In the fast-paced and highly competitive business world of today, conducting thorough company analysis is essential for investors and industry observers. In this article, we will conduct an extensive industry comparison, evaluating Eli Lilly and Co (NYSE:LLY) in relation to its major competitors in the Pharmaceuticals industry. Through a detailed examination of key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and illuminate company's performance in the industry.

Eli Lilly and Co Background

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for diabetes; and Taltz and Olumiant for immunology.

By closely examining Eli Lilly and Co, we can identify the following trends:

Debt To Equity Ratio

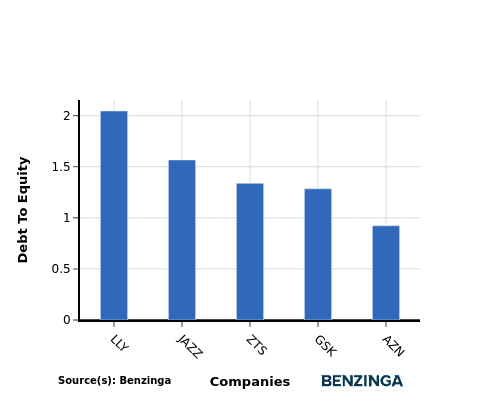

The debt-to-equity (D/E) ratio is a financial metric that helps determine the level of financial risk associated with a company's capital structure.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

When evaluating Eli Lilly and Co alongside its top 4 peers in terms of the Debt-to-Equity ratio, the following insights arise:

Key Takeaways

For Eli Lilly and Co in the Pharmaceuticals industry, the PE, PB, and PS ratios are all high compared to its peers, indicating potentially overvalued stock. On the other hand, the high ROE and revenue growth suggest strong profitability and future prospects. However, the low EBITDA and gross profit may raise concerns about operational efficiency and sustainability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.