Financial giants have made a conspicuous bearish move on Stellantis. Our analysis of options history for Stellantis (NYSE:STLA) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $50,840, and 6 were calls, valued at $392,415.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $18.0 and $25.0 for Stellantis, spanning the last three months.

Volume & Open Interest Trends

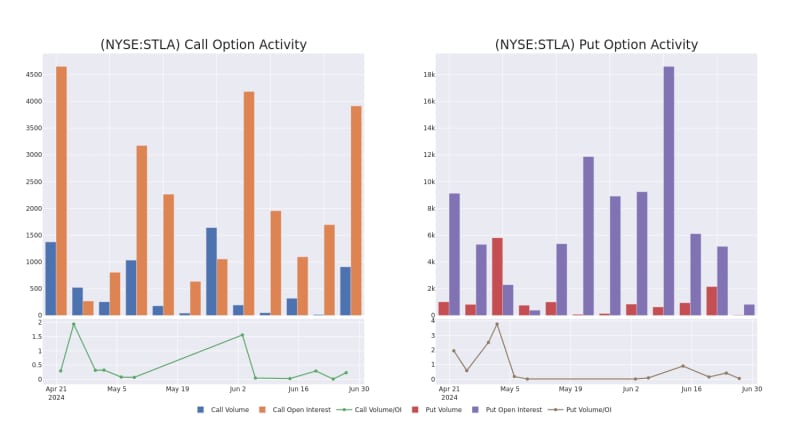

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Stellantis's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Stellantis's whale activity within a strike price range from $18.0 to $25.0 in the last 30 days.

Stellantis Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

About Stellantis

Stellantis NV was formed on Jan. 16, 2021, from the merger of Fiat Chrysler Automobiles and PSA Group. The combination of the two companies created the world's fifth-largest automaker, with 14 automobile brands. In 2023, pro forma Stellantis had sales volume of 6.2 million vehicles and EUR 189.5 billion in revenue, albeit affected by the microchip shortage. Europe is Stellantis' largest market, accounting for 44% of 2023 global volume while North America and South America were 29% and 15%, respectively.

Following our analysis of the options activities associated with Stellantis, we pivot to a closer look at the company's own performance.

Stellantis's Current Market Status

- With a trading volume of 6,148,342, the price of STLA is down by -4.53%, reaching $19.79.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 28 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Stellantis, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.