The Terra Luna Classic (LUNC) community expects impressive price actions from the altcoin in the upcoming sessions.

Binance exchange will destroy massive amounts of LUNC next week as part of the ongoing burn campaign.

The recent burn saw LUNC’s supply plunging to 6.78 trillion, with massive trading volume.

Scarcity in the financial markets is a recipe for increased demand.

Moreover, delegators have significantly staked with LUNC validators, pushing the overall staked tokens to more than 1 trillion.

Terra Luna Classic awaits massive token burn

The LUNC community awaits an enormous token burn from Binance to reduce the asset’s supply.

The leading cryptocurrency exchange has burned approximately 61 billion LUNC coins this month.

That accounted for roughly 48.8% of the overall tokens that the community destroyed.

The Terra Classic community has burned about 124 billion tokens to date, with 53 billion destroyed via on-chain burn and 71 billion sent to burn wallet.

The project burned nearly 7 billion tokens in the past seven days as investors and whales transferred LUNC from CEXs.

These transactions incurred fees of 8.34 billion LUNC.

LUNC staked supply skyrockets

Meanwhile, the total staked LUNC assets have climbed past 1 trillion, suggesting adequate backing from the community and validators.

Terra Luna Classic’s staking ratio soared to 14.83%.

Furthermore, the community reserve pool attained the needed boost – with 6.22B LUNCH & 12.37M USTC.

That gives the project and community sufficient money to fund development activities.

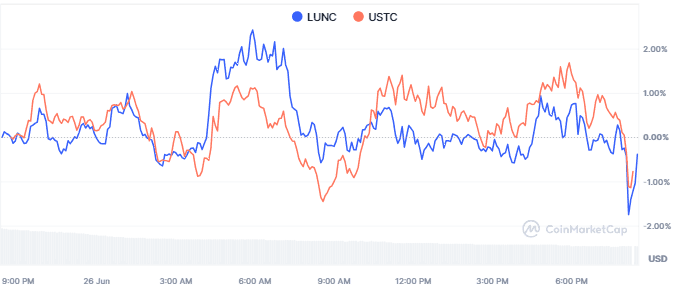

LUNC & USTC’s current price actions

The altcoins maintained sideways price moves over the past 24 hours.

LUNC hovered at $0.00008069. It hit a daily high of $0.00008352 and a 24-hour low of $0.00008012.

LUNC’s daily trading volume is $24,889,518, reflecting a 47% slump within the previous 24 hours.

Meanwhile, USTC lost 1.20% over the past day to a press time value of $0.01767.

Its daily high and low are $0.01815 and $0.01759, respectively.

USTC’s 24-hour trading volume declines by 35% to hover at $10.59 million.

The burn events will likely welcome surged trading volume and propel prices to the upside.

LUNC’s move past $0.000090 would suggest extended gains and propel USTC prices higher.

Enhanced chain efficiency and broad market recovery would be essential in maintaining stable price actions in the upcoming times.

The post LUNC price outlook: staked assets and upcoming token burn suggest imminent rally appeared first on Invezz