Global investment manager VanEck has filed for a spot Solana exchange-traded fund in the United States.

The company’s move comes after the Securities & Exchange Commission approved Bitcoin ETFs early in 2024 and positive developments for Ethereum exchange-traded funds.

The U.S. SEC authorized Ether ETFs’ 19b-4 forms in May and they will start trading after approved registration statements.

The authorization saw VanEck unveiling a new Ethereum exchange-traded fund.

Meanwhile, market experts suggest that ETH ETFs will start trading next week.

Meanwhile, VanEck’s head of research Mathew Sigel added that Solana is a commodity like Bitcoin and Ethereum.

“We believe the native token, SOL, functions similarly to other digital commodities such as Bitcoin and ETH. It is utilized to pay for transaction fees and computational services on the blockchain. Like ether on the Ethereum network, SOL can be traded on digital asset platforms or used in peer-to-peer transactions.”

VanEck’s move is part of an ongoing trend where global asset managers seek for authorization of different crypto exchange-traded funds.

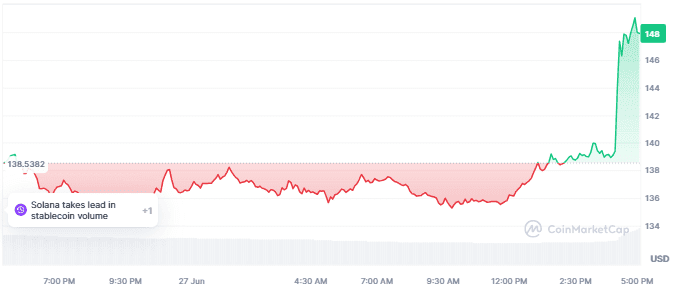

SOL’s current price outlook

The alt maintained robust bullishness amidst VanEck’s latest news. SOL saw a sudden 7% uptick to trade above $147 at press time.

Its 24-hour trading volume jumped 25% to $2.35 billion, confirming surged trader optimism on the alt.

This is a developing story. More details to follow

The post Just in: VanEck officially files for spot Solana ETF appeared first on Invezz