Artificial intelligence (AI) has taken the world by storm, sparking a competitive race among companies eager to leverage its transformative potential. As investors flock to capitalize on AI's immense promise, AI-related stocks have surged in popularity, often commanding premium prices.

According to at least one analyst, chip giant Advanced Micro Devices, Inc. (AMD) stands out, offering an attractive valuation compared to its industry peers. Beyond its attractive valuation, Advanced Micro Devices is aggressively expanding its AI chip lineup, positioning itself to compete head-on with industry giants like Intel (INTC) and Nvidia (NVDA), underscoring its commitment to innovation and growth.

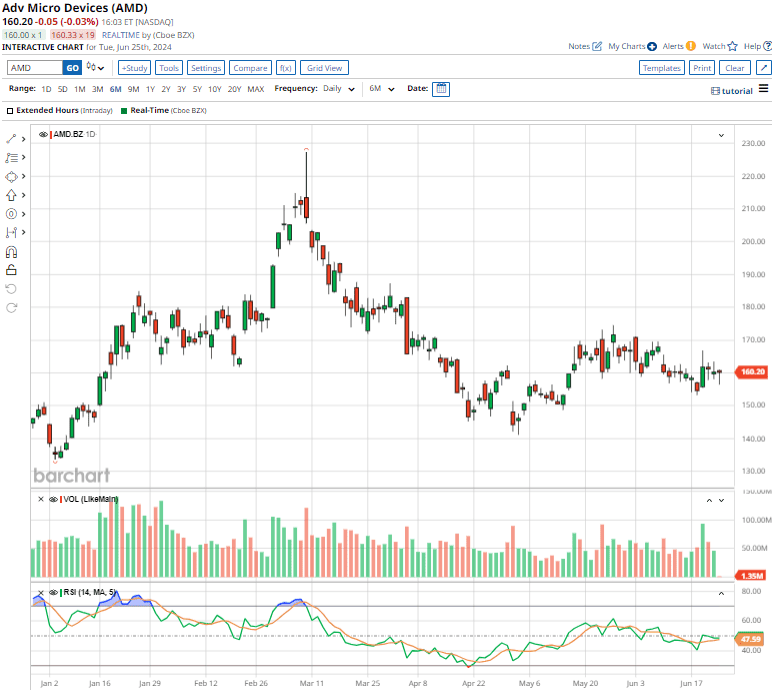

Furthermore, despite a sharp pullback of nearly 29.5% from its peak of $227.30, set on March 8, Advanced Micro Devices continues to attract bullish attention from market observers. So, let's take a closer look at this stock.

About Advanced Micro Devices Stock

Commanding a massive market cap of $259 billion, California-based Advanced Micro Devices, Inc. (AMD) boasts the industry's widest array of cutting-edge high-performance and adaptive processor technologies. The company’s portfolio spans CPUs, GPUs, FPGAs, Adaptive SoCs, and extensive software expertise.

Founded in 1969 as a Silicon Valley start-up, Advanced Micro Devices began with a small but dedicated team committed to revolutionizing semiconductor technology. From these humble beginnings, the company has evolved into a global powerhouse, setting the benchmark for modern computing. Trusted by billions worldwide, including Fortune 500 enterprises and pioneering research institutions, the company’s technology enhances daily life, work, and play experiences globally.

Shares of this mega-cap stock have climbed about 8% on a YTD basis. Over the past 52 weeks, the stock has soared 44.8%, overshadowing the broader S&P 500 Index’s ($SPX) gain of 25.7% during this time frame.

From a valuation perspective, AMD stock may not appear quite cheap at first glance, but it stands out favorably compared to its industry peers.

For instance, the stock trades at 62.03 times forward earnings and 1.87 times price/earnings to growth, much lower than rivals like Intel and Marvell (MRVL). Moreover, priced at 11.49 times sales, AMD trades far cheaper than its biggest AI chip rival, Nvidia, which trades at 51.11x.

AMD Slides After Q1 Earnings Beat

Following the announcement of its Q1 earnings results after the close on April 30, shares of Advanced Micro Devices tumbled almost 9% in the subsequent session. Despite narrowly beating expectations on both the top and bottom lines, the chip giant's Q2 guidance, which roughly aligned with Wall Street’s forecasts, failed to ignite investor enthusiasm, resulting in the downturn.

The company posted revenue of $5.5 billion, marking a 2.2% annual jump, while its adjusted EPS of $0.62 improved 3.3% year over year. The chip maker demonstrated robust performance across its Data Center and Client segments, with impressive 80% and 85% annual revenue increases, respectively.

This solid growth was driven by heightened shipments of the MI300 AI accelerators and robust adoption of Ryzen and EPYC processors, underscoring the company’s thriving market presence. AMD’s gaming segment revenue, however, faced challenges, declining 48% year over year due to lower chip sales for game consoles and PCs.

CEO Dr. Lisa Su commented on the Q1 performance, “This is an incredibly exciting time for the industry as widespread deployment of AI is driving demand for significantly more compute across a broad range of markets. We are executing very well as we ramp our data center business and enable AI capabilities across our product portfolio.”

For Q2, management forecasts revenue of around $5.7 billion, with a potential range of plus or minus $300 million. This forecast suggests an annual growth of about 6% and a sequential growth of approximately 4%. Additionally, non-GAAP gross margin is expected to be approximately 53%.

Analysts tracking Advanced Micro Devices expect the company’s profit to reach $2.61 per share in fiscal 2024, up 31.2% year over year, and rise another 68.2% to $4.39 per share in fiscal 2025.

What Do Analysts Expect For Advanced Micro Devices Stock?

Despite its recently underwhelming price action, Piper Sandler analyst Harsh Kumar is bullish on AMD stock, elevating it to "top pick" status after upbeat discussions with the company's management team. The analyst expressed strong confidence in AMD's strategic direction, highlighting the company's robust competitive positioning and further growth opportunities in both server and PC sectors.

Moreover, investors are heavily focused on the company’s AI strategy, which Kumar regards favorably. Despite initial supply challenges in the first half of the year, the company anticipates significant improvement in the second half, particularly regarding memory for its AI accelerator products.

“At this time, MI300 is performing very well with an expected ramp to greater than $4 billion this year," Kumar wrote.

Supported by all these positive factors, Piper Sandler maintains an “Overweight” rating on AMD with a $175 target price, implying a 9.3% potential upside from current levels. Analyst Kumar and his team "like AMD's valuation here relative to peers in the compute space."

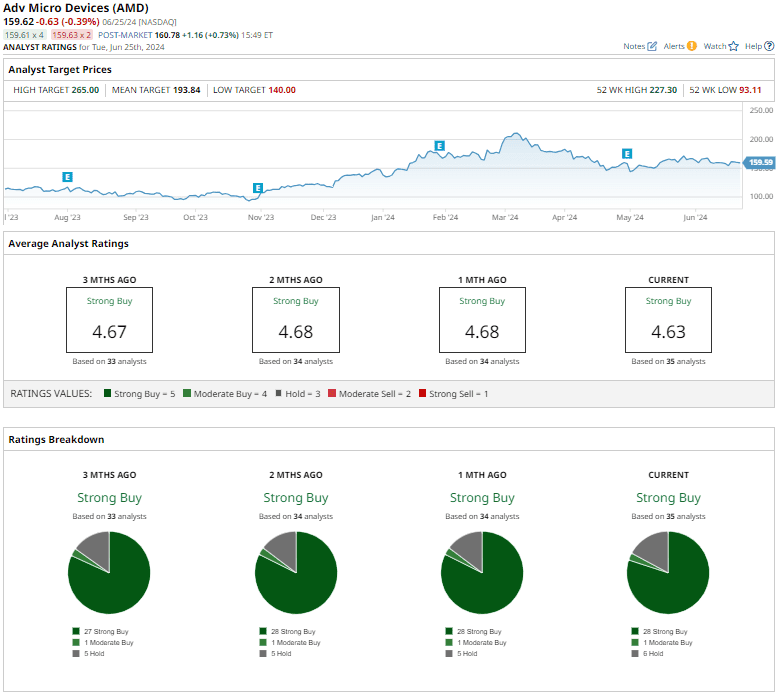

AMD stock has a consensus “Strong Buy” rating overall. Out of the 35 analysts covering the stock, 28 suggest a “Strong Buy,” one recommends a “Moderate Buy,” and the remaining six give a “Hold” rating.

Top pick or not, Piper Sandler's price target for AMD is on the low side, relatively speaking. The average analyst price target of $193.84 indicates a notable potential upside of 21.5% from the current price levels. Meanwhile, the Street-high price target of $265 suggests that the stock could rally as much as 66%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.