The USDA released its June World Agricultural Supply and Demand Estimates Report on Wednesday, June 12. I reached out to Jake Hanley, the Managing Director of the Teucrium family of agricultural ETF products, including CORN, SOYB, and WEAT, for his opinion on the latest report that is the gold standard for fundamental supply and demand data for the agricultural products that feed and increasingly power the world. Jake told me:

The June WASDE report largely lived up to its reputation of being a non-event. Nothing in today’s report is likely to change the prevailing narratives that all converge on the conclusion that global supplies of corn, soybeans, and wheat are adequate.

Still, with another month of data under our belts we have the opportunity to sharpen our understanding of current conditions.

Starting with wheat, as it is a relative outlier compared to corn and soybeans. Note that the global wheat balance sheet is expected to tighten for the 5th consecutive year. That is to say that the world is set to consumer more wheat than it produces for the 5th year in a row. The global stocks-to-use ratio (ending stocks/usage) is projected to be the lowest in 9 years. A tighter global balance sheet is fundamentally supportive for wheat prices. This fundamental picture helped fuel the recent rally in wheat futures that extended from late April through most of May. Much of the rally was tied to news of frost and drought conditions impacting key growing areas in Russia and Ukraine. The USDA acknowledged these production challenges with a 5 million metric ton (mmt) revision lower for Russia wheat production and a 1.5 mmt revision lower for Ukraine wheat production. At present, it seems that these production concerns are already factored into the market. Bull markets need to be fed, and it seems that wheat bulls are now wondering from where their next snack is going to come.

The USDA is projecting year over year supply builds in both corn and soybeans. What’s more the global corn balance sheet appears stable, whereas global soybean supplies are nearing a record high relative to demand. To be certain these projections depend on favorable North American growing conditions. The weather has cooperated thus far, and both U.S. corn and soybean crops are off to a healthy start. The expectation of increased supplies relative to demand is likely to weigh on both corn and soybean prices. Lower prices are to be expected unless and/or until there is a shift in the fundamental outlook. Such a shift would likely be related to an unfavorable weather outlook, and/or a geopolitical event/shock.

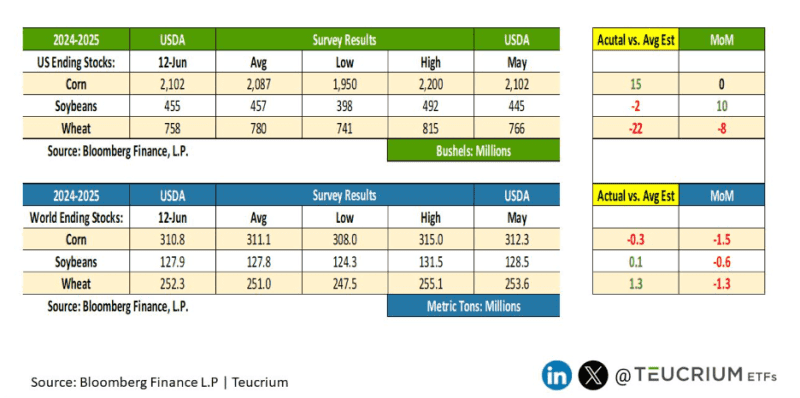

Jake provided the following table:

The table highlights the slight differences between expectations and the accrual ending inventory levels in the June WASDE report. As Jake said, the report was mostly a “non-event.”

Corn in the aftermath of the June WASDE

The USDA told the corn futures market that global stocks moved lower, but the price forecast remained unchanged.

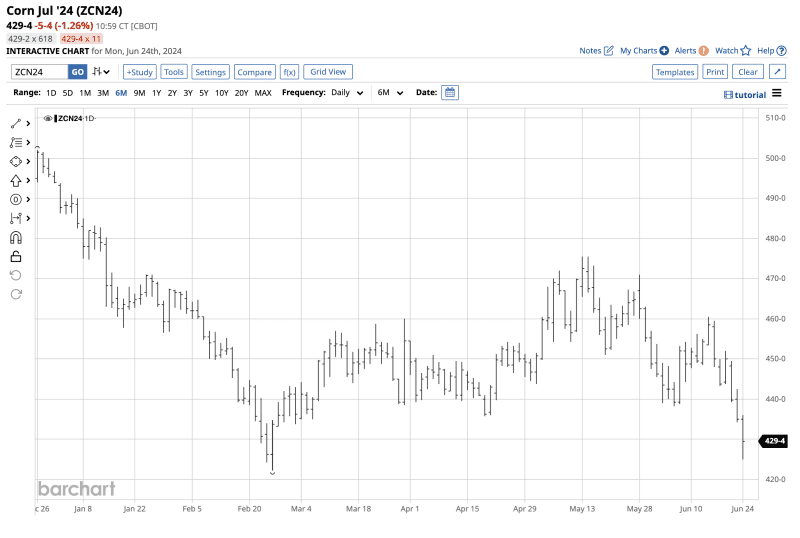

The daily chart highlights that corn for July delivery settled at $4.4950 per bushel on June 11, the night before the June WASDE report. After the latest USDA report, corn futures fell below the $4.30 level. July corn futures have been in a sideways pattern since the late February $4.2225 low.

Soybean futures have been trending lower

The June WASDE told the soybean futures market that while U.S. inventories rose, global stocks edged lower.

The daily CBOT July soybean futures chart illustrates that the oilseed closed at $11.78 on June 11 and was marginally lower after the report and under the $11.70 level. Given the current fundamentals, beans in the teens are not likely.

A wheat recovery ran out of upside steam

U.S. and global wheat stocks declined in the June WASDE, but the rally ran out of steam.

The daily CBOT July soft red winter wheat futures chart shows the decline from the $7.20 May 28 high. Wheat futures settled at $6.2650 on June 11 and were significantly lower below the $5.50 per bushel level.

The weather is the primary factor for grain and oilseed futures

As always, the weather conditions in the northern hemisphere during the growing season will determine the path of least resistance of grain and oilseed prices. Any excessive moisture or drought conditions could cause rallies. If Mother Nature cooperates, prices should remain stable around the current levels as the harvest will be adequate to meet the rising worldwide demand.

From a long-term perspective, as agricultural products feed the world, farmers will need to keep pace with population growth as the demand side of the fundamental equations increases. Moreover, grains and oilseeds are critical ingredients in biofuel, only increasing the demand side of the equation.

Europe’s breadbasket remains a warzone

Ukraine and Russia are significant wheat and corn producers and exporters. As the war continues, the fertile soil and logistical hub in the Black Sea ports remains warzones. If regional production declines, it could impact exports, causing periodic rallies. Wheat is the most sensitive grain; Russia and Ukraine are leading exporting countries.

While there is more upside potential than downside risk, the latest WASDE did nothing to prompt rallies in the agricultural futures markets. Weather conditions over the coming weeks will be the most influential factor for grain and oilseed futures markets during the 2024 growing season.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.