Financial giants have made a conspicuous bullish move on Bit Digital. Our analysis of options history for Bit Digital (NASDAQ:BTBT) revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 12% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $269,050, and 4 were calls, valued at $114,827.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $2.0 to $10.0 for Bit Digital during the past quarter.

Insights into Volume & Open Interest

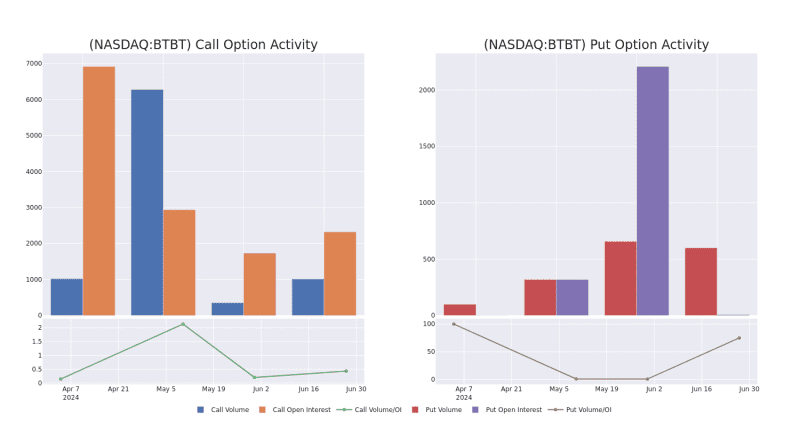

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Bit Digital's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Bit Digital's substantial trades, within a strike price spectrum from $2.0 to $10.0 over the preceding 30 days.

Bit Digital Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

About Bit Digital

Bit Digital Inc is engaged in the Bitcoin mining business, Ethereum staking activities and specialized cloud-infrastructure services for artificial intelligence applications through its wholly owned subsidiaries.. Its mining platform operates with the primary intent of accumulating bitcoin which may sell for fiat currency from time to time depending on market conditions. It generates revenue from digital asset mining and ETH staking business.

Having examined the options trading patterns of Bit Digital, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Bit Digital

- Currently trading with a volume of 11,426,643, the BTBT's price is up by 3.15%, now at $3.44.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 47 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Bit Digital, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.