The CAC 40 index continued its freefall on Friday as traders focused on the upcoming election in France. The index, which tracks the 40 biggest companies in the country, tumbled to €7,500, its lowest point since January 26th. It has dropped by over 9% from its highest point this year and is approaching a technical recession.

France election ahead

The CAC 40 index has tumbled after Emmanuel Macron suffered a major embarrassment in European elections earlier this month. The big loss pushed him to call an election that will happen on Sunday and one that could see Marin Le Pen’s party win the majority.

This election has pushed most companies in the CAC index to crash hard in the past few weeks. Airbus Group, which also warned about supply chain issues, has been the worst-performing company in the CAC index as it dropped by 17% in the past 30 days.

Bougues, a leading French engineering company, has plummeted by 15% in the same period. Other top laggards in the index were the likes of Renault, Societe Generale, Credit Agricole, Vinci, and Engie, which have dropped by over 10%.

Still, as I wrote before, I believe that the ongoing sell-off is exaggerated, as we have seen in other countries before.

In France’s case, Emmanuel Macron will remain being president, only that he might lose his majority. And in the worst-case scenario, I don’t expect that politics will have a major impact on the corporate sector.

A good example of this is what happened in 2016 when Trump won the US election. While stocks initially tumbled, they then staged a strong rally and reached a record high during his administration.

Similarly, most recently, India’s stocks crashed after Narendra Modi won by a smaller margin than expected. They have now reversed and reached their all-time high.

Further, a victory by the right-wing parties in France has already been priced in. As such, if it happens, it could lead to a bullish reversal.

CAC 40 index forecast

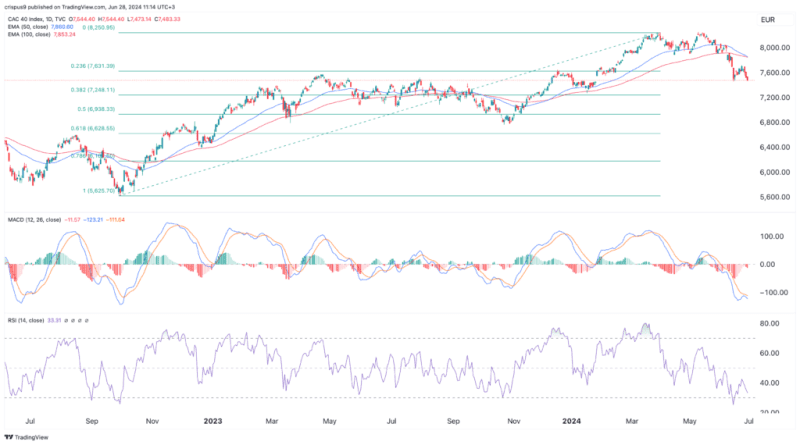

The daily chart shows that the CAC 40 index has dropped sharply in the past few weeks. This decline happened after it formed a double-top chart pattern at €8,250. In technical analysis, this is one of the most bearish signs in the market.

The index has now moved below the 23.6% Fibonacci Retracement point while the 50-day and 100-day Exponential Moving Averages (EMA) have made a bearish crossover.

Also, the Relative Strength Index (RSI) and the MACD have continued falling. Therefore, the index will likely drop to the 50% retracement point at €6,938 and then resume the uptrend as the political temperatures cool.

The post CAC 40 index nears correction ahead of election: buy the dip? appeared first on Invezz