderate Sell” rating.

PayPal

PayPal (PYPL), a pioneer in online payments, was founded in 1998 and is headquartered in San Jose. As a global online payments facilitator, PayPal allows individuals and businesses to send and receive money electronically. They also offer additional financial services including credit, working capital solutions, and merchant services. It currently commands a market cap of $63.4 billion.

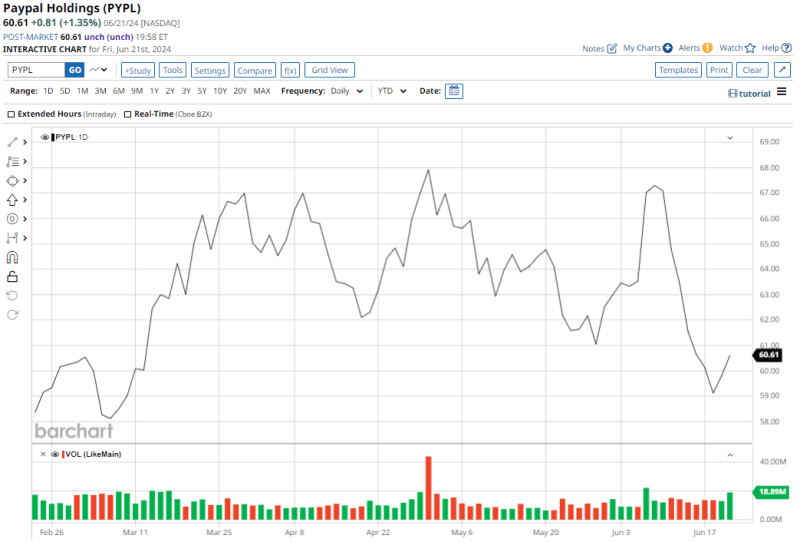

PYPL stock is down 3.1% on a YTD basis.

PayPal's numbers for Q1 topped the Street's expectations. Net revenues for the quarter came in at $7.7 billion, up 9.4% from the previous year. Non-GAAP EPS rose by 27% over the same period to $1.08. The company's EPS has topped expectations in four out of the past five quarters.

The company closed the first quarter with a cash balance of $22.28 billion, much higher than its long-term debt levels of $9.68 billion. In Q1, the company generated net cash from operating activities of $1.92 billion and adjusted free cash flow of $1.86 billion, suggesting robust cash flow activities.

Moreover, the total payments value increased by 14% from the previous year to $403.86 million, while the number of payment transactions rose by 11% over the same period to 6.5 billion.

Over the past 10 years, PayPal's revenues and EPS have expanded at CAGRs of 16.04% and 16.09%, respectively.

To accelerate growth, PayPal is placing a big bet on Fastlane, a checkout feature expected to be widely available by year-end. This rollout aligns with the impressive 26% year-over-year volume growth in their Unbranded segment (driven by recent pricing improvements) during Q1. Branded volume growth also exceeded expectations, fueled by large enterprises and international clients. In the short term, PayPal will prioritize increasing penetration among small and medium-sized businesses (SMEs) and enhancing their mobile user experience (UX).

Looking beyond core services, PayPal is exploring new ventures. Capitalizing on the momentum in digital assets, they recently launched their stablecoin, PayPal USD (PYUSD), on the Solana blockchain. This interest in cryptocurrencies aligns well with Statista's forecast of a nearly 17% CAGR for cryptocurrency payments between 2023 and 2030.

Expansion also continues for Venmo. Since April, both PayPal and Venmo collaborated with the Visa+ peer-to-peer payment system, enabling cross-platform money transfers. This strengthens PayPal's ecosystem and increases user appeal for transferring funds across platforms.

Another strategic move is the expansion into digital advertising. Recently, PayPal picked up Uber's (UBER) former head of advertising to lead their new digital ads business line.

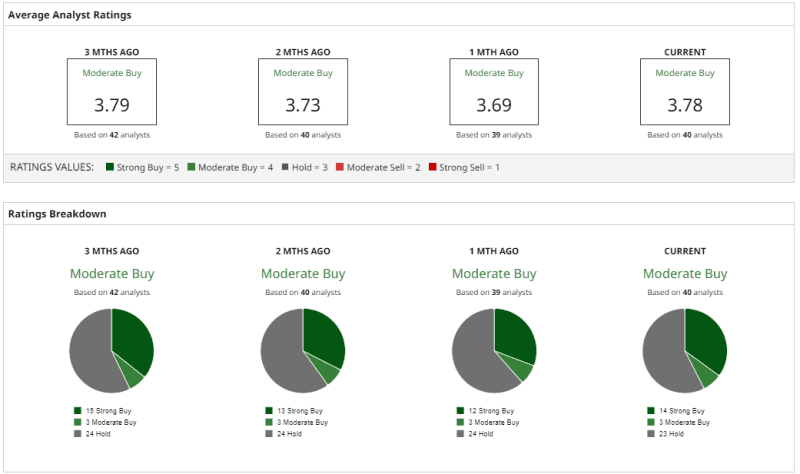

Analysts have a consensus rating of “Moderate Buy” for PYPL stock, with a mean target price of $74.61. This indicates an upside potential of roughly 25.4% from current levels. Out of 40 analysts covering the stock, 14 have a “Strong Buy” rating, 3 have a “Moderate Buy” rating, and 23 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.