If you work in Japan, then a payslip or kyuryou meisai is no stranger to you. You receive it either as a physical sheet of paper or a digital file. Upon opening it, you’ll see the breakdown of your salary, from special allowances or bonuses to how many more days of vacation you have. It can be overwhelming at first as it’s full of kanji (Chinese characters with Japanese meaning), but most of these payslips follow a relatively similar template. While they might differ slightly depending on the company, we’ve compiled this short guide on how to read a Japanese payslip.

Japanese Payslips

Payslips are normally distributed close to payday. It lists your work attendance, how much you earn and how much is deducted. When you receive it, always check the amount listed just in case of any errors. It’s recommended to hold onto your payslips for at least two years just in case because you can use them as proof of income tax payments. In the case of applying for unemployment benefits, these can help support your case. For more information about employment in Japan, read more on our Japan101 page.

Vocabulary for Japanese Payslips

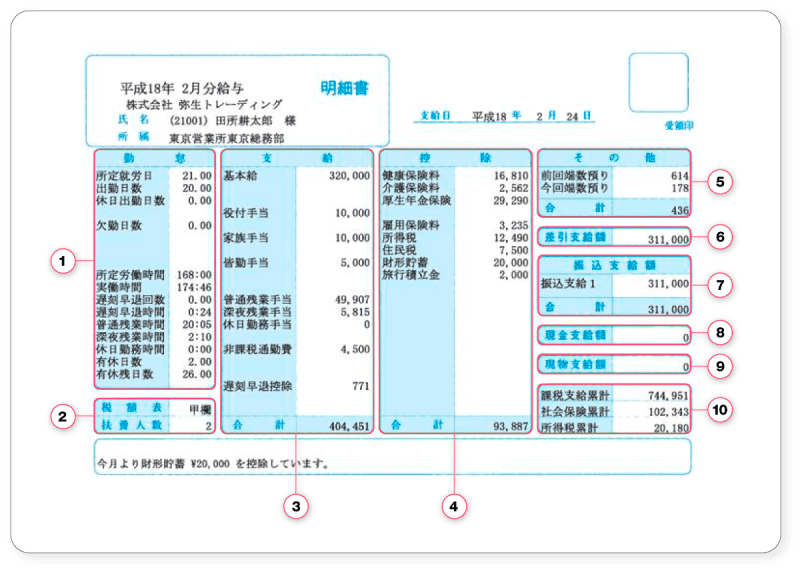

To understand how much you’re actually earning (and what’s being taken away), you’ll need to familiarize yourself with some kanji. Keep in mind that Japanese payslips and their formats vary but usually have three major categories: attendance, earnings and deductions. Here’s what one of the many payslips in Japan looks like, broken down into parts.

1. Work Attendance

This section of the payslip covers the time you spent working. It includes an itemized account of your days worked, the number of vacation days left and any tardiness throughout the month.

Japanese English Romaji Days/Hours勤怠 Work Attendance Kintai所定就労日 Fixed Work Day Shotei shuu robi 21.00出勤日数 Days Worked Shukkin hisuu 20.00休日出勤日数 Day off day Kyuujitsu shukkin bisuu 0.00欠勤日数 Leave day taken Kekkin bisuu 0.00所定労働時間 Fixed working hours Shotei roudou jikan 168:00実働時間 Actual worked hours Jitsu dou jikan 174:46遅刻早退回数 Lateness or early leave time Chikoku soutai kaisuu 0:00遅刻早退時間 Lateness or early issuedhours Chikoku soutai jikan 0:24普通残業時間 Regular overtime hours Futsuu zangyou jikan 20:05深夜残業時間 Midnight shift overtime hours Shinya zangyou jikan 2:10休日勤務時間 Holiday overtime hours Kyuujitsu kinmu jikan 0:00有休日数 Paid leave used Yuukyuu bisuu 2.00有休残日数 Paid leave balance Yuukyuu zan nisuu 26.00

2. Payer and Dependents

This part of the payslip details your dependents and who your main source of income is.

Japanese English Romaji税額表 Payer (if your company) Zeigaku hyou甲欄 Main source of income Kou ran扶養人数 Number of dependents Fuyou nin zuu

3. Earnings

See how much money you’ve made before taxes in this column of the payslip. From base salary to special allowances by your company, it should all be listed here.

Japanese English Romaji Amount支給 Earnings Shi kyuu基本給 Base salary Kihon kyuu 320,000役付手当 Position allowance Yakutsuki te ate 10,000家族手当 Family allowance Kazoku te ate 10,000皆勤手当 Perfect attendance allowance Kaikin te ate 5,000普通残業手当 Regular overwork allowance Futsuu zangyou te ate 49,907深夜残業手当 Midnight shift overwork allowance Shinya zangyou te ate 5,815休日勤務手当 Holiday overwork allowance Kyuuji tsukinmu te ate 0非課税通勤費 Non-taxable commuting allowance Hikazei tsuukin hi 4,500遅刻早退控除 Lateness or early leave penalty/deduction Chikoku soutai koujo 771合計 Sum Goukei 404,451

4. Salary Deductions

Going through this part of your payslip will show you how much you’re paying for pension, taxes and different types of insurance.

Japanese English Romaji Amount控除 Deductions Koujo健康保険料 Health insurance fee Kenkou hoken ryou 16,810介護保険料 Nursing Care insurance Kaigo hoken ryou 2,562厚生年金保険料 Welfare Pension insurance Kouse nenkin hoken ryou 29,290雇用保険料ほ Unemployment insurance Koyou hoken ryou 3,235所得税 Income tax Shoto ku zei 12,490住民税 Inhabitant tax Jumin zei 7,500財形貯蓄 Employee’s savings Zaikei chochiku 20,000合計 Sum Goukei 93,887

5. Other

This column documents fractional amounts when your salary is calculated as salaries in Japan are rounded up to whole numbers.

Japanese English Romaji Amountその他 Other Sono hoka前回端数預り Previous salary deduction from rounding up sum Zenkai hasuu azukari 614今回端数預り This salary deduction from rounding up sum Konkai hasuu azukari 178合計 Sum Goukei 436

6. Net Payments

Salary with all the tax deductions and other fees subtracted from it.

Japanese English Romaji Amount差引支給額 Net payments Sashihiki shikyuu gaku 311,000

7. Amount Transferred

The total amount you will receive this month by bank transfer.

Japanese English Romaji Amount振込支給 Amount transferred Furikomi shikyuu 311,000合計 Sum Goukei 311,000

8. Cash Payment

A part of your salary is handed directly to you in cash.

Japanese English Romaji Amount現金支給額 Actual cash payments Genkin shikyuu gaku 0

9. Goods or Non-Cash Payments

The value of any goods or non-cash payments you received this month.

Japanese English Romaji Amount現物支給額 Goods or non-cash payments value Genbutsu shikyuu hitai 0

10. Total Deducted Taxes

Your total amount of deductions so far.

Japanese English Romaji Amount課税支給累計 Total taxable income (yearly) Kazei shikyuu ruikei 744,951社会保険累計 Total accumulated social insurance Shakai hoken ruikei 102,343所得税累計 Total accumulated income tax Shotoku zei ruikei 20,180

We hope this short guide on how to read a Japanese payslip was helpful to you. Let us know what you think in the comments!