Traders and investors are desperately looking for support as the Super Micro Computer (NASDAQ: SMCI) stock price crashes. After surging to a high of $1,230 in March this year, the stock has moved into a deep bear market as it collapsed by over 33%.

Super Micro Computer’s stock has plunged despite positive news by the company. Its revenue is showing no signs of slowing down after it jumped to over $3.8 billion in the first quarter from $1.23 billion in the same period in 2023. The increase was also higher than the $3.6 billion it made in the previous quarter.

Super Micro’s profits are also booming. Its net profit soared from over $85 million in Q1’23 to over $400 million. This performance makes it one of the fastest-growing companies in the industry.

Analysts also believe that Super Micro Computer’s growth will accelerate this year. The expectation is that its revenue will rise by 109% this year to over $14.93 billion followed by 68% to $24 billion in the following year. Its earnings per share will rise from $11.8 in 2023 to $23.86 and $34.24 in 2024 and 2025, respectively.

SMCI’s stock’s recent crash has coincided with that of Nvidia, which has moved to a deep correction as it dropped by over 13% from the highest level this year.

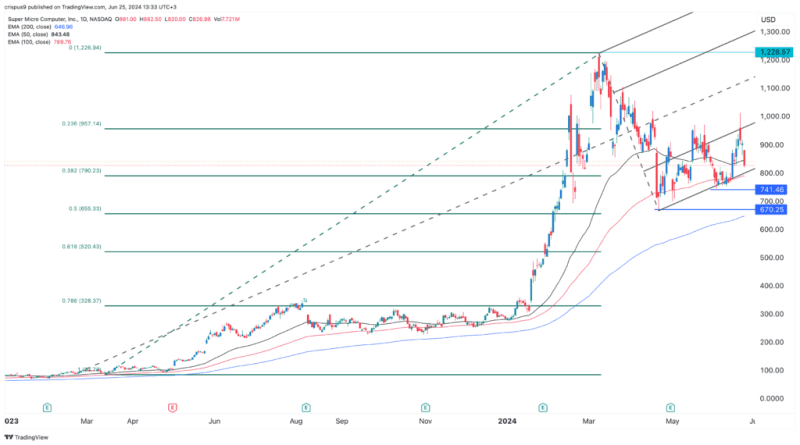

SMCI stock chart

Therefore, amidst all this, investors are focused on the technicals to find the next potential direction. On the daily chart, we see that the stock has constantly remained above the 100-day and 200-day Exponential Moving Averages (EMA).

At the same time, the stock has remained above the crucial support level at $670, its lowest point in April this year. It has also moved above the important support at $740, its lowest swing in June.

Additionally, the SMCI stock price has remained between the first and second support levels of the Andrew’s pitchfork indicator. It is also above the 38.2% Fibonacci Retracement point, which connects its lowest point in 2023 and the highest level this year.

Therefore, while the Super Micro Computer stock price has pulled back, I believe that the long-term trend is still bullish. More downside will only be confirmed if the price moves below the crucial support level at $670, its lowest point in April this year.

The post SMCI: Traders look for support as Super Micro stock plunges appeared first on Invezz