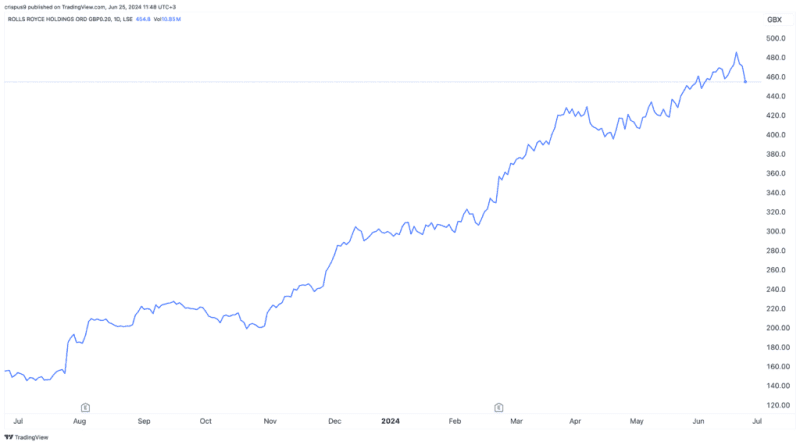

Rolls-Royce (LON: RR) share price has slumped for three straight days, becoming one of the worst-performing companies in the FTSE 100 index. It has crashed from this month’s high of 488p to the current 456p.

Rolls-Royce stock price chart

The stock has pulled back after Airbus, the biggest aircraft manufacturer in the world, published a mixed financial estimate. In it, the company said that it will deliver about 770 new aircraft this year, lower than what it guided before.

It also noted that Rolls-Royce engines for the A320neo planes were behind schedule, a move that has pushed its stock price to 133 euros, its lowest level since December last year. It has tumbled by more than 25% from the highest point this year.

This update means that Rolls-Royce could be having some operational challenges, which could affect its deliveries and financial performance.

Rolls-Royce has grown to become one of the biggest engine providers in the industry, where it competes with the likes of General Electric and Pratt & Whitney.

Still, despite the ongoing retreat, its stock has been one of the best performers in London. It has soared by more than 1,300% from its lowest point in 2020. Also, the stock has surged by more than 50% this year, beating most industrial companies like GE and Safran.

The company has done well because of the management’s focus on profitability and its updated guidance. Under Tufan Erginbilgiç, the company hopes to grow its operating profit from last year’s £1.6 billion to between £2.5 billion and £2.8 billion. Its operating margin is expected to move to between 13% and 15% in the mid-term.

Like other industrial companies, Rolls-Royce Holdings has gone through major supply chain issues after the Covid-19 pandemic. In its last presentation to investors, the company noted that its civil aerospace business was making:

“Strong progress improving onerous contracts offset by the impacts of supply chain challenges.”

Still, it is unclear whether these challenges will impact Rolls-Royce’s business because of how it works. Unlike other manufacturers, the company makes most of its money from the long-term contracts to airlines like Etihad, Lufthansa, and Emirates. As I have written before, I believe that Rolls-Royce stock price has more room to climb to 500p in the near term. Most analysts are also bullish on the shares.

The post Rolls-Royce share price suffers a harsh reversal: here’s why appeared first on Invezz