This guide will help you decide which Japanese point cards are right for you, from the basics to in-depth insight into the most popular cards.

If you have spent any amount of time in Japan, you will quickly notice that point card culture here is on another level. Japanese point cards are a big deal—almost every shop has its own point card!

Whether at the convenience store, department store or the local neighborhood cafe, the first question you will likely be asked by the cashier is ポイントカードはおもちですか? (pointo ka-do wa omochidesuka?; “Do you have a point card?”)

You may wonder if you need a Japanese point card for every shop you visit. While it is tempting to collect them all for those “just in case” moments, there are a few popular point cards that will be your key to extra savings.

Don’t worry if you are unsure how to sign up, we will cover everything you need to know about Japanese point cards.

Japan’s Point Card History

In essence, a point card is a rewards system that allows customers to earn points for every yen they spend at a particular store or list of retailers. To understand Japan’s love of point cards, we need to look back at past promotions.

Japanese point cards date back to a Kitakyushu City clothier in 1916. The popular stamp cards that we know today were introduced in the 1960s, but point cards began to gain momentum after the rise of cash cards and credit cards promoted rewards programs in the 1980s. Soon after, department stores, convenience stores and service providers entered the point card market.

Point cards benefit shoppers with redeemable cash rewards but are ultimately useful for companies to track sales and campaigns. You will often see 貯まる (tamaru; “to save”) and 使える (tsukaeru; “can be used”) on promotional point card posters throughout shops and stations.

Types Of Japanese Point Cards

Before stuffing your wallet with the endless number of point cards in Japan, there are a few different types to be aware of and which provide the most benefits when redeemed.

Multiple Shop Use Point Cards

Big names in the point card world include Rakuten, dPoint, and T-Point. These cards are popular because they offer a long list of shops and restaurants from which you can earn points. It’s a fast and easy way to earn points and discover new promotions and sales.

If you see its logo at the checkout area, you will know if a shop is compatible with your Japanese point card.

Single Shop Use Point Cards

It’s common to see supermarkets, drugstores and chain retail shops offering their own point cards. Matsumoto Kiyoshi, the largest chain pharmacy, has a point card that is eligible to earn points on the majority of purchases and often runs point multiplier promotions.

Redeeming points at single shops will lead to discounts at the register, a win if you are a frequent shopper.

Japanese Stamp Cards

Sometimes this can be confusing, as some stores use the term interchangeably. The main difference between Japanese point cards and stamp cards is the reward systems.

Stamp cards will receive a physical stamp every time an eligible purchase is made, such as a cup of coffee from your favorite cafe. When the card is full, it can be redeemed for a free item or yen off the next time you stop in.

How Can I Make A Japanese Point Card?

Making a Japanese point card is straightforward. If you are ready to sign up for one, you can go to your local point card-carrying store and fill out an application or apply online.

If you don’t want a wallet full of point cards, start with one or two that cover your essentials.

If applying in person, you can say to the cashier, ポイントカードを作りたいです (pointo kaado wo tsukuritai desu; “I’d like to have a point card made”). The cashier will hand you a paper application to add your information. Once complete, you will leave the store with your shiny new point card in hand.

You can also apply for some cards online and receive the physical card in the mail or pick it up in-store.

Most Popular Japanese Point Cards

It’s important to remember that just because you can get a point card, does not mean you need one. We recommend getting the cards that you will use regularly and will reward you generously.

These are the five-point cards worth looking into and making space for in your wallet.

Rakuten

Whether you use Rakuten’s services or not, you have seen its logo while shopping. Most known for its online shopping marketplace, Rakuten extends to credit cards, an online banking app and a robust points card rewards program.

Points can be earned on their official e-commerce site, Rakuten Ichiba, FamilyMart, Mister Donut and an endless amount of restaurants, retailers, pharmacies, gas stations and so much more. View the full list of eligible locations here.

Receive Rakuten points online, through the app or on the physical card. The card has the most locations to earn points, making it the one you should always have on you.

- Physical card fee:Free!

- Conversion Rewards:1 point per ¥100 spent (depending on participating stores)

- Redeem:1 point = ¥1

- Do points expire? Yes, one year after your last earned points.

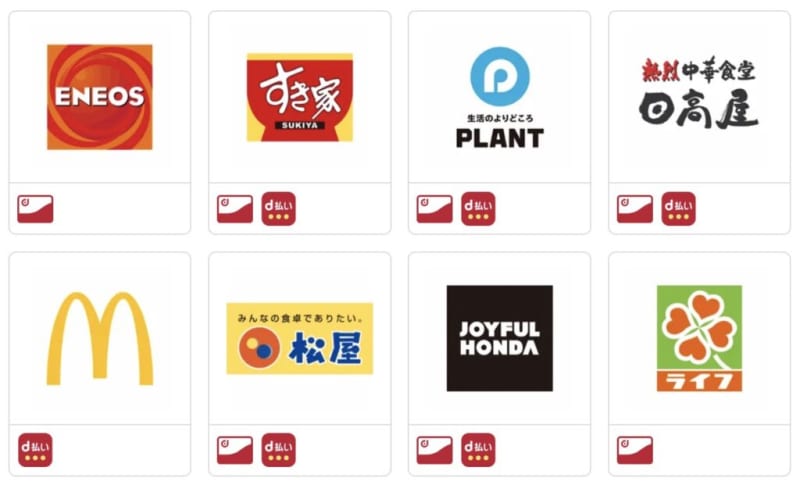

dPoint

dPoint is a point card by the mobile company Docomo. While you don’t need a Docomo phone plan to sign up, you will need to visit a Docomo store, a store in partnership with Docomo, a Lawson convenience store, or apply via the app to get a point card.

This card is popular due to the hundreds of shop locations where you can earn points and participate in additional point campaigns. If you have a Docomo phone plan, you can use points towards your monthly bill, which is a nice perk if you are already a user.

- Physical card fee:Free!

- Rewards:1 point per ¥100 spent

- Redeem:1 point = ¥1

- Do points expire? Yes, two years after your last earned points.

T-Point

T-Point is another versatile Japanese point card that offers some of the best point-earning opportunities for its users. Although technically a Tsutaya card, it is associated with FamilyMart and can be used at many of the chain shops, restaurants and pharmacies in your area.

If you are a FamilyMart loyalist, be sure to look out for the small green signs that indicate items that offer additional points. It’s a quick way to earn back your lunches. Another sweet perk of T-Point is earning points on Tabelog and Airbnb reservations.

We also love that you can redeem points for donations with T-Point.

- Physical card fee:Free!

- Rewards:1 point per ¥200 spent

- Redeem:1 point = ¥1

- Do points expire? Yes, one year after your last earned points.

Ponta

The notorious orange card with the raccoon mascot is the Lawson Ponta point card. Good for all Lawson branches in Japan and over 200 other stores, the Ponta card is an easy option to start with if Lawson is your conbini(convenience store) of choice.

Thanks to its free registration, unique shops eligible for points, like the famous 2nd Street second-hand shop, and the ability to exchange JR Kyushu points through online train reservations, Ponta is a fair option.

- Physical card fee:Free!

- Rewards:1 point per ¥100 spent

- Redeem:1 point = ¥1

- Do points expire? Yes, one year after your last earned points.

Nanaco

Nanaco point cards are 7-Eleven’s answer to the virtual rewards program. The only catch is that they’re technically an electronic payment card. They work similarly to your Suica or Pasmo, meaning you will need to charge the card with funds to use it in stores and accumulate points.

If you’re a regular at the convenience store and the over 200 Seven&iHoldings-operated restaurants and stores, the cute giraffe mascot and rainbow card may be for you! Using your Nanaco card to pay for items on the 7-Eleven app will reward you with extra points.

- Physical card fee:Non-refundable issuance fee of ¥300

- Rewards: 1 point per ¥100 spent (1 point = ¥200 at some stores)

- Redeem:1 point = ¥1

- Do points expire? Yes, two years after your last earned points.

Are Japanese Point Cards Worth It?

If you know your shopping habits and tend to shop at the same places for regular items and groceries, Japanese point cards are a great way to be rewarded for your loyalty. The more points you accrue, the more savings you will have overall.

If you don’t want a wallet full of point cards, start with one or two that cover your essentials. One point per minimum purchase (200 yen on average) may not seem like a lot, but if you’re making small daily purchases, the points will add up fast. Especially if you choose a card affiliated with a lot of businesses you frequent.

Regular Point Cards vs Payment Cards with Loyalty Points

As we noted, not all Japanese point cards are the same. Like the Nanaco card, there are prepaid point cards with an added loyalty point system. These cards, known as 電子マネー(denshi mane-; “electric money”), are preloaded with funds and can be spent at the list of retailers just like an IC transportation card. A regular point card does not require funds.

You can also sign up for debit/credit cards with loyalty points. They work just like regular bank cards but generally offer points on eligible purchases and reward campaigns to earn more points.

Online App Cards

If you don’t want to constantly have up to 10 point cards taking up space in your wallet, Japanese point cards with apps may be your best bet (as long as you don’t mind the app usage on your phone.)

Many point cards have a corresponding app that allows you to scan the app when purchasing instead of fumbling with finding the physical card. You can apply for some popular point cards online, making the need for an actual card obsolete. And better yet, it’s free!

If you love deal hunting, the point card apps always have new campaigns and sales.

So, what do you think? Are you a point card lover, or are they just a waste of wallet space? Let us know in the comments.